Priceline 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

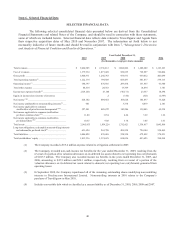

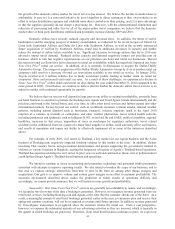

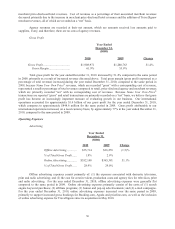

Item 6. Selected Financial Data

SELECTED FINANCIAL DATA

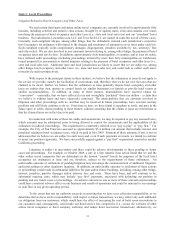

The following selected consolidated financial data presented below are derived from the Consolidated

Financial Statements and related Notes of the Company, and should be read in connection with those statements,

some of which are included herein. Selected financial data reflects data related to TravelJigsaw and Agoda from

their respective acquisition dates of May 2010 and November 2007. The information set forth below is not

necessarily indicative of future results and should be read in conjunction with Item 7, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations.”

Year Ended December 31,

2010 2009 2008 2007 2006

(In thousands, except per share amounts)

Total revenues .................................................................. $ 3,084,905 $ 2,338,212 $ 1,884,806 $ 1,409,409 $ 1,123,103

Cost of revenues ............................................................... 1,175,934 1,077,449 928,835 769,997 722,004

Gross profit ...................................................................... 1,908,971 1,260,763 955,971 639,412 401,099

Total operating expenses(1)............................................... 1,122,174 789,928 666,497 501,477 339,113

Operating income(1) .......................................................... 786,797 470,835 289,474 137,935 61,986

Total other expense .......................................................... 40,514 28,533 13,369 16,074 1,761

Income tax (expense) benefit(2) ........................................ (218,141) 47,168 (90,171) 23,537 14,594

Equity in income (loss) income of investees - 2 (310) (321) (1,393)

Net income(1)(2) ................................................................. 528,142 489,472 185,624 145,077 73,426

Net income attributable to noncontrolling interests(3) ..... 601 - 3,378 4,679 2,161

Net income applicable to common

stockholders of priceline.com Incorporated (1)(2) ......... 527,541 489,472 182,246 138,843 69,338

Net income applicable to common stockholders

per basic common share(1)(2) ........................................ 11.00 11.54 4.64 3.69 1.86

Net income applicable to common stockholders

per diluted share(1)(2) .................................................... 10.35 9.88 3.74 3.05 1.61

Total assets ....................................................................... 2,905,953 1,834,224 1,312,421 1,334,017 1,045,509

Long-term obligations, redeemable noncontrolling interests

and redeemable preferred stock(4) ............................... 621,624 263,708 459,928 724,144 554,469

Total liabilities ................................................................. 1,046,828 476,610 538,520 672,492 578,931

Total stockholders’ equity ............................................... 1,813,336 1,321,629 698,826 453,625 390,368

(1) The Company recorded a $55.4 million expense related to a litigation settlement in 2007.

(2) The Company recorded non-cash income tax benefits for the year ended December 31, 2009, resulting from the

reversal of a portion of its valuation allowance on its deferred tax assets related to net operating loss carryforwards

of $183.3 million. The Company also recorded income tax benefits in the years ended December 31, 2007, and

2006, amounting to $47.9 million and $28.1 million, respectively, resulting from a reversal of a portion of the

valuation allowance on its deferred tax assets related to domestic net operating loss carryfowards generated from

operating losses.

(3) In September 2008, the Company repurchased all of the remaining outstanding shares underlying noncontrolling

interests in Priceline.com International Limited. Noncontrolling interests in 2010 relates to the Company’s

purchase of TravelJigsaw in May 2010.

(4) Includes convertible debt which is classified as a current liability as of December 31, 2010, 2009, 2008 and 2007.