Priceline 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

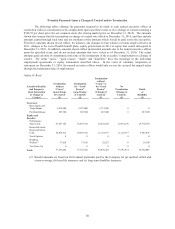

remaining “target” PSU grant based on the length of the performance period that had elapsed between

the date that is six months after the “Change of Control” and the end of the performance period; if

Mr. Boyd is terminated without “Cause,” for “Good Reason,” or as the result of death or “Disability”

after the date that is six months after the “Change of Control” but prior to the end of the performance

period, then Mr. Boyd would receive a pro-rata portion of the remaining “target” PSU grant based on

the length of the performance period that had elapsed between the date that is six months after the

“Change of Control” and the date of termination.

x If a “Change of Control” occurs and Mr. Boyd is terminated without “Cause,” for “Good Reason,” or as

a result of death or “Disability” within the six-month period after the effective date of the “Change of

Control,” the PSU performance multiplier would be applied to a pro-rata portion (based on the lesser of

36 and the number of full months that had elapsed since January 1, 2008 as of the effective date of the

“Change of Control”) of Mr. Boyd’s “target” PSU grant; the performance multiplier could range from 0

to 2x, depending on the Company’s performance through the most recently completed fiscal quarter;

Mr. Boyd would also receive a pro-rata portion of Mr. Boyd’s “target” PSU grant (based on the number

of full months that had elapsed since the effective date of the “Change of Control” as of the date of

termination).

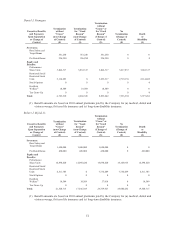

Mr. Finnegan

Employment Agreement

Termination without “Cause” or for “Good Reason”. In the event of a termination of Mr. Finnegan’s

employment by the Company without “Cause” (as defined in the agreement with Mr. Finnegan) or by Mr.

Finnegan for “Good Reason” (as defined in the agreement), then Mr. Finnegan will be entitled to receive, among

other things, in addition to his compensation accrued through the date of his termination of employment, the

following severance compensation and benefits:

(1) one times his base salary and target bonus, if any, paid over a 12-month period following his

termination of employment;

(2) if a bonus plan is in place, a pro-rata target annual bonus for the year in which termination of

employment occurs; and

(3) continuation for one year following termination of employment of group health, life and disability

insurance benefits as if he were an employee of the Company.

Stock Options. The agreement with Mr. Finnegan provides that the options to acquire 35,000 shares of the

Company’s common stock (of which 1,728 were outstanding as of March 31, 2011) that were granted in

October 2005 upon his promotion to Senior Vice President, Controller and Chief Accounting Officer will vest in

full on the date that is six months following the occurrence of a “Change of Control” provided that Mr. Finnegan

remains employed with the Company through such date. In the event that Mr. Finnegan’s employment is

terminated without “Cause” (as defined in Mr. Finnegan’s agreement) within six months following a “Change of

Control,” the options will vest in full on the date of termination and will remain exercisable for six months

following the date of termination.

Other. Mr. Finnegan entered into a non-competition agreement with the Company in October 2005 pursuant to

which Mr. Finnegan is subject to one-year non-competition and non-solicitation obligations following

Mr. Finnegan’s termination of employment with the Company.

Equity Instruments

2010 PSUs. The PSUs granted to Mr. Finnegan in March 2010 would be treated in the same fashion

as the 2010 PSUs held by Mr. Boyd described above under “Mr. Boyd – Equity Instruments” except for the fact

that the PSU performance multiplier could range from 1x to 2x instead of 0 to 3x.