Priceline 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.102

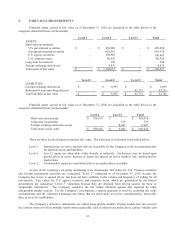

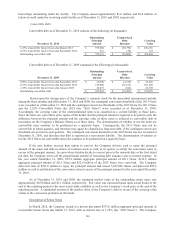

Accounting guidance requires that cash-settled convertible debt, such as the Company’s convertible senior

notes, be separated into debt and equity at issuance and each be assigned a value. The value assigned to the debt

component is the estimated fair value, as of the issuance date, of a similar bond without the conversion feature. The

difference between the bond cash proceeds and this estimated fair value, representing the value assigned to the

equity component, is recorded as a debt discount. Debt discount is amortized using the effective interest method

over the period from origination or modification date through the earlier of the first stated put date or the stated

maturity date.

The Company estimated the straight debt borrowing rates at debt origination to be 5.89% for the 2015

Notes and 8.0% for the 2013 Notes. The yield to maturity was estimated at an at-market coupon priced at par.

Debt discount after tax of $69.1 million ($115.2 million before tax) partially offset by financing costs

associated with the equity component of convertible debt of $1.6 million were recorded in additional paid-in capital

related to the 2015 Notes at December 31, 2010.

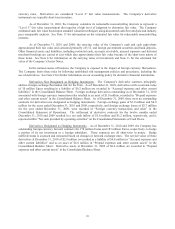

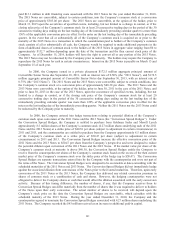

For the years ended December 31, 2010, 2009 and 2008, the Company recognized interest expense of

$27.6 million, $22.1 million and $33.4 million, respectively, related to convertible notes, comprised of $5.8 million,

$2.9 million and $4.6 million, respectively, for the contractual coupon interest, $20.1 million, $18.2 million and

$26.7 million, respectively, related to the amortization of debt discount and $1.7 million, $1.0 million and $2.1

million, respectively, related to the amortization of debt issuance costs. In addition, unamortized debt issuance costs

written off to interest expense related to debt conversions in 2010, 2009 and 2008 was $1.4 million, $1.2 million,

and $0.3 million, respectively. The remaining period for amortization of debt discount and debt issuance costs is the

stated maturity dates for the respective debt. The effective interest rates for the years ended December 31, 2010,

2009, and 2008 are 6.7%, 8.5% and 8.5%, respectively.

In addition, if the Company’s convertible debt is redeemed or converted prior to maturity, a gain or loss on

extinguishment will be recognized. The gain or loss is the difference between the fair value of the debt component

immediately prior to extinguishment and its carrying value. To estimate the fair value at each conversion date, the

Company used an applicable LIBOR rate plus an applicable credit default spread based upon the Company’s credit

rating at the respective conversion dates. In the years ended December 31, 2010, 2009 and 2008, the Company

recognized a loss of $11.3 million ($6.8 million after tax), a loss of $1.0 million ($0.6 million after tax) and a gain of

$6.0 million ($3.6 million after tax), respectively, in “Foreign currency transactions and other” in the Consolidated

Statements of Operations.

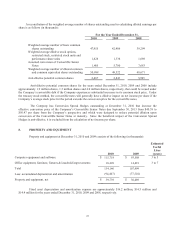

12. TREASURY STOCK

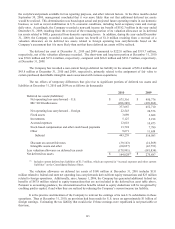

In the first quarter of 2010, the Company’s Board of Directors authorized an additional repurchase of up to

$500 million of the Company’s common stock from time to time in the open market or in privately negotiated

transactions, including the approval to purchase up to $100 million from the proceeds from the issuance of the 2015

Notes. During the year ended December 31, 2010, the Company repurchased 461,437 shares of its common stock at

an aggregate cost of approximately $106.1 million.

The Board of Directors has also given the Company the general authorization to repurchase shares of its

common stock to satisfy employee withholding tax obligations related to stock-based compensation. In the years

ended December 31, 2010, 2009 and 2008, the Company repurchased 94,572, 180,071, and 38,640 shares at an

aggregate cost of approximately $23.4 million, $17.4 million and $4.4 million, respectively, to satisfy employee

withholding taxes related to stock-based compensation.

The Company may make additional repurchases of shares under its stock repurchase program, depending

on prevailing market conditions, alternate uses of capital and other factors. Whether and when to initiate and/or

complete any purchase of common stock and the amount of common stock purchased will be determined in the

Company’s complete discretion. The Company has a remaining authorization of $459.2 million to repurchase

common stock. As of December 31, 2010, there were approximately 7.4 million shares of the Company’s common

stock held in treasury.

13. NONCONTROLLING INTERESTS

On May 18, 2010, the Company, through its wholly-owned subsidiary, Priceline.com International Limited

(“PIL”), paid $108.5 million, net of cash acquired, to purchase a controlling interest of the outstanding equity of