Priceline 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

TravelJigsaw Holdings Limited and its operating subsidiary, TravelJigsaw Limited (collectively, “TravelJigsaw”), a

Manchester, UK-based international rental car reservation service. Transaction costs of $1.9 million were expensed

during the three months ended June 30, 2010.

Certain key members of TravelJigsaw’s management team retained a noncontrolling ownership interest in

TravelJigsaw Holdings Limited. In addition, certain key members of the management team of Booking.com

purchased a 3% ownership interest in TravelJigsaw from PIL in June 2010 (together with TravelJigsaw

management’s investment, the “Redeemable Shares”). The holders of the Redeemable Shares will have the right to

put their shares to PIL and PIL will have the right to call the shares in each case at a purchase price reflecting the

fair value of the Redeemable Shares at the time of exercise. Subject to certain exceptions, one-third of the

Redeemable Shares will be subject to the put and call options in each of 2011, 2012 and 2013, respectively, during

specified option exercise periods.

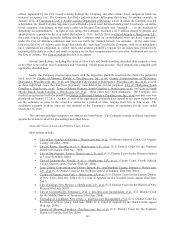

Redeemable noncontrolling interests are measured at fair value, both at the date of acquisition and

subsequently at each reporting period. The redeemable noncontrolling interests are reported on the Consolidated

Balance Sheet in mezzanine equity in “Redeemable noncontrolling interests.”

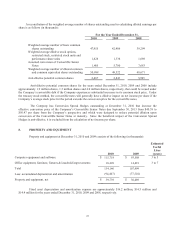

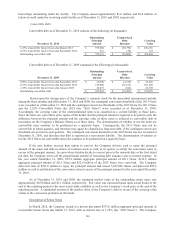

A reconciliation of redeemable noncontrolling interests for the year ended December 31, 2010 is as follows

(in thousands):

2010

Balance, December 31, 2009 $ --

Fair value at acquisition(1) 29,520

Sale of subsidiary shares at fair value(2) 4,311

Net income attributable to noncontrolling interests 601

Fair value adjustment(3) 7,876

Currency translation adjustments 3,443

Balance, December 31, 2010 $ 45,751

(1) The fair value was determined based on the price paid at acquisition.

(2) The Company retained a controlling interest after the sale of the subsidiary shares in June 2010.

(3) The estimated fair value was based upon standard valuation techniques using discounted cash flow analysis and

industry peer comparable analysis.

In connection with the Company’s acquisition of Booking.com B.V. in July 2005 and Booking.com

Limited in September 2004 and the reorganization of its European operations, key managers of Booking.com B.V.

and Booking.com Limited purchased shares of priceline.com International. In addition, these key managers were

granted restricted stock and restricted stock units in priceline.com International shares that vested over time. The

holders of the noncontrolling interests in priceline.com International had the right to put their shares to the Company

and the Company had the right to call their shares at a purchase price reflecting fair value of the shares at the time of

the exercise of the put or call right. During the year ended December 31, 2008, the Company repurchased the

remaining outstanding shares underlying noncontrolling interests for an aggregate purchase price of $154.0 million.

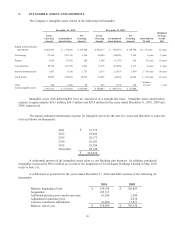

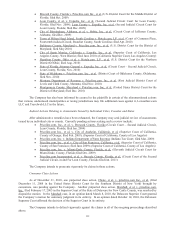

14. ACCUMULATED OTHER COMPREHENSIVE LOSS

The table below provides the balances for each classification of accumulated other comprehensive loss as

of December 31, 2010, 2009 and 2008 (in thousands):

December 31,

2010

December 31,

2009

December 31,

2008

Foreign currency translation

adjustments (1) $

(33,407) $

(3,224)

$

(40,506)

Net unrealized gain on

investment securities (2)

518

224

109

Accumulated other

comprehensive loss $

(32,889) $

(3,000)

$

(40,397)