Priceline 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

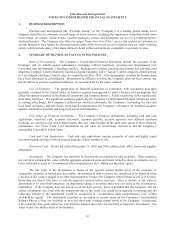

intent to sell. If an entity intends to sell, or it is more-likely-than not that it will have to sell, impaired securities

before recovery, the adjustment to fair value would be recognized through earnings. If an entity does not intend to

sell the impaired debt security but it is probable that the entity will not collect all amounts due, then only the

impairment due to credit risk would be recognized in earnings and the remaining amount of the impairment would

be recognized in equity, in other comprehensive income but separately disclosed from other gains or losses on

available-for-sale securities. The non-credit risk portion of the impairment for held-to-maturity securities will be

amortized prospectively over the remaining life of the security. This change in accounting is effective for interim

reporting periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009,

and applies to existing and new investments held as of the beginning of the interim period in which it is adopted.

The adoption of this standard, effective with the three months ended March 31, 2009, did not have an impact on the

Company’s Consolidated Financial Statements.

In May 2009, the FASB issued new accounting guidance which required entities to state in their periodic

filings the date through which subsequent events were evaluated. The Company adopted this accounting standard

for the six months ended June 30, 2009. In February 2010, this accounting guidance was amended. Although the

Company is still required to conduct its review of subsequent events until its periodic reports are filed, it is no longer

required to specifically state that date in its filings. This change in guidance also requires an entity to update its

evaluation of subsequent events through the date revised financial statements are issued (“revised financial

statements” is a new term that incorporates the retrospective adoption of new accounting standards and the

correction of an error).

In June 2009, the FASB issued guidance on its Accounting Standards Codification™ (“ASC” or

“Codification”) and the hierarchy of U.S. GAAP. Effective July 1, 2009, the FASB launched the Codification

which became effective for all interim and annual periods ending after September 15, 2009. The Codification is the

single official source of authoritative, nongovernmental U.S. GAAP and supersedes all previously issued non-SEC

accounting and reporting standards. The Codification as launched did not change U.S. GAAP but organized the

accounting literature by topical areas in a user-friendly online research system. The Codification also includes

relevant SEC guidance organized using the same topical structure. Specific changes that modify the Codification

are communicated by the FASB by the issuance of an Accounting Standard Update (“ASU”). During 2009 and

2010, the FASB issued several ASUs that mostly entailed technical corrections to existing guidance or affected

guidance to specialized industries or entities. With the exception of the 2010 accounting updates that require

disclosure of supplemental pro forma information for business combinations and additional disclosure on fair value

measurements, none of the ASUs issued to date is expected to have an impact on the Company.

In April 2008, the FASB issued guidance on determining the useful life of acquired intangible assets. The

new guidance removed the requirement to consider whether an intangible asset can be renewed without substantial

cost of material modifications to the existing terms and conditions and, instead, required an entity to consider its

own historical experience in renewing similar arrangements. This accounting guidance also expanded disclosure

related to the determination of intangible asset useful lives. The accounting guidance is effective for financial

statements issued for fiscal years beginning after December 15, 2008, and may impact any intangible assets the

Company acquires in future transactions.

In May 2008, the FASB issued an accounting standard which identified the sources of accounting

principles and the framework for selecting the principles to be used in the preparation of financial statements of non-

governmental entities that are presented in conformity with U.S. generally accepted accounting principles. This

standard was effective November 15, 2008. The adoption of this statement did not result in a change in the

Company’s current practices.

In June 2008, the FASB ratified a proposal that addressed the determination of whether an instrument (or

an embedded feature) is indexed to an entity’s own stock. This accounting guidance is effective for years beginning

after December 15, 2008. The adoption of this standard on January 1, 2009 did not have an impact on the

Company’s Consolidated Financial Statements.

In December 2008, accounting guidance was issued for accounting for defensive intangible assets. A

defensive asset is an acquired intangible asset where the acquirer has no intention of using, or intends to discontinue

use of, the intangible asset but holds it to prevent competitors from obtaining any benefit from it. The acquired

defensive asset is treated as a separate unit of accounting and the useful life assigned is based on the period during

which the asset will diminish in value. This accounting guidance is effective for fiscal years beginning on or after