Priceline 2010 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

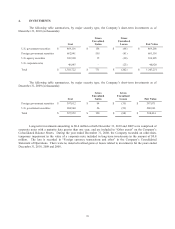

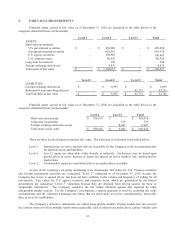

currency rates. Derivatives are considered “Level 2” fair value measurements. The Company’s derivative

instruments are typically short-term in nature.

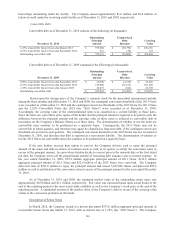

As of December 31, 2010, the Company considers its redeemable noncontrolling interests to represent a

“Level 3” fair value measurement that requires a high level of judgment to determine fair value. The Company

estimated such fair value based upon standard valuation techniques using discounted cash flow analysis and industry

peer comparable analysis. See Note 13 for information on the estimated fair value for redeemable noncontrolling

interests.

As of December 31, 2010 and 2009, the carrying value of the Company’s cash and cash equivalents

approximated their fair value and consisted primarily of U.S. and foreign government securities and bank deposits.

Other financial assets and liabilities, including restricted cash, accounts receivable, accrued expenses and deferred

merchant bookings are carried at cost which also approximates their fair value because of the short-term nature of

these items. See Note 4 for information on the carrying value of investments and Note 11 for the estimated fair

value of the Company’s Senior Notes.

In the normal course of business, the Company is exposed to the impact of foreign currency fluctuations.

The Company limits these risks by following established risk management policies and procedures, including the

use of derivatives. See Note 2 for further information on our accounting policy for derivative financial instruments.

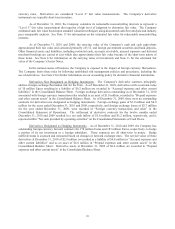

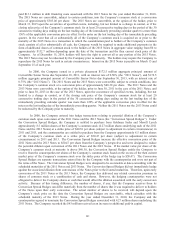

Derivatives Not Designated as Hedging Instruments – The Company’s derivative contracts principally

address foreign exchange fluctuation risk for the Euro. As of December 31, 2010, derivatives with a notional value

of 30 million Euros resulting in a liability of $0.2 million are recorded in “Accrued expenses and other current

liabilities” in the Consolidated Balance Sheet. Foreign exchange derivatives outstanding as of December 31, 2010

associated with foreign currency transaction risks resulted in an asset of $1.0 million, recorded in “Prepaid expenses

and other current assets” in the Consolidated Balance Sheet. As of December 31, 2009, there were no outstanding

contracts for derivatives not designated as hedging instruments. Foreign exchange gains of $3.0 million and $4.0

million for the years ended December 31, 2010 and 2008, respectively, and foreign exchange losses of $2.7 million

for the year ended December 31, 2009, were recorded in “Foreign currency transactions and other” in the

Consolidated Statement of Operations. The settlement of derivative contracts for the twelve months ended

December 31, 2010 and 2009 resulted in a net cash inflow of $3.6 million and $5.2 million, respectively, and is

reported within “Net cash provided by operating activities” on the Consolidated Statements of Cash Flows.

Derivatives Designated as Hedging Instruments – As of December 31, 2010 and 2009, the Company has

outstanding foreign currency forward contracts for 378 million Euros and 183 million Euros, respectively, to hedge

a portion of its net investment in a foreign subsidiary. These contracts are all short-term in nature. Hedge

ineffectiveness is assessed and measured based on changes in forward exchange rates. The net fair value of these

derivatives at December 31, 2010 of $2.8 million is recorded as a liability of $6.8 million in “Accrued expenses and

other current liabilities” and as an asset of $4.0 million in “Prepaid expenses and other current assets” in the

Consolidated Balance Sheet. Derivative assets at December 31, 2009 of $8.0 million are recorded in “Prepaid

expenses and other current assets” in the Consolidated Balance Sheet.