Priceline 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

certain investors. After extensive negotiations, the parties reached a comprehensive settlement on or about March

30, 2009. On April 2, 2009, plaintiffs filed a Notice of Motion for Preliminary Approval of Settlement. On June 9,

2009, the court granted the motion and scheduled the hearing for final approval for September 10, 2009. The

settlement, previously approved by a special committee of our Board of Directors, compromised the claims against

us for approximately $0.3 million. The court issued an order granting final approval of the settlement on October 5,

2009. Notices of appeal of the Court’s order have been filed with the Second Circuit. All but one of the appeals has

been resolved. The remaining appeal is still pending.

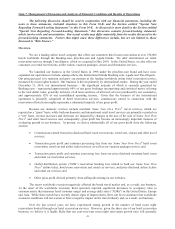

OFT Inquiry

In September 2010, the United Kingdom’s Office of Fair Trading (the “OFT”), the competition authority in

the U.K., announced it was conducting a formal early stage investigation into suspected breaches of competition law

in the hotel online booking sector and had written to a number of parties in the industry to request information.

Specifically, the investigation focuses upon whether there are agreements or concerted practices between hotels and

online travel companies and/or hotel room reservation “wholesalers” relating to the fixed or minimum resale prices

of hotel room reservations. In September 2010, Booking.com B.V. and priceline.com Incorporated, on behalf of

Booking.com, received a Notice of Inquiry from the OFT; we and Booking.com are cooperating with the OFT’s

investigation. We are unable at this time to predict the outcome of the OFT’s investigation and the impact, if any,

on our business, financial condition and results of operations.

We intend to defend vigorously against the claims in all of the proceedings described in this Item 3. We

have accrued for certain legal contingencies where it is probable that a loss has been incurred and the amount can be

reasonably estimated. Except as disclosed, such amounts accrued are not material to our Consolidated Balance

Sheets and provisions recorded have not been material to our consolidated results of operations. We are unable to

estimate the potential maximum range of loss.

From time to time, we have been, and expect to continue to be, subject to legal proceedings and claims in the

ordinary course of business, including claims of alleged infringement of third party intellectual property rights. Such

claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources, divert

management’s attention from our business objectives and could adversely affect our business, results of operations,

financial condition and cash flows.