Priceline 2010 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

borrowings outstanding under the facility. The Company issued approximately $1.6 million and $2.4 million of

letters of credit under the revolving credit facility as of December 31, 2010 and 2009, respectively.

Convertible Debt

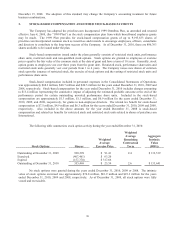

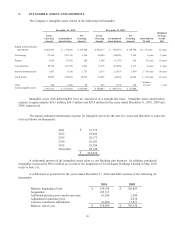

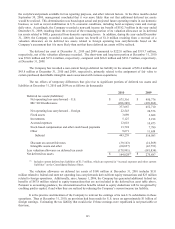

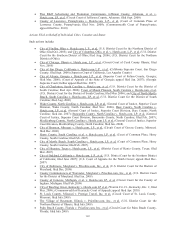

Convertible debt as of December 31, 2010 consists of the following (in thousands):

December 31, 2010

Outstanding

Principal

Amount

Unamortized

Debt

Discount

Carrying

Value

1.25% Convertible Senior Notes due March 2015 $ 575,000 $ (98,770) $ 476,230

0.75% Convertible Senior Notes due September 2013 213 (38) 175

Outstanding convertible debt $ 575,213 $ (98,808) $ 476,405

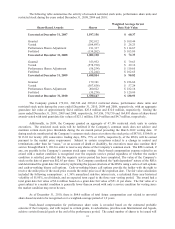

Convertible debt as of December 31, 2009 consisted of the following (in thousands):

December 31, 2009

Outstanding

Principal

Amount

Unamortized

Debt

Discount

Carrying

Value

0.50% Convertible Senior Notes due September 2011 $ 39,990 $ (4,730) $ 35,260

0.75% Convertible Senior Notes due September 2013 133,000 (31,151) 101,849

2.25% Convertible Senior Notes due January 2025 22,873 (104) 22,769

Outstanding convertible debt $ 195,863 $ (35,985) $ 159,878

Based upon the closing price of the Company’s common stock for the prescribed measurement periods

during the three months ended December 31, 2010 and 2009, the contingent conversion thresholds of the 2013 Notes

were exceeded as of December 31, 2010 and the contingent conversion thresholds of the 2013 Notes, the 2011 Notes

and the 2.25% Convertible Notes due 2025 (the “2025 Notes”) were exceeded as of December 31, 2009.

Accordingly, the carrying value of the aforementioned notes was classified as a current liability at those dates.

Since the notes are convertible at the option of the holder and the principal amount is required to be paid in cash, the

difference between the principal amount and the carrying value of these notes is reflected as convertible debt in

mezzanine on the Company’s Balance Sheets as of those dates. The determination of whether or not the notes are

convertible must continue to be performed on a quarterly basis. Consequently, the 2013 Notes may not be

convertible in future quarters, and therefore may again be classified as long-term debt, if the contingent conversion

thresholds are not met in such quarters. The contingent conversion threshold on the 2015 Notes was not exceeded at

December 31, 2010, and therefore that debt is reported as a non-current liability. The determination of whether or

not the 2015 Notes are convertible must also continue to be performed on a quarterly basis.

If the note holders exercise their option to convert, the Company delivers cash to repay the principal

amount of the notes and delivers shares of common stock or cash, at its option, to satisfy the conversion value in

excess of the principal amount. In cases where holders decide to convert prior to the maturity date or the first stated

put date, the Company writes off the proportionate amount of remaining debt issuance costs to interest expense. In

the year ended December 31, 2010, $39.9 million aggregate principal amount of 2011 Notes, $132.8 million

aggregate principal amount of 2013 Notes and $22.9 million of the 2025 Notes were converted. The Company

delivered cash of $195.6 million to repay the principal amount and issued 3,457,828 shares and delivered $99.8

million in cash in satisfaction of the conversion value in excess of the principal amount for the year ended December

31, 2010.

As of December 31, 2010 and 2009, the estimated market value of the outstanding senior notes was

approximately $0.9 billion and $1.1 billion, respectively. Fair value was estimated based upon actual trades at the

end of the reporting period or the most recent trade available as well as the Company’s stock price at the end of the

reporting period. A substantial portion of the market value of the Company’s debt in excess of the carrying value

relates to the conversion premium on the bonds.

Description of Senior Notes

In March 2010, the Company issued in a private placement $575.0 million aggregate principal amount of

Convertible Senior Notes due March 15, 2015, with an interest rate of 1.25% (the “2015 Notes”). The Company