Priceline 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

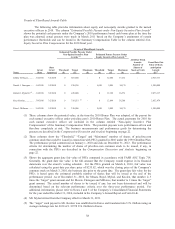

subject to market conditions. The fair value of a grant subject to a market condition is generally lower than

an award with only a service condition for vesting since the market condition may never be met. The

aggregate grant date fair value for these RSUs was determined subject to market conditions by replicating

the payout structure of the RSUs using a series of call options and cash-or-nothing binary call options, using

methods and assumptions set forth in Notes 2 and 3 of the Company’s Consolidated Financial Statements

for the year ended December 31, 2010, included in the Company’s Annual Report on Form 10-K. If the

2009 RSUs granted to Messrs. Boyd and Mylod were not subject to market conditions, based on a stock

price of $82.65 per share on the date of grant, the value of the RSUs would have been $2,299,984 and

$1,599,939, respectively. The 2009 awards to Messrs. Finnegan, Koolen and Millones did not contain a

market condition, so the aggregate grant date fair value is calculated by multiplying the number of units

granted by $82.65, the value of the Company’s stock on the date of grant. For 2008, the amount reflects the

estimated probable payout, as of the grant date, for the 2008 performance awards to Messrs. Boyd, Mylod

and Millones, of 2 times the “target” amount, which is the maximum number of shares that could be issued

under this grant. With respect to Mr. Koolen, for 2008, this column represents the estimated probable

payout, as of the grant date, for the 2008 performance award to Mr. Koolen, of 1 times the “target” amount.

The maximum number of shares that could be issued under this grant is 3.2054 times the “target” amount,

which would result in a value of $6,209,126 for this grant, based upon the stock price at the date of grant.

With respect to Mr. Koolen, for 2008, this column also includes 35,000 RSUs that were not performance

based with a grant date fair value of $3,528,700 based on a grant date price of $100.82 per share. For

additional information, please refer to Notes 2 and 3 of the Company’s Consolidated Financial Statements

for the year ended December 31, 2010, included in the Company’s Annual Report on Form 10-K. The

amounts in this column reflect the Company’s estimate of the payout for these awards, as of the date of

grant, and do not correspond to the actual value, if any, that will be recognized by the named executive

officers.

(6) Represents 2010 cash awards paid in February 2011 under the 2010 Bonus Plan.

(7) With respect to Messrs. Boyd, Mylod, Millones and Finnegan, the amount represents the dollar value of any

insurance premiums paid by priceline.com during 2010 with respect to life insurance and accidental death &

dismemberment insurance for the benefit of such named executive officer and matching contributions made

by priceline.com to each individual’s 401(k) plan for the fiscal year ended 2010. With respect to Mr.

Koolen, the amount represents matching contributions made by Booking.com B.V., a wholly-owned

subsidiary of priceline.com, to a defined contribution plan in the Netherlands.