Priceline 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

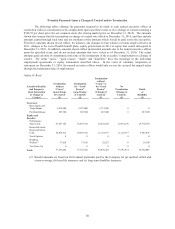

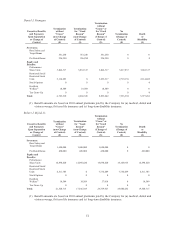

multiplier could range from 0 to 3x, depending on the Company’s performance through the most

recently completed fiscal quarter; and Mr. Boyd would also receive a pro-rata portion of Mr. Boyd’s

“target” PSU grant (based on the number of full months that had elapsed since the effective date of the

“Change of Control” as of the date of his termination). However, if Mr. Boyd’s employment is

terminated prior to the 6th fiscal quarter completed since January 1, 2010, the PSU performance

multiplier cannot exceed 2x.

x If a “Change of Control” occurs on or after January 1, 2013 and Mr. Boyd is terminated without

“Cause,” for “Good Reason,” or as a result of death or “Disability” coincident with or at any time

following the effective date of the “Change of Control,” the PSU performance multiplier would be

applied to Mr. Boyd’s “target” PSU grant and could range from 0 to 3x, depending on the Company’s

performance through the 12th fiscal quarter completed since January 1, 2010.

2009 Restricted Stock Units (“RSUs”). The RSUs granted to Mr. Boyd in March 2009 provide for

accelerated vesting upon a “Change of Control,” a termination without “Cause,” or a termination as the result of

death or “Disability.” The number of shares to be delivered to Mr. Boyd would depend on the type of

termination event (change of control or termination without cause/death/disability) and the time of its occurrence.

x Upon a termination without “Cause” or as the result of death or “Disability” on or prior to March 4,

2012, as long as the Company’s lowest closing stock price on NASDAQ for a period of 20 consecutive

trading days during the six-month period preceding the termination date reaches a minimum threshold

amount, the RSU performance multiplier (which could range from 0.5 to 1x, depending on the

Company’s stock price performance for a 20-day period during the six-month period prior to the

termination date) would be applied to a pro-rata portion (based on the number of full months that had

elapsed since March 4, 2009 as of the date of the termination) of Mr. Boyd’s “target” RSU grant.

x If a “Change of Control” occurs on or prior to March 4, 2012 and Mr. Boyd remains employed by the

Company for six months after the effective date of the “Change of Control,” as long as the Company’s

closing stock price on NASDAQ on the effective date of the “Change of Control” reaches a minimum

threshold amount, the RSU performance multiplier (which could range from 0.5 to 1x, depending on

the Company’s closing stock price on the effective date of the “Change of Control”) would be applied

to Mr. Boyd’s “target” RSU grant.

x If a “Change of Control” occurs on or prior to March 4, 2012 and Mr. Boyd is terminated without

“Cause” or as the result of death or “Disability” within the six-month period after the effective date of

the “Change of Control,” as long as the Company’s closing stock price on NASDAQ on the effective

date of the “Change of Control” reaches a minimum threshold amount, the RSU performance multiplier

(which could range from 0.5 to 1x, depending on the Company’s closing stock price on the effective

date of the “Change of Control”) would be applied to Mr. Boyd’s “target” RSU grant.

2008 PSUs. The PSUs granted to Mr. Boyd in March 2008 provide for accelerated vesting upon a

“Change of Control,” a termination without “Cause,” a termination for “Good Reason,” or a termination as the

result of death or “Disability.” The number of shares to be delivered to Mr. Boyd would depend on the

termination event (change of control or termination without cause/good reason/death/disability) and when it

occurred.

x Upon a termination without “Cause,” for “Good Reason,” or as the result of death or “Disability,” the

PSU performance multiplier would be applied to a pro-rata portion (based on the number of full months

that had elapsed since January 1, 2008 as of the date of the termination) of Mr. Boyd’s “target” PSU

grant and could range from 0 to 2x, depending on the Company’s performance through the most

recently completed fiscal quarter.

x If a “Change of Control” occurs and Mr. Boyd remains employed by the Company for six months after

the effective date of the “Change of Control,” the PSU performance multiplier would be applied to a

pro-rata portion (based on the lesser of 36 and the number of full months that had elapsed since January

1, 2008 as of the date that is six months after the “Change of Control”) of Mr. Boyd’s “target” PSU

grant; the performance multiplier could range from 0 to 2x, depending on the Company’s performance

through the most recently completed fiscal quarter; if Mr. Boyd remains employed by the Company

until the end of the performance period, then Mr. Boyd would also receive a pro-rata portion of the