Priceline 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

number of our equity awards have performance targets (a performance “contingency”) which, if

satisfied, can increase the number of shares issued to the recipients at the end of the performance

period or, in certain instances, if not satisfied, reduce the number of shares issued to the recipients,

sometimes to zero, at the end of the performance period. The performance periods for our

performance based equity awards are typically three years. We record stock-based compensation

expense for these performance-based awards based upon our estimate of the probable outcome at

the end of the performance period (i.e., the estimated performance against the performance

targets). We periodically adjust the cumulative stock-based compensation recorded when the

probable outcome for these performance-based awards is updated based upon changes in actual

and forecasted operating results. Stock-based compensation for the year ended December 31,

2010 includes charges amounting to $13.4 million, representing the cumulative impact of

adjusting the estimated probable outcome of unvested performance share units. Our actual

performance against the performance targets could differ materially from our estimates.

We record stock-based compensation expense net of estimated forfeitures. In determining the

estimated forfeiture rates, we periodically review actual and projected forfeitures. To the extent

that actual or projected forfeiture rates differ from current estimates, such amounts are recorded as

a cumulative adjustment in the period in which the estimate is revised.

x Allowance for Doubtful Accounts. Booking.com earns agency commissions from hotel

transactions and because some commissions are not paid, we are therefore subject to potential

write-offs. We provide an allowance for doubtful accounts based upon the age of the commission

receivables, taking into consideration past experience and current trends. In addition, because we

are the merchant of record in Name Your Own Price ® and price-disclosed merchant transactions,

we may be held liable for accepting fraudulent credit cards on our website as well as other

payment disputes with our customers. We are also held liable for accepting fraudulent credit cards

in certain retail transactions when we do not act as merchant of record. Accordingly, we calculate

and record an allowance for the resulting credit card charge-backs based upon past experience and

current trends. The ultimate resolution of these matters may be greater or less than the reserves

recorded.

x Valuation of Goodwill. We have recorded goodwill related to businesses we have acquired.

Goodwill is reviewed at least annually for impairment using appropriate valuation techniques. In

the event that future circumstances indicate that any portion of our goodwill is impaired, an

impairment charge would be recorded.

A substantial amount of our goodwill relates to our acquisition of Booking.com. The estimated

fair value for Booking.com, as well as the Company’s other reporting units, is substantially in

excess of their respective carrying values. Since the annual impairment test in September 2010,

there have been no events or changes in circumstances to indicate a potential impairment.

x Valuation of Long-Lived Assets and Intangibles. We evaluate whether events or circumstances

have occurred which indicate that the carrying amounts of long-lived assets and intangibles may

be impaired. The significant factors that are considered that could trigger an impairment review

include changes in business strategies, market conditions, or the manner of use of an asset; under

performance relative to historical or expected future operating results; and negative industry or

economic trends. In evaluating an asset for possible impairment, management estimates that

asset’s future undiscounted cash flows to measure whether the carrying value of the asset is

recoverable. If it is determined that the asset is not recoverable, we measure the impairment based

upon the fair value of the asset compared to its carrying value. The fair value represents the

projected discounted cash flows of the asset over its remaining life.

Recent Accounting Pronouncements

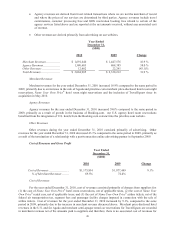

In December 2010, the Financial Accounting Standards Board (“FASB”) amended accounting guidance

concerning disclosure of supplemental pro forma information for business combinations. If an entity presents

comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though

the business combination that occurred in the current year had occurred as of the beginning of the comparable prior

annual reporting period only. The accounting guidance also requires additional disclosures to describe the nature