Priceline 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

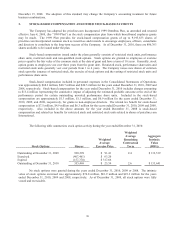

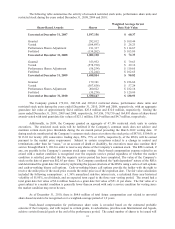

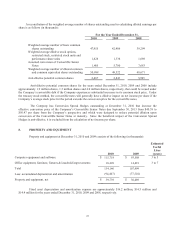

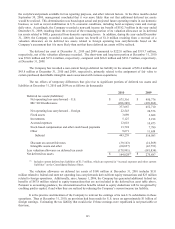

A reconciliation of the weighted average number of shares outstanding used in calculating diluted earnings per

share is as follows (in thousands):

For the Year Ended December 31,

2010 2009 2008

Weighted average number of basic common

shares outstanding

47,955

42,406

39,299

Weighted average dilutive stock options,

restricted stock, restricted stock units and

performance share units 1,628

1,336

1,689

Assumed conversion of Convertible Senior

Notes 1,405

5,780

7,683

Weighted average number of diluted common

and common equivalent shares outstanding 50,988

49,522

48,671

Anti-dilutive potential common shares 2,487 2,843 5,905

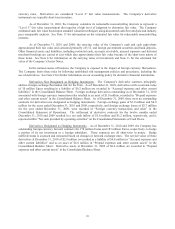

Anti-dilutive potential common shares for the years ended December 31, 2010, 2009 and 2008 include

approximately 1.9 million shares, 1.5 million shares and 4.0 million shares, respectively, that could be issued under

the Company’s convertible debt if the Company experiences substantial increases in its common stock price. Under

the treasury stock method, the convertible notes will generally have a dilutive impact on net income per share if the

Company’s average stock price for the period exceeds the conversion price for the convertible notes.

The Company has Conversion Spread Hedges outstanding at December 31, 2010 that increase the

effective conversion price of the Company’s Convertible Senior Notes due September 30, 2013 from $40.38 to

$50.47 per share from the Company’s perspective and which were designed to reduce potential dilution upon

conversion of the Convertible Senior Notes at maturity. Since the beneficial impact of the Conversion Spread

Hedges is anti-dilutive, it is excluded from the calculation of net income per share.

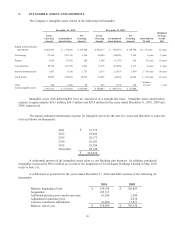

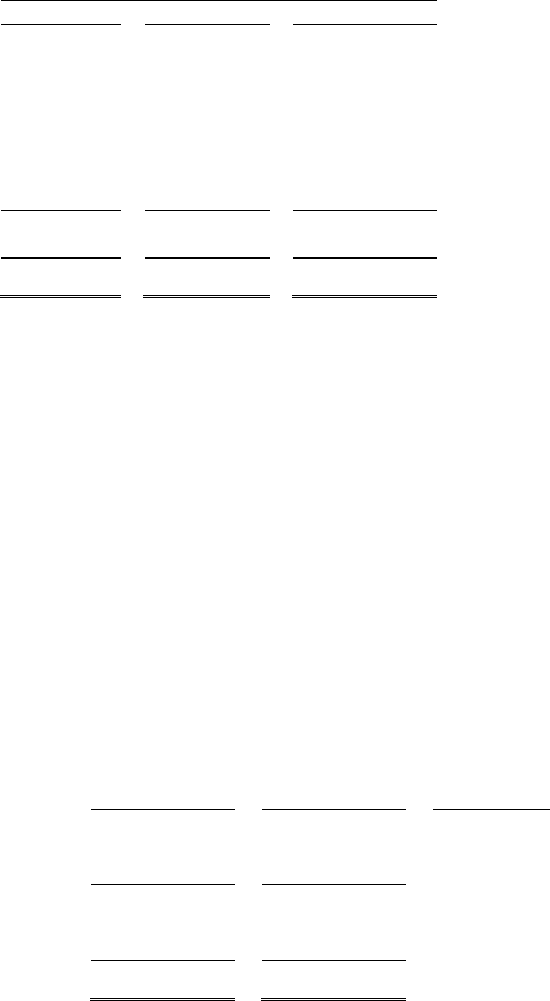

8. PROPERTY AND EQUIPMENT

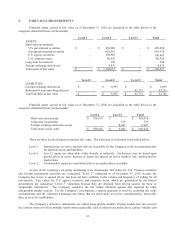

Property and equipment at December 31, 2010 and 2009 consists of the following (in thousands):

2010

2009

Estimated

Useful

Lives

(years)

Computer equipment and software $ 115,718 $ 93,508 3 to 5

Office equipment, furniture, fixtures & leasehold improvements 18,428 14,491 3 to 7

Total

134,146 107,999

Less: accumulated depreciation and amortization (94,407) (77,510)

Property and equipment, net $ 39,739 $ 30,489

Fixed asset depreciation and amortization expense are approximately $16.2 million, $14.5 million and

$14.4 million for the years ended December 31, 2010, 2009 and 2008, respectively.