Priceline 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

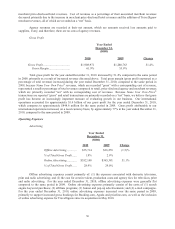

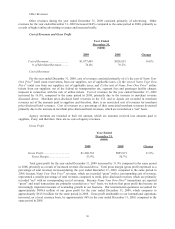

Income Taxes

Year Ended

December 31,

($000)

2009 2008 Change

Income Tax Benefit (Expense) ................ $47,168 $(90,171) (152.3)%

Our effective tax rate for the years ended December 31, 2009 and 2008 was (10.7)% and 32.7%,

respectively. Our effective tax rate for the year ended December 31, 2009 differs from the expected tax provision at

the U.S. statutory tax rate of 35%, principally because it includes tax benefits of $183.3 million resulting from the

reversal of a portion of the valuation allowance on our deferred tax assets related to net operating loss carryforwards.

Other items contributing to the difference between our effective tax rate and the statutory tax rate for the

years ended December 31, 2009 and 2008 include lower foreign tax rates and the foreign tax benefit of interest

expense on intercompany debt, partially offset by state income taxes.

Due to our significant NOLs, we do not expect to pay significant cash taxes on our U.S. federal taxable

income for the foreseeable future. We expect to make cash payments for foreign taxes, U.S. state income taxes and

U.S. federal alternative minimum tax.

See Note 15 to the Consolidated Financial Statements for details about the non-cash income tax benefits for

the year ended December 31, 2009.

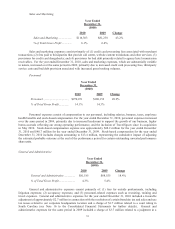

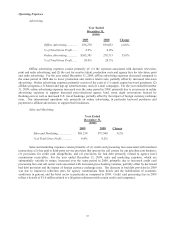

Equity in Income (Loss) of Investees

Year Ended

December 31,

($000)

2009 2008 Change

Equity in Income (Loss) of Investees ................................................ $2 $(310) (100.6)%

Equity in income (loss) of investees for the years ended December 31, 2009 and 2008 represented our pro

rata share of pricelinemortgage.com’s net results. In July 2009, pricelinemortgage.com was dissolved, and we

received $8.9 million in cash for our 49% equity investment in pricelinemortgage.com. We do not expect the

dissolution of our investment in pricelinemortgage.com to materially impact future periods.

Noncontrolling Interests

Year Ended

December 31,

($000)

2009 2008 Change

Noncontrolling Interests ...................................................................... $ - $3,378 (100.0)%

Noncontrolling interests for the year ended December 31, 2008, represented income associated with the

ownership of priceline.com International that was held by former shareholders of Booking.com B.V. and

Booking.com Limited, including certain European based managers of that business. In September 2008, we

repurchased all of the remaining outstanding shares of priceline.com International and, as a result, there are no

longer any noncontrolling interests in priceline.com International.