Priceline 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

The Committee believes that the PSUs described above closely align senior management with

priceline.com’s achievement of longer-term - in the case of each of the PSU grants, three years - financial

objectives that enhance stockholder value.

PSUs granted to Messrs. Boyd, Finnegan, Mylod and Millones and tied to priceline.com’s 2010

through 2012 consolidated earnings performance.

In 2010, each of Messrs. Boyd, Finnegan, Mylod and Millones was granted PSUs that were based on

the Company’s consolidated earnings performance over the three year period ending December 31, 2012. The

number of shares that could be issued at the end of the three-year performance period ranges from zero to three

times the “target” grant for Messrs. Boyd and Mylod, and from one to two times the “target” grant for Messrs.

Finnegan and Millones, in each case depending on the Company’s performance over that period.

The Committee established consolidated non-GAAP EBITDA as the performance measure to judge

priceline.com’s performance over the three year performance period. The calculation of consolidated non-GAAP

EBITDA is intended to be substantially consistent with the calculation used by priceline.com in its quarterly and

annual earnings announcements. The calculation of non-GAAP EBITDA is similar to the calculation of non-

GAAP EBITDA described above under Performance Based Cash Bonus and the reasons for adoption of non-

GAAP EBITDA as the performance measure are substantially similar.

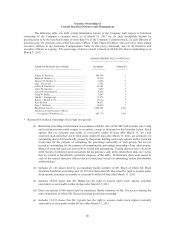

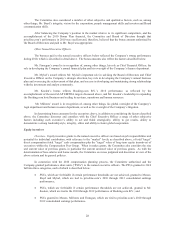

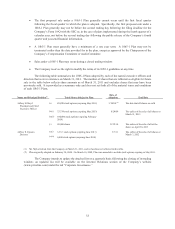

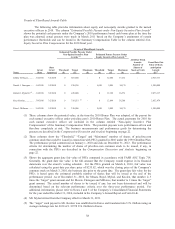

With respect to the grant to Messrs. Boyd and Mylod, the PSUs will vest and be earned at the end of the

three year performance period if the consolidated non-GAAP EBITDA hurdles below are accomplished:

If consolidated non-

GAAP EBITDA for the

three-year period ending

December 31, 2012 is:

Then, the number of shares

that will be issued is:

Consolidated non-GAAP EBITDA

target for the three-

y

ear period endin

g

December 31, 2012 expressed as a

multiple of consolidated non-GAAP

EBITDA for the three-year period

ending December 31, 2009 (reflects

upper limit of each applicable tier of

consolidated non-GAAP EBITDA):

Less than $1,840.9 million 0 1.6x

Between $1,840.9 million

and $2,021.6 million 0x to 1x the “target” grant 1.8x

Between $2,021.6 million

and $2,434.8 million 1x the “target” grant 2.1x

Between $2,434.8 million

and $2,593.7 million 1x to 2x the “target” grant 2.3x

Between $2,593.7 million

and $2,840.9 million 2x to 3x the “target” grant 2.5x

Over $2,840.9 million 3x the “target” grant Greater than 2.5x

The PSUs will be forfeited and no shares will be issued if, over the three year performance period,

priceline.com does not increase its consolidated non-GAAP EBITDA by at least approximately 60% over its

consolidated non-GAAP EBITDA over the three year period ending December 31, 2009 (2007 through 2009).