Priceline 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

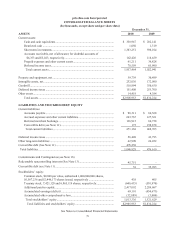

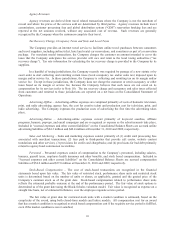

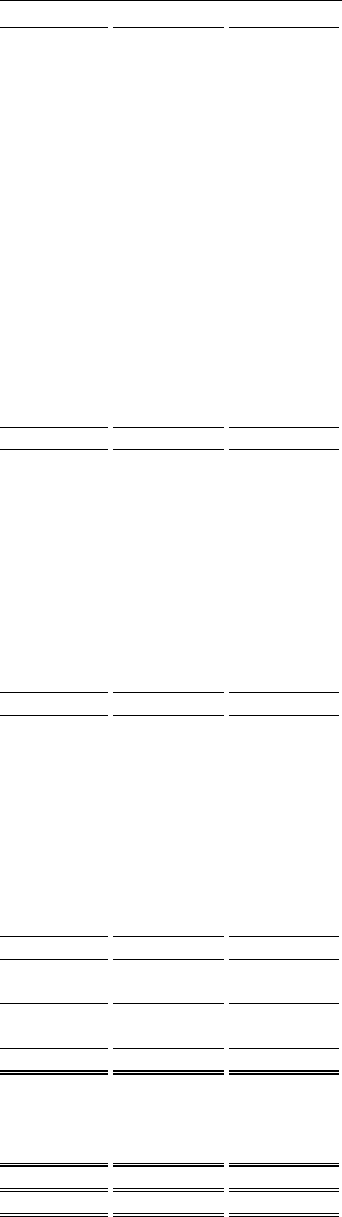

82

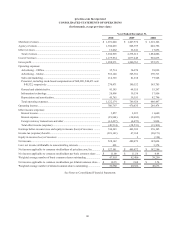

Priceline.com Incorporated

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

OPERATING ACTIVITIES: 2010 2009 2008

Net income ....................................................................................................................... $ 528,142 $ 489,472 $ 185,624

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation ................................................................................................................ 16,209 14,491 14,388

Amortization ............................................................................................................... 34,255 24,702 28,680

Provision for uncollectible accounts, net .................................................................... 7,102 3,227 13,113

Reversal of valuation allowances on deferred tax assets ............................................. - (183,272) -

Other deferred income taxes ....................................................................................... 37,540 30,990 19,899

Stock-based compensation and other stock based payments ....................................... 68,396 40,671 40,522

Amortization of debt issuance costs ............................................................................ 3,332 2,465 2,525

Amortization of debt discount .................................................................................... 20,110 18,203 26,669

Loss (gain) on early extinguishment of debt ............................................................... 11,334 1,048 (6,014)

Equity in (income) loss of investees ........................................................................... - (2) 310

Loss on impairment of investment .............................................................................. - - 843

Changes in assets and liabilities:

Accounts receivable .................................................................................................... (29,275) (22,767) (42,888)

Prepaid expenses and other current assets .................................................................. (22,373) (979) (5,153)

Accounts payable, accrued expenses and other current liabilities ............................... 84,750 86,792 32,245

Other ........................................................................................................................... 17,775 4,624 4,790

Net cash provided by operating activities ......................................................................... 777,297 509,665 315,553

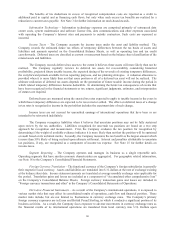

INVESTING ACTIVITIES:

Purchase of investments .............................................................................................. (1,813,032) (922,163) (196,308)

Proceeds from sale of investments .............................................................................. 1,071,669 432,184 218,555

Purchase of shares held by noncontrolling interests ................................................... - - (154,034)

Additions to property and equipment ......................................................................... (22,593) (15,106) (18,322)

Acquisitions and other equity investments, net of cash acquired ................................ (112,405) (1,500) (599)

Proceeds from redemption of equity investment in pricelinemortgage.com ............... - 8,921 -

Proceeds from foreign currency contracts ................................................................... 44,564 - -

Payments on foreign currency contracts ..................................................................... (9,561) (5,025) -

Change in restricted cash ............................................................................................ 260 1,229 (1,197)

Net cash used in investing activities ................................................................................. (841,098) (501,460) (151,905)

FINANCING ACTIVITIES:

Proceeds from the issuance of convertible senior notes .............................................. 575,000 - -

Payment of debt issuance costs ................................................................................... (13,334) - -

Payments related to conversion of senior notes .......................................................... (295,401) (197,122) (176,943)

Repurchase of common stock ..................................................................................... (129,445) (17,415) (4,449)

Proceeds from the sale of subsidiary shares to noncontrolling interests ..................... 4,311 - -

Proceeds from exercise of stock options ..................................................................... 25,751 43,428 5,507

Proceeds from the termination of conversion spread hedges ...................................... 42,984 - -

Excess tax benefit from stock-based compensation .................................................... 3,091 2,149 7,037

Net cash provided by (used in) provided by financing activities ...................................... 212,957 (168,960) (168,848)

Effect of exchange rate changes on cash and cash equivalents ......................................... 7,670 (1,654) (15,609)

Net increase (decrease) in cash and cash equivalents ....................................................... 156,826 (162,409) (20,809)

Cash and cash equivalents, beginning of period ............................................................... 202,141 364,550 385,359

Cash and cash equivalents, end of period ......................................................................... $ 358,967 $ 202,141 $ 364,550

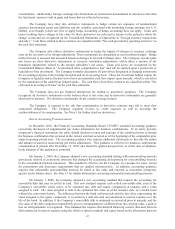

SUPPLEMENTAL CASH FLOW INFORMATION:

Cash paid during the period for income taxes ............................................................. $ 169,320 $ 95,512 $ 66,948

Cash paid during the period for interest ..................................................................... $ 4,901 $ 4,448 $ 6,353

Non-cash fair value adjustments for redeemable noncontrolling interests .................. $ 7,876 $ - $ -

See Notes to Consolidated Financial Statements.