Priceline 2010 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

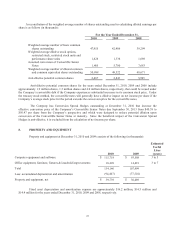

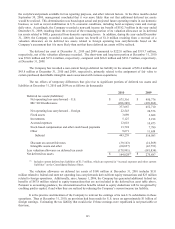

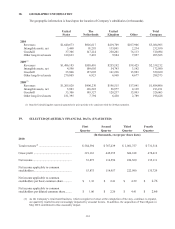

The following is a reconciliation of the total amount of unrecognized tax benefits (in thousands):

2010

2009

Unrecognized tax benefit – January 1

$ 741 $ 741

Gross increases – tax positions in current period

12,645 -

Unrecognized tax benefit – December 31 $ 13,386 $ 741

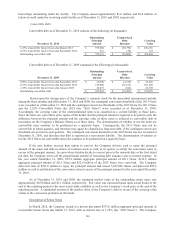

The unrecognized tax benefits are included in “Other long-term liabilities” on the Consolidated Balance

Sheets for the years ended December 31, 2010 and 2009 and, if recognized, would impact the effective tax rate. The

Company estimates that the unrecognized tax benefits may increase by approximately $20 million within the next

twelve months.

The Company’s U.K., Netherlands, U.S. federal and Connecticut income tax returns, constituting the

returns of the major taxing jurisdictions, are subject to examination by the taxing authorities for all open years as

prescribed by applicable statute. No income tax waivers have been executed that would extend the period subject to

examination beyond the period prescribed by statute.

16. COMMITMENTS AND CONTINGENCIES

Litigation Related to Hotel Occupancy and Other Taxes

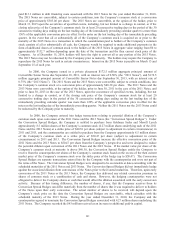

The Company and certain third-party defendant online travel companies are currently involved in

approximately fifty lawsuits, including certified and putative class actions, brought by or against states, cities and

counties over issues involving the payment of hotel occupancy and other taxes (i.e., state and local sales tax) and the

Company’s “merchant” hotel business. The Company’s subsidiaries Lowestfare.com LLC and Travelweb LLC are

named in some but not all of these cases. Generally, each complaint alleges, among other things, that the defendants

violated each jurisdiction’s respective hotel occupancy tax ordinance with respect to the charges and remittance of

amounts to cover taxes under each law. Each complaint typically seeks compensatory damages, disgorgement,

penalties available by law, attorneys’ fees and other relief. The Company is also involved in one consumer lawsuit

relating to, among other things, the payment of hotel occupancy taxes and service fees. In addition, approximately

sixty municipalities or counties, and at least six states, have initiated audit proceedings (including proceedings

initiated by more than forty municipalities in California), issued proposed tax assessments or started inquiries

relating to the payment of hotel occupancy and other taxes (i.e., state and local sales tax). Additional state and local

jurisdictions are likely to assert that the Company is subject to, among other things, hotel occupancy and other taxes

(i.e., state and local sales tax) and could seek to collect such taxes, retroactively and/or prospectively.

With respect to the principal claims in these matters, the Company believes that the ordinances at issue do

not apply to the service it provides, namely the facilitation of reservations, and, therefore, that it does not owe the

taxes that are claimed to be owed. Rather, the Company believes that the ordinances at issue generally impose hotel

occupancy and other taxes on entities that own, operate or control hotels (or similar businesses) or furnish or provide

hotel rooms or similar accommodations. In addition, in many of these matters, municipalities have asserted claims

for “conversion” – essentially, that the Company has collected a tax and wrongfully “pocketed” those tax dollars – a

claim that the Company believes is without basis and has vigorously contested. The municipalities that are currently

involved in litigation and other proceedings with the Company, and that may be involved in future proceedings,

have asserted contrary positions and will likely continue to do so. From time to time, the Company has found it

expedient to settle, and may in the future agree to settle, claims pending in these matters without conceding that the

claims at issue are meritorious or that the claimed taxes are in fact due to be paid.

In connection with some of these tax audits and assessments, the Company may be required to pay any

assessed taxes, which amounts may be substantial, prior to being allowed to contest the assessments and the

applicability of the ordinances in judicial proceedings. This requirement is commonly referred to as “pay to play” or

“pay first.” For example, the City of San Francisco assessed the Company approximately $3.4 million (an amount

that includes interest and penalties) relating to hotel occupancy taxes, which the Company paid in July 2009.

Payment of these amounts, if any, is not an admission that the Company believes it is subject to such taxes and, even