Priceline 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.83

priceline.com Incorporated

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS DESCRIPTION

Priceline.com Incorporated (the “Priceline Group,” or the “Company”) is a leading global online travel

company that offers its customers a broad range of travel services, including the opportunity to purchase hotel room

reservations, car rentals, airline tickets, vacation packages, cruises and destination services in a traditional price-

disclosed manner. The Company also offers its unique Name Your Own Price® service that enables its customers to

use the Internet to save money by allowing them to make offers for travel services at prices they set, while enabling

sellers, which include many of the major domestic hotel, airline and rental car companies, to generate revenue.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation – The Company’s Consolidated Financial Statements include the accounts of the

Company and its wholly-owned subsidiaries, including without limitation, priceline.com International Ltd.

(“priceline.com International”), Booking.com B.V., Booking.com Limited, priceline.com Europe Ltd, priceline.com

Mauritius Company Limited (formerly known as Agoda Company, Ltd.) (“Agoda”), and its majority-owned interest

in TravelJigsaw Holdings Limited since its acquisition in May 2010. All intercompany accounts and transactions

have been eliminated in consolidation. Investments in affiliates in which the Company does not have control, but

has the ability to exercise significant influence, are accounted for by the equity method.

Use of Estimates – The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and assumptions that

affect the amounts reported in the financial statements and footnotes thereto. Actual results may differ significantly

from those estimates. The significant estimates underlying the Company’s Consolidated Financial Statements relate

to, among other things, the Company’s deferred tax valuation allowance, the Company’s accounting for state and

local hotel occupancy and sales taxes, stock-based compensation, the Company’s allowance for doubtful accounts,

and the valuation of goodwill and long-lived assets and intangibles.

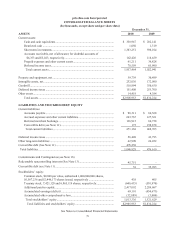

Fair Value of Financial Instruments – The Company’s financial instruments, including cash and cash

equivalents, restricted cash, accounts receivable, accounts payable, accrued expenses and deferred merchant

bookings, are carried at cost which approximates their fair value because of the short-term nature of these financial

instruments. See Notes 4 and 5 for information on fair value for investments, derivatives and the Company’s

outstanding Convertible Senior Notes.

Cash and Cash Equivalents – Cash and cash equivalents consists primarily of cash and highly liquid

investment grade securities with an original maturity of three months or less.

Restricted Cash – Restricted cash at December 31, 2010 and 2009 collateralizes office leases and supplier

obligations.

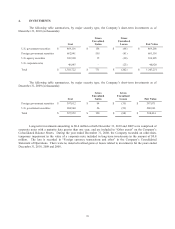

Investments – The Company has classified its investments as available-for-sale securities. These securities

are carried at estimated fair value with the aggregate unrealized gains and losses related to these investments, net of

taxes, reflected as a part of “Accumulated other comprehensive loss” within stockholders’ equity.

The fair value of the investments is based on the specific quoted market price of the securities or

comparable securities at the balance sheet dates. Investments in debt securities are considered to be impaired when

a decline in fair value is judged to be other than temporary because the Company either intends to sell or it is more-

likely-than not that it will have to sell the impaired security before recovery. Once a decline in fair value is

determined to be other than temporary, an impairment charge is recorded and a new cost basis in the investment is

established. If the Company does not intend to sell the debt security, but it is probable that the Company will not

collect all amounts due, then only the impairment due to the credit risk would be recognized in earnings and the

remaining amount of the impairment would be recognized in “Accumulated other comprehensive loss” within

stockholders’ equity. The marketable securities are presented as current assets on the Company’s Consolidated

Balance Sheets, if they are available to meet the short-term working capital needs of the Company. Investments

with a maturity date greater than one year from the balance sheet date are classified as long-term investments. See

Notes 4 and 5 for further detail of investments.