Priceline 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

the carryforward periods available for tax reporting purposes, and other relevant factors. In the three months ended

September 30, 2009, management concluded that it was more likely than not that additional deferred tax assets

would be realized. This determination was based upon actual and projected future operating results in our domestic

business, as well as recent stabilization in U.S. economic conditions, including hotel occupancy rates and average

daily rates. Accordingly, the Company recorded a non-cash income tax benefit of $182.3 million in the year ended

December 31, 2009, resulting from the reversal of the remaining portion of its valuation allowance on its deferred

tax assets related to NOLs generated from domestic operating losses. In addition, during the year ended December

31, 2009, the Company recorded a non-cash income tax benefit of $1.0 million resulting from a reversal of a

valuation allowance on its deferred tax assets related to foreign operating loss carryforwards based on the

Company’s assessment that it is more likely than not that these deferred tax assets will be realized.

The deferred tax asset at December 31, 2010 and 2009 amounted to $222.0 million and $319.7 million,

respectively, net of the valuation allowance recorded. The short-term and long term portion at December 31, 2010

was $70.6 million and $151.4 million, respectively, compared with $66.0 million and $253.7 million, respectively,

at December 31, 2009.

The Company has recorded a non-current foreign deferred tax liability in the amount of $56.4 million and

$43.8 million at December 31, 2010 and 2009, respectively, primarily related to the assignment of fair value to

certain purchased identifiable intangible assets associated with various acquisitions.

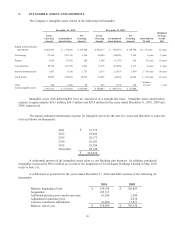

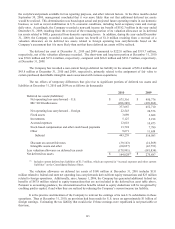

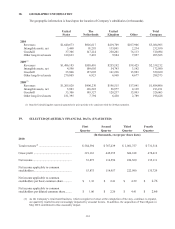

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and

liabilities at December 31, 2010 and 2009 are as follows (in thousands):

2010 2009

Deferred tax assets/(liabilities):

Net operating loss carryforward – U.S. $ 875,316 $ 950,776

IRC 382 Disallowance (498,249) (498,066)

377,067 452,710

Net operating loss carryforward – Foreign 22,543 24,576

Fixed assets 3,089 3,688

Investments 5,127 5,198

Accrued expenses 12,018

10,473

Stock-based compensation and other stock based payments 13,724

7,780

Other 9,671 11,658

Subtotal 443,239 516,083

Discount on convertible notes (39,163) (14,569)

Intangible assets and other (60,057) (43,793)

Less valuation allowance on deferred tax assets (179,991) (181,834)

Net deferred tax assets $ 164,028(1) $ 275,887

(1) Includes current deferred tax liabilities of $1.5 million, which are reported in “Accrued expenses and other current

liabilities” on the Consolidated Balance Sheet.

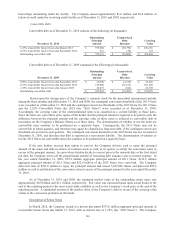

The valuation allowance on deferred tax assets of $180 million at December 31, 2010 includes $151

million related to federal and state net operating loss carryforwards derived from equity transactions and $23 million

related to foreign operations. Additionally, since January 1, 2006, the Company has generated additional federal tax

benefits of $87.8 million related to equity transactions that are not included in the deferred tax asset table above.

Pursuant to accounting guidance, the aforementioned tax benefits related to equity deductions will be recognized by

crediting paid in capital, if and when they are realized by reducing the Company’s current income tax liability.

It is the practice and intention of the Company to reinvest the earnings of its non-U.S. subsidiaries in those

operations. Thus at December 31, 2010, no provision had been made for U.S. taxes on approximately $1 billion of

foreign earnings. Estimating the tax liability that would arise if these earnings were repatriated is not practicable at

this time.