Priceline 2010 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

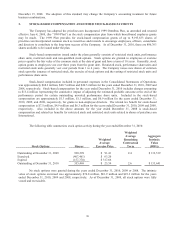

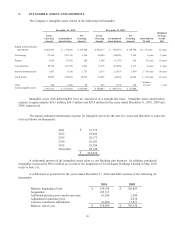

A substantial amount of the Company’s goodwill relates to its acquisition of Booking.com. In addition, the

acquisition of TravelJigsaw Holdings Limited in May 2010 increased goodwill by $105.3 million (refer to Note 13)

and contingent purchase price consideration recorded in December 2010 related to the acquisition of priceline.com

Mauritius Company Limited (formerly known as Agoda) in 2007 increased goodwill by $60.1 million (refer to Note

16).

As of September 30, 2010, the Company performed its annual goodwill impairment testing using standard

valuation techniques. The estimated fair value of Booking.com, as well as the Company’s other reporting units,

substantially exceeded their respective carrying values. Since the annual impairment test, there have been no events

or changes in circumstances to indicate a potential impairment.

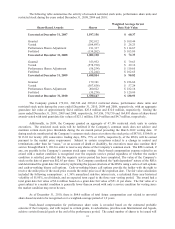

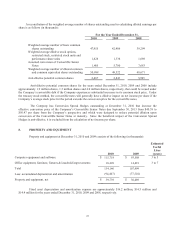

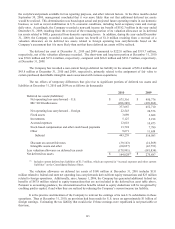

10. OTHER ASSETS

Other assets at December 31, 2010 and 2009 consist of the following (in thousands):

2010

2009

Deferred debt issuance costs $ 9,576 $ 2,235

Long-term investments 394 359

Other 4,448 1,790

Total $ 14,418 $ 4,384

Deferred debt issuance costs arose from(i) the Company’s issuance, in March 2010, of the $575.0 million

aggregate principal amount of 1.25% Convertible Senior Notes due 2015 (the “2015 Notes”); (ii) a $175 million

revolving credit facility in September 2007; (iii) the Company’s issuance, in September 2006, of $172.5 million

aggregate principal amount of 2011 Notes; and (iv) the Company’s issuance, in September 2006, of $172.5 million

aggregate principal amount of 2013 Notes. Deferred debt issuance costs are being amortized using the effective

interest rate method over the term of approximately five years, except for the 2013 Notes, which are amortized over

their term of seven years. The period of amortization for the Company’s debt issue costs was determined at

inception of the related debt agreements to be the stated maturity date or the first stated put date, if earlier.

Unamortized debt issuance costs written off to interest expense in the years ended December 31, 2010 and 2009

related to early conversion of convertible debt amounted to $1.4 million and $1.2 million, respectively.

Long-term investments amounting to $0.4 million at both December 31, 2010 and 2009 were comprised of

corporate notes with a maturity date greater than one year.

Other assets, consisting primarily of supplier and other security deposits, increased by $2.7 million during

the year ended December 31, 2010. This increase is principally related to the other assets acquired with the

acquisition of TravelJigsaw Holdings Limited in May 2010 (see Note 13 for further information on this acquisition).

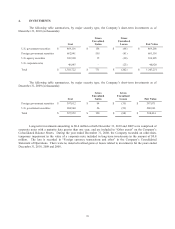

11. DEBT

Revolving Credit Facility

In September 2007, the Company entered into a $175.0 million five-year committed revolving credit

facility with a group of lenders, which is secured, subject to certain exceptions, by a first-priority security interest on

substantially all of the Company’s assets and related intangible assets located in the United States. In addition, the

Company’s obligations under the revolving credit facility are guaranteed by substantially all of the assets and related

intangible assets of the Company’s material direct and indirect domestic and foreign subsidiaries. Borrowings under

the revolving credit facility will bear interest, at the Company’s option, at a rate per annum equal to the greater of (a)

JPMorgan Chase Bank, National Association’s prime lending rate and (b) the federal funds rate plus ½ of 1%, plus

an applicable margin ranging from 0.25% to 0.75%; or at an adjusted LIBOR for the interest period in effect for

such borrowing plus an applicable margin ranging from 1.25% to 1.75%. Undrawn balances available under the

revolving credit facility are subject to commitment fees at the applicable rate ranging from 0.25% to 0.375%.

The revolving credit facility provides for the issuance of up to $50.0 million of letters of credit as well as

borrowings on same-day notice, referred to as swingline loans, which are available in U.S. dollars, Euros, Pounds

Sterling and any other foreign currency agreed to by the lenders. The proceeds of loans made under the facility will

be used for working capital and general corporate purposes. As of December 31, 2010 and 2009, there were no