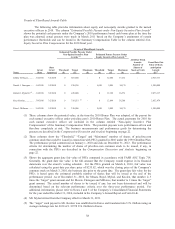

Priceline 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

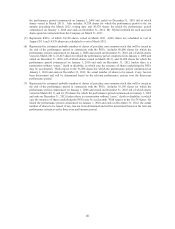

2009 Restricted Stock Units. The RSUs granted to Mr. Mylod in March 2009 would be treated in the

same fashion as the 2009 RSUs held by Mr. Boyd described above under “Mr. Boyd – Equity Instruments.”

2008 PSUs. The PSUs granted to Mr. Mylod in March 2008 would be treated in the same fashion as

the 2008 PSUs held by Mr. Boyd described above under “Mr. Boyd – Equity Instruments.”

Mr. Millones.

2010 PSUs. The PSUs granted to Mr. Millones in March 2010 would be treated in the same fashion as

the 2010 PSUs held by Mr. Boyd described above under “Mr. Boyd – Equity Instruments” except for the fact that

the PSU performance multiplier could range from 1x to 2x instead of 0 to 3x.

2009 Restricted Stock Units. The RSUs granted to Mr. Millones in March 2009 provide for

accelerated vesting upon a termination without “Cause” or as the result of death or “Disability.” If a termination

without “Cause” or as the result of death or “Disability” occurs, Mr. Millones will receive a pro-rata portion of

the RSUs as of the date of termination. If a “Change of Control” occurs and Mr. Millones remains an employee

of the Company as of the date which is six months after the “Change of Control,” a pro-rata portion of the RSUs

will vest as of such six-month date and the remaining portion of the RSUs will vest on the third anniversary of

the date of grant, provided that Mr. Millones remains an employee of the Company through such date. Upon a

termination without “Cause” or as the result of death or “Disability” that occurs after a “Change of Control” but

prior to the six-month date following a “Change of Control,” vesting of all outstanding RSUs will be accelerated

on the date on which Mr. Millones is terminated.

2008 PSUs. The PSUs granted to Mr. Millones in March 2008 would be treated in the same fashion as

the 2008 PSUs held by Mr. Boyd described above under “Mr. Boyd – Equity Instruments.”

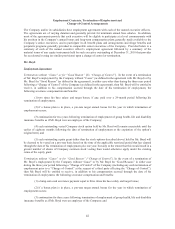

Mr. Koolen

Employment Agreement

The employment agreement between Mr. Koolen and Booking.com B.V., an indirect wholly-owned

subsidiary of the Company, which was entered into effective September 1, 2008, does not have a fixed term and

is terminable at will by either party upon due observance of the statutory notice period in The Netherlands, which

is currently one month for an employment relationship under five years. The agreement automatically terminates

upon Mr. Koolen reaching the age of 65.

Termination without “Cause” Or “Good Reason.” In the event of a termination of Mr. Koolen’s

employment by the Company without “Cause” (as defined in the agreement with Mr. Koolen) or by Mr. Koolen

for “Good Reason” (as defined in Mr. Koolen’s agreement), then Mr. Koolen will be entitled to receive, among

other things, in addition to his compensation accrued through the date of his termination of employment, the

following severance compensation and benefits:

(1) two times his base salary and target bonus, if any, paid over a 12-month period following his

termination of employment; and

(2) if a bonus plan is in place, a pro-rata target annual bonus for the year in which termination of

employment occurs.

Because Mr. Koolen’s employment agreement is governed by Dutch law, and under Dutch law, a court

has discretion to award severance to an employee depending on the facts and circumstances of the termination of

the employee (e.g., the reason for the termination), if a court awards Mr. Koolen any compensation upon his

termination, then the amount of such award shall be deducted from the amounts described above.

Termination as the Result of Death. In the event of a termination of Mr. Koolen’s employment as the

result of his death, then Mr. Koolen will be entitled to receive, among other things, in addition to his

compensation accrued through the date of termination of employment, if a bonus plan is in place, a pro-rata

target annual bonus for the year in which termination of employment occurs.