Priceline 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

At the direction of the Committee, management generally provides all Committee materials to Mercer

and discusses all materials and recommendations with Mercer in advance of each Committee meeting. Mercer

considers the information presented to the Committee and discusses the information with the Committee. Mercer

generally attends all Committee meetings and, at the end of most meetings, meets in executive session with the

Committee without management present.

With the support of the Committee, management (generally the Executive Vice President and General

Counsel and, to a lesser extent prior to his retirement in March 2011, the Vice Chairman) regularly asks Mercer

to provide calculations and market data to be used by the Committee in its decision-making process. The

Committee periodically requests the Executive Vice President and General Counsel and his staff to seek

Mercer’s input or recommendation with respect to a specific compensation practice, program or arrangement

being considered by the Committee. The Committee’s Chairperson and/or management may also independently

seek Mercer’s advice on various matters to assist the Committee in its decision-making process.

During 2010, among other things, Mercer assisted the Committee on the following matters:

x Advised the Committee on the composition of the Compensation Peer Group;

x Prepared analyses of named executive officer compensation levels as compared to the

Compensation Peer Group and made compensation recommendations;

x Evaluated the design and opined on the appropriateness of the Company’s 2010 performance based

bonus plan and long term incentives and provided suggested design changes and

recommendations; and

x Prepared tally sheets and IRC Section 280G analysis (“excise parachute payments”).

Benchmarking

In making compensation decisions, the Committee compares each element of total compensation

against a peer group of publicly-traded companies. The Committee reviews annually the appropriateness of the

companies comprising the peer group. In determining the appropriate peer group of companies to be used in

connection with the 2010 compensation planning process, the Committee looked closely at, among other things,

companies included in the prior year’s peer group, which was based in part upon the S&P North American

Technology-Internet Index (previously the Goldman, Sachs & Co. Internet index).

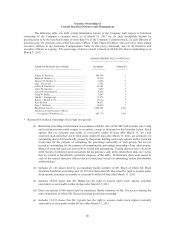

After discussion with Mercer, the Committee determined that the fifteen companies listed below, which

are primarily Internet services, travel services and/or e-commerce companies, would comprise the 2010 peer

group (the “Compensation Peer Group”):

x eBay Inc.

x Yahoo Inc.

x Amazon.com Inc.

x Expedia Inc.

x Orbitz Worldwide

x Earthlink, Inc.

x Netflix Inc.

x ValueClick Inc.

x United Online Inc.

x Monster Worldwide Inc.

x 1-800-Flowers.com

x Ticketmaster Entertainment

x Real/Networks Inc.

x GSI Commerce Inc.

x Digital River Inc.

For comparison purposes, the Committee focused on priceline.com’s gross profit versus the

Compensation Peer Group as an indicator of company size. Based on the four most recent quarters of data that

were available at the time that the Committee initiated its review (for most, but not all companies, the fourth

quarter 2008 through the third quarter 2009), priceline.com’s gross profit ranked at approximately the 73rd

percentile of the Compensation Peer Group. In comparing priceline.com’s compensation against the

Compensation Peer Group, the Committee generally considered this percentile of executive pay for the

Compensation Peer Group to be a general proxy for “market” compensation. In arriving at “market”

compensation for the Compensation Peer Group, Mercer adjusted the cash compensation information from the

Compensation Peer Group to account for projected pay increases over the 2009-2010 timeframe and discounted

long-term incentive values of the Compensation Peer Group to account for market decreases in the value of long-

term incentive grants in the first half of 2009.