Priceline 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

66

As of December 31, 2010 and 2009, we had outstanding forward currency contracts with a notional value

of 378 million Euros and 183 million Euros, respectively, to hedge a portion of our net investment in a foreign

subsidiary. These contracts are all short-term in nature. Mark-to-market adjustments on these net investment

hedges are recorded as currency translation adjustments. The net fair value of these derivatives at December 31,

2010 was a net liability of $2.8 million, with assets of $4.0 million recorded in “Prepaid expenses and other current

assets” and liabilities of $6.8 million recorded in “Accrued expenses and other current liabilities” in the

Consolidated Balance Sheet. Derivative assets at December 31, 2009 of $8.0 million are recorded in “Prepaid

expenses and other current assets” in the Consolidated Balance Sheet. A hypothetical 10% strengthening of the

foreign exchange rates relative to the U.S. Dollar, with all other variables held constant, would have resulted in a

derivative liability of approximately $53 million as of December 31, 2010. See Note 5 to the Consolidated Financial

Statements for further detail on our derivative instruments.

Additionally, fixed rate investments are subject to unrealized gains and losses due to interest rate volatility.

To the extent that changes in interest rates and currency exchange rates affect general economic conditions, the

Priceline Group would also be affected by such changes.

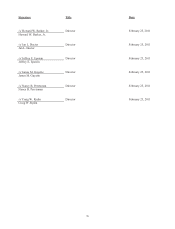

Item 8. Financial Statements and Supplementary Data

The following Consolidated Financial Statements of the Company and the report of our independent

registered public accounting firm are filed as part of this Annual Report on Form 10-K (See Item 15).

Consolidated Balance Sheets as of December 31, 2010 and 2009; Consolidated Statements of Operations,

Changes in Stockholders’ Equity and Cash Flows for the years ended December 31, 2010, 2009 and 2008; Notes to

Consolidated Financial Statements and Report of Independent Registered Public Accounting Firm.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.