Priceline 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

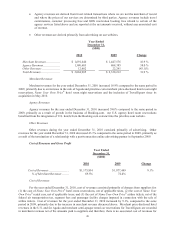

international operations contributed approximately $1.4 billion to our revenues for the year ended December 31,

2010, which compares to $852.0 million for the year ended December 31, 2009 (year-over-year growth of

approximately 70%). Revenue attributable to our international operations increased on a local currency basis by

approximately 77% in the year ended December 31, 2010, compared to the same period in 2009. In the fourth

quarter of 2010, the U.S. Dollar was stronger against the Euro and the British Pound Sterling, relative to the fourth

quarter of 2009, which negatively impacted the growth rates of our Euro and British Pound Sterling denominated

gross bookings, gross profit and net income as expressed in U.S. Dollars.

In early 2010, Greece and certain other European Union countries with high levels of sovereign debt had

difficulty refinancing that debt and central bank intervention was required, causing significant devaluation of the

Euro relative to other currencies, such as the U.S. Dollar, and concerns that sovereign defaults could lead to

devaluation or abandonment of the common currency. Sovereign debt issues could lead to further significant, and

potentially longer-term, devaluation of the Euro against the U.S. Dollar, which would adversely impact our Euro-

denominated net assets, gross bookings, revenues, operating expenses, and net income as expressed in U.S. Dollars.

In addition, many governments around the world, including the U.S. government, are operating at very large

financial deficits. Disruptions in the economies of such governments could cause, contribute to or be indicative of,

deteriorating macro-economic conditions. Furthermore, governmental austerity measures aimed at reducing deficits

could impair the economic recovery and adversely affect travel demand.

We generally enter into derivative instruments to minimize the impact of short-term currency fluctuations

on our consolidated operating results. Such derivative instruments are short term in nature and not designed to

hedge against currency fluctuation that could impact our foreign currency denominated gross bookings, revenue or

gross profit. See Note 5 to the Consolidated Financial Statements for additional information on our derivative

contracts.

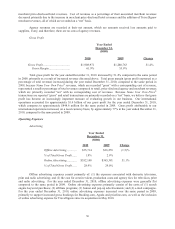

Domestic Trends. Competition in domestic online travel remains intense and traditional online travel

companies are creating new promotions and consumer value features in an effort to gain competitive advantage. For

example, in 2009, Travelocity launched an opaque price-disclosed hotel booking service that allows customers to

book rooms at a discount because, similar to our Name Your Own Price® hotel booking service, the name of the

hotel is not disclosed until after purchase. In addition, in the fourth quarter of 2010, Expedia began making opaque

hotel room reservations available on its principal website under the name “Expedia Unpublished Rates.” If Expedia

or Travelocity are successful in growing their opaque hotel service, our share of the discount hotel market in the

U.S. could decrease. Online travel companies have also offered consumers value features such as, without

limitation, the elimination and/or reduction of processing fees, the adoption of “best price” guarantees and the

waiver of cancellation and change fees. The elimination of processing fees on retail airline tickets by us and our

major competitors, coupled with the recent significant year over year increases in retail air fares, has led consumers

to engage in increased shopping behavior before making a purchase. Increased shopping behavior reduces our

advertising efficiency and effectiveness as traffic obtained through online advertising becomes less likely to result in

a purchase on our web site. Therefore, online advertising expenses for our priceline.com U.S. business grew at a

faster rate than gross profit for the year ended December 31, 2010.

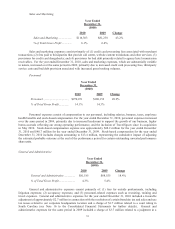

Some travel suppliers are encouraging third-party travel intermediaries, such as us, to develop technology

to bypass the traditional GDSs, such as enabling direct connections to the travel suppliers or using alternative global

distribution methods. For example, in December 2010, American Airlines terminated its participation in the Orbitz

service and withdrew its fares from the Orbitz website. This is consistent with an effort on the part of American

Airlines, and the airline industry in general, to reduce distribution costs. American Airlines’ termination of its

distribution arrangement with Orbitz could be indicative of the airlines in general becoming more aggressive toward

requiring online travel agents to implement direct connections. In addition, in December 2010, Expedia

preemptively removed American Airlines flights from its site as its contract with American was set to expire on

December 31, 2010. It is feasible that a dispute between an airline and a GDS could lead to an airline removing its

fares from the GDS. Despite the fact that such a dispute may not involve us, our business could be adversely

affected if we are denied access to airfares in a major GDS. During 2010, we implemented a direct connection with

American Airlines. Development and implementation of the technology to enable additional direct connections to

travel suppliers could cause us to incur additional operating expenses, increase the frequency/duration of system

problems and delay other projects. In addition, any additional migration toward direct connections would reduce the

compensation we receive from GDSs.

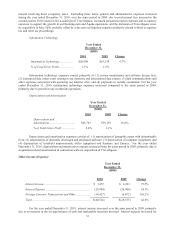

While demand for online travel services continues to experience annualized growth, we believe that the

domestic market share of third-party distributors, like priceline.com, has declined over the last several years and that