Priceline 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

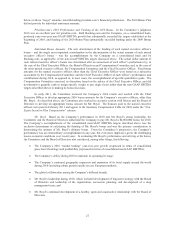

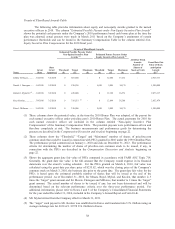

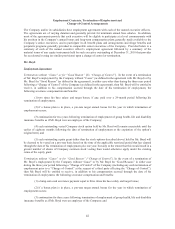

Compensation of Named Executive Officers

Summary Compensation Table

The following table shows compensation earned during 2010, 2009 and 2008, except for Mr. Finnegan,

as noted below, by our Chief Executive Officer, Chief Financial Officer and the next three most highly-

compensated executive officers serving at the end of 2010. These individuals are referred to as the “named

executive officers.” Mr. Finnegan’s information is for 2010 and 2009 only, in accordance with applicable SEC

rules, since he first became a named executive officer as of the beginning of 2009. Unless otherwise indicated,

titles shown in the table are titles held as of December 31, 2010.

Summary Compensation Table

Name and Principal

Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)(5)

Option

Awards

($)

Non-Equity

Incentive Plan

Compensation

($)

All Other

Compensatio

n

($) Total

($)

Jeffery H. Boyd, President

and Chief Executive

Officer .......................................

2010

2009

2008

550,000

550,000

550,000

-

-

-

2,925,111

1,422,289

4,160,645

-

-

-

4,000,000

2,300,000

2,000,000

(6) 7,674

7,674

13,049

(7)

7,482,785

4,279,963

6,723,694

Daniel J. Finnegan,

Chief Financial Officer(1) ...........

2010

2009

315,000

315,000

-

-

1,200,088

749,966

-

-

725,000

575,000

(6)

7,674

7,674

(

7

)

2,247,762

1,647,640

Robert J. Mylod Jr.,

Vice Chairman and Head of

Worldwide Strategy &

Planning(2) ................................

2010

2009

2008

420,000

420,000

420,000

-

-

-

2,875,117

989,387

2,894,322

-

-

-

2,500,000

1,500,000

1,200,000

(6) 7,674

7,674

7,224

(7)

5,802,791

2,917,061

4,521,546

Kees Koolen,

Chief Executive Officer,

Booking.com B.V.(3) ..................

2010

2009

2008

319,531

337,214

292,336

26,359

25,780

21,508

(4)

2,852,479

1,399,926

5,465,783

-

-

-

2,920,020

1,393,450

1,102,898

(6)

16,085

16,901

15,341

(

7

)

6,134,474

3,173,271

6,897,866

Peter J. Millones, General

Counsel, Corporate Secretary

and Executive Vice President ......

2010

2009

2008

330,000

330,000

320,000

-

-

-

1,200,088

749,966

1,175,905

-

-

-

800,000

625,000

550,000

(6)

7,674

7,674

7,224

(

7

)

2,337,762

1,712,640

2,053,129

(1) Mr. Finnegan was named Chief Financial Officer of priceline.com effective January 1, 2009.

(2) Mr. Mylod retired from the Company effective March 31, 2011.

(3) Mr. Koolen was named Chief Executive Officer of Booking.com B.V. effective September 1, 2008. Mr.

Koolen’s compensation is translated into U.S. Dollars using an average exchange rate for 2010 of 1.32728

U.S. Dollars to Euros.

(4) For Mr. Koolen includes a statutory bonus required under Dutch law of $25,562 for 2010, as well as an

annual “holiday” bonus paid to all employees of Booking.com B.V. of $664 and an anniversary bonus of

$133 for 2010.

(5) Represents the aggregate grant date fair value of performance share units (“PSUs”) in 2010 and 2008, and

restricted stock units (“RSUs”) in 2009, in each case, computed in accordance with FASB ASC Topic 718.

For 2010, the amount reflects 1 times the "target" amount, as of the grant date, for the 2010 performance

awards. The maximum number of shares that could be issued under this grant to Messrs. Boyd, Mylod and

Koolen is 3 times the "target" amount, which would result in a value of $8,775,334, $8,625,352 and

$8,557,436, respectively, based upon the stock price at the date of grant. The maximum number of shares

that could be issued under this grant to Messrs. Finnegan and Millones is 2 times the "target" amount, which

would result in a value of $2,400,176 for each, based upon the stock price at the date of grant. The number

of shares that Messrs. Boyd and Mylod will receive in connection with the 2009 RSU awards, if any, will be

based on the Company’s stock price determined during the six month period preceding the March 2012

vesting date, and, subject to certain exceptions, is dependent upon the executive being employed by the

Company at that time. The value of the Company’s stock on the date of grant was $82.65 per share. The

fair value of these 2009 RSUs at grant date was determined to be $51.11 per share since the RSUs were