Priceline 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

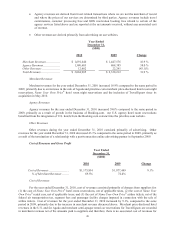

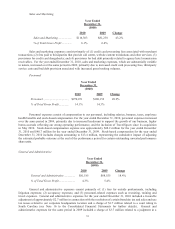

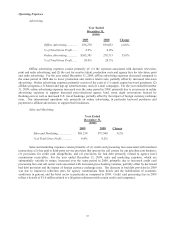

Sales and Marketing

Year Ended

December 31,

($000)

2010 2009 Change

Sales and Marketing .................. $116,303 $81,238 43.2%

% of Total Gross Profit ............. 6.1% 6.4%

Sales and marketing expenses consist primarily of (1) credit card processing fees associated with merchant

transactions; (2) fees paid to third-parties that provide call center, website content translations and other services; (3)

provisions for credit card chargebacks; and (4) provisions for bad debt primarily related to agency hotel commission

receivables. For the year ended December 31, 2010, sales and marketing expenses, which are substantially variable

in nature, increased over the same period in 2009, primarily due to increased credit card processing fees, third-party

service costs and bad debt provision associated with increased gross booking volumes.

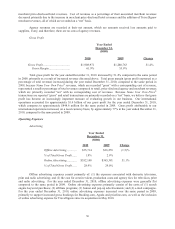

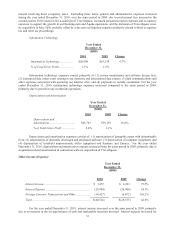

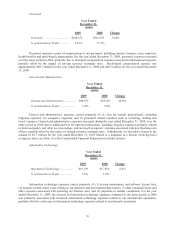

Personnel

Year Ended

December 31,

($000)

2010 2009 Change

Personnel .................................. $270,071 $180,152 49.9%

% of Total Gross Profit ............. 14.1% 14.3%

Personnel expenses consist of compensation to our personnel, including salaries, bonuses, taxes, employee

health benefits and stock-based compensation. For the year ended December 31, 2010, personnel expenses increased

over the same period in 2009, primarily due to increased headcount to support the growth of our business, higher

bonus accruals reflecting our strong operating performance, and the inclusion of TravelJigsaw since its acquisition

in May 2010. Stock-based compensation expense was approximately $68.2 million for the year ended December

31, 2010 and $40.7 million for the year ended December 31, 2009. Stock-based compensation for the year ended

December 31, 2010 includes charges amounting to $13.4 million, representing the cumulative impact of adjusting

the estimated probable outcome at the end of the performance period for certain outstanding unvested performance

share units.

General and Administrative

Year Ended

December 31,

($000)

2010 2009 Change

General and Administrative ............... $81,185 $68,555 18.4%

% of Total Gross Profit ...................... 4.3% 5.4%

General and administrative expenses consist primarily of: (1) fees for outside professionals, including

litigation expenses; (2) occupancy expenses; and (3) personnel-related expenses such as recruiting, training and

travel expenses. General and administrative expenses for the year ended December 31, 2010 included a favorable

adjustment of approximately $2.7 million in connection with the resolution of certain franchise tax and sales and use

tax issues related to our corporate headquarters location and a charge of $1.7 million related to a court ruling in

South Carolina (see Note 16 to the Consolidated Financial Statements for further details). General and

administrative expenses for the same period in 2009 included a charge of $3.7 million related to a judgment in a