IBM 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

96

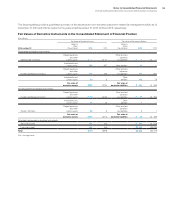

The following table reflects the purchase price related to these acquisitions and the resulting purchase price allocations as of December 31, 2013.

2013 Acquisitions

($ in millions)

Amortization

Life (in Years)

SoftLayer

Other

Acquisitions

Current assets $ 80 $ 97

Fixed assets/noncurrent assets 300 41

Intangible assets

Goodwill N/A 1,285 961

Completed technology 5—7 290 181

Client relationships 6—7 245 97

In-process R&D N/A 2 —

Patents/trademarks 2—7 75 32

Total assets acquired 2,277 1,408

Current liabilities (56) (61)

Noncurrent liabilities (244) (105)

Total liabilities assumed (300) (166)

Total purchase price $1,977 $1,242

N/A—Not applicable

In addition to SoftLayer, each acquisition further complemented and

enhanced the company’s portfolio of product and services offerings.

The acquisition of StoredIQ advances the company’s efforts to help

clients derive value from big data. The combination of the company’s

and Star Analytics’ software will advance the company’s business

analytics initiatives. UrbanCode automates the delivery of software,

helping businesses quickly release and update mobile, social, big

data and cloud applications. CSL deepens the consolidation cloud

capabilities by offering simplified management of the virtualization

environment. Trusteer extends the company’s data security capabili-

ties further into the cloud, mobile and endpoint security space. Daeja

delivers software that helps employees across all industries, espe-

cially data intensive ones such as banking, insurance and healthcare,

get faster access to critical business information, and complements

the company’s big data capabilities. Xtify is a leading provider of

cloud-based mobile messaging tools that help organizations

improve mobile sales, drive in-store traffic and engage customers

with personalized offers. The Now Factory is a provider of analytics

software that helps communications service providers (CSPs)

deliver better customer experiences and drive new revenue oppor-

tunities. Fiberlink is a mobile management and security company,

that supports the company’s expanding vision for enterprise mobility

management, which encompasses secure transactions between

businesses, partners, and customers.

For the “Other Acquisitions,” the overall weighted-average life of

the identified amortizable intangible assets acquired is 6.6 years.

These identified intangible assets will be amortized on a straight-line

basis over their useful lives. Goodwill of $961 million has been

assigned to the Software ($948 million) and Systems and Technology

($13 million) segments. It is expected that approximately 2 percent of

the goodwill will be deductible for tax purposes.

On January 17, 2014, the company completed the acquisition of

Aspera, Inc. (Aspera), a privately held company based in Emeryville,

CA. Aspera’s technology helps companies securely speed the

movement of massive data files around the world. At the date of

issuance of the financial statements, the initial purchase accounting

was not complete for this acquisition.

On February 24, 2014, the company announced that it had signed

a definitive agreement to acquire Boston, MA-based Cloudant, Inc.,

(Cloudant) a privately held database-as-a-service (DBaaS) provider

that enables developers to easily and quickly create next generation

mobile and web apps. Cloudant will extend the company’s big data

and analytics, cloud, and mobile offerings by further helping clients

take advantage of these key growth initiatives. The acquisition is

expected to close in the first quarter of 2014.

2012

In 2012, the company completed 11 acquisitions at an aggregate

cost of $3,964 million.

Kenexa Corporation (Kenexa)—On December 3, 2012, the com-

pany completed the acquisition of 100 percent of Kenexa, a publicly

held company, for cash consideration of $1,351 million. Kenexa, a

leading provider of recruiting and talent management solutions,

brings a unique combination of cloud-based technology and con-

sulting services that integrates both people and processes,

providing solutions to engage a smarter, more effective workforce

across their most critical businesses functions. Goodwill of $1,014

million was assigned to the Software ($771 million) and Global Tech-

nology Services (GTS) ($243 million) segments. As of the acquisition

date, it was expected that approximately 10 percent of the goodwill

would be deductible for tax purposes. The overall weighted-average

useful life of the identified intangible assets acquired was 6.5 years.