Priceline 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

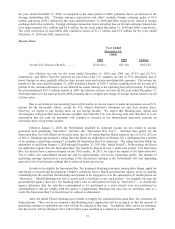

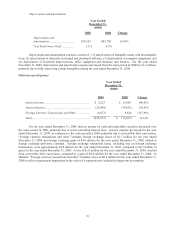

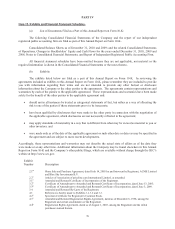

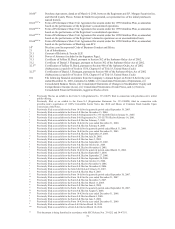

The following table represents our material contractual obligations and commitments as of December 31,

2010 (see Note 16 to the Consolidated Financial Statements):

Payments due by Period (in thousands)

Contractual Obligations

Total

Less than

1 Year

1 to 3

Years

3 to 5

Years

More than

5 Years

Operating lease obligations $ 81,722 $ 20,400 $ 30,667 $ 11,947 $ 18,708

Convertible debt

(

1

)

607,858 9,499 14,375 583,984 -

Earnouts – acquisitions 64,636 64,636 - - -

Redeemable noncontrolling

interests

45,751

15,250

30,501

-

-

Total

(

2

)

$ 799,967 $ 109,785 $ 75,543 $ 595,931 $ 18,708

(1) Convertible debt represents the aggregate principal amount of the Notes and interest of $32.6 million. See Note 11 to the Consolidated

Financial Statements.

(2) We reported “Other long-term liabilities” of $43 million on the Consolidated Balance Sheet at December 31, 2010, of which approximately

$26 million related to our reserve for potential resolution of issues related to hotel occupancy and other hotel-related transaction taxes (refer

to Note 16 to the Consolidated Financial Statements) and $13 million related to unrecognized tax benefits (refer to Note 15 to the

Consolidated Financial Statements). A variety of factors could affect the timing of payments for these liabilities. We believe that these

matters will likely not be resolved in the next twelve months and accordingly we have classified the estimated liability as “non-current” on

the Consolidated Balance Sheet. We have excluded “Other long-term liabilities” in the amount of $43 million from the contractual

obligations table because we cannot reasonably estimate the timing of such payments.

The contingent conversion threshold on the 2015 Notes was not exceeded at December 31, 2010, and

therefore, that debt is reported as a non-current liability. The determination of whether the 2015 Notes are

convertible must continue to be performed on a quarterly basis. These notes may become convertible at the option

of the holder prior to their stated maturity date of March 2015 if the closing price of our common stock exceeds the

contingent conversion threshold for the prescribed measurement periods (see Note 11 to the Consolidated Financial

Statements).

In connection with our acquisition of Agoda in 2007, contingent consideration of up to $141.6 million was

payable in 2011 if Agoda achieved specified “gross bookings” and earnings targets for the period of January 1, 2008

through December 31, 2010. Based upon actual results for the three year period ended December 31, 2010, we

recorded a liability and increased goodwill by $60.1 million. This treatment did not impact the Consolidated

Statement of Cash Flows for 2010. This amount will be reflected as an investing cash outflow when it is paid in

2011.

In September 2007, we entered into a $175.0 million five-year committed revolving credit facility with a

group of lenders, which is secured, subject to certain exceptions, by a first-priority security interest on substantially

all of our assets and related intangible assets located in the United States. In addition, our obligations under the

revolving credit facility are guaranteed by substantially all of the assets and related intangible assets of our material

direct and indirect domestic and foreign subsidiaries. Borrowings under the revolving credit facility will bear

interest, at our option, at a rate per annum equal to the greater of (a) JPMorgan Chase Bank, National Association’s

prime lending rate and (b) the federal funds rate plus ½ of 1%, plus an applicable margin ranging from 0.25% to

0.75%; or at an adjusted LIBOR for the interest period in effect for such borrowing plus an applicable margin

ranging from 1.25% to 1.75%. Undrawn balances available under the revolving credit facility are subject to

commitment fees at the applicable rate ranging from 0.25% to 0.375%.

The revolving credit facility provides for the issuance of up to $50.0 million of letters of credit as well as

borrowings on same-day notice, referred to as swingline loans, which are available in U.S. Dollars, Euros, British

Pounds Sterling and any other foreign currency agreed to by the lenders. The proceeds of loans made under the

facility will be used for working capital and general corporate purposes. As of December 31, 2010, there were no

borrowings outstanding under the facility and we have issued approximately $1.6 million of letters of credit under

the revolving credit facility.

We believe that our existing cash balances and liquid resources will be sufficient to fund our operating

activities, capital expenditures and other obligations through at least the next twelve months. However, if during that

period or thereafter, we are not successful in generating sufficient cash flow from operations or in raising additional

capital when required in sufficient amounts and on terms acceptable to us, we may be required to reduce our planned

capital expenditures and scale back the scope of our business plan, either of which could have a material adverse