Priceline 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

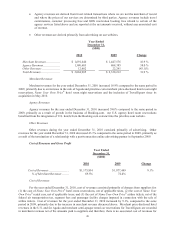

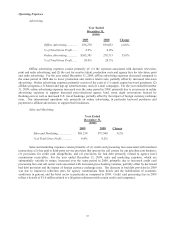

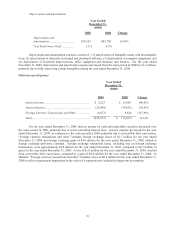

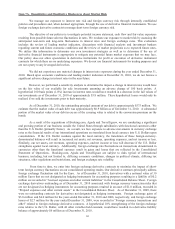

Depreciation and Amortization

Year Ended

December 31,

($000)

2009 2008 Change

Depreciation and

Amortization ...................................

$39,193

$42,796

(8.4)%

% of Total Gross Profit .................. 3.1% 4.5%

Depreciation and amortization expenses consist of: (1) amortization of intangible assets with determinable

lives; (2) amortization of internally developed and purchased software, (3) depreciation of computer equipment; and

(4) depreciation of leasehold improvements, office equipment and furniture and fixtures. For the year ended

December 31, 2009, depreciation and amortization expense decreased from the same period in 2008 by $3.6 million,

primarily due to fully amortizing certain intangibles during the year ended December 31, 2008.

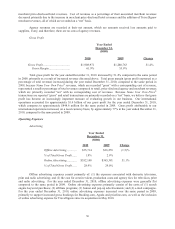

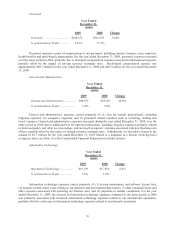

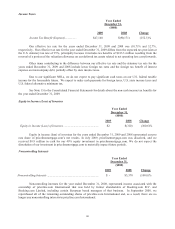

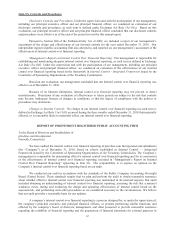

Other Income (Expense)

Year Ended

December 31,

($000)

2009

2008

Change

Interest Income .............................................................. $ 2,223 $ 11,660 (80.9)%

Interest Expense ............................................................ (24,084) (34,853) (30.9)%

Foreign Currency Transactions and Other ................... (6,672) 9,824 (167.9)%

Total .............................................................................. $(28,533) $ (13,369) 113.4%

For the year ended December 31, 2009, interest income on cash and marketable securities decreased over

the same period in 2008, primarily due to lower prevailing interest rates. Interest expense decreased for the year

ended December 31, 2009, as compared to the same period in 2008, primarily due to convertible debt conversions.

“Foreign currency transactions and other” includes foreign exchange losses of $2.7 million for the year ended

December 31, 2009 and foreign exchange gains of $4.0 million for the year ended December 31, 2008, related to

foreign exchange derivative contracts. Foreign exchange transaction losses, including fees on foreign exchange

transactions, were approximately $2.9 million for the year ended December 31, 2009, compared to $0.3 million of

gains for the year ended December 31, 2008. A loss of $1.0 million for the year ended December 31, 2009, resulted

from convertible debt conversions, compared to a gain of $6.0 million for the year ended December 31, 2008. In

addition, “Foreign currency transactions and other” includes a loss of $0.8 million for the year ended December 31,

2008 to reflect a permanent impairment in the value of a corporate note included in long-term investments.