IBM 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

135

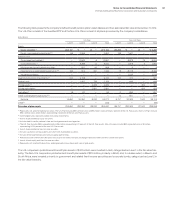

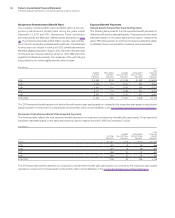

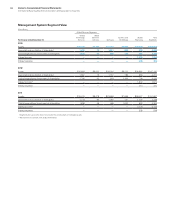

Plan Assets

Retirement-related benefit plan assets are recognized and measured

at fair value as described in note A, “Significant Accounting Policies,”

on pages 91 and 92. Because of the inherent uncertainty of valua-

tions, these fair value measurements may not necessarily reflect the

amounts the company could realize in current market transactions.

Investment Policies and Strategies

The investment objectives of the Qualified PPP portfolio are

designed to generate returns that will enable the plan to meet its

future obligations. The precise amount for which these obligations

will be settled depends on future events, including the retirement

dates and life expectancy of the plans’ participants. The obliga-

tions are estimated using actuarial assumptions, based on the

current economic environment and other pertinent factors described

on pages 132 through 134. The Qualified PPP portfolio’s investment

strategy balances the requirement to generate returns, using poten-

tially higher yielding assets such as equity securities, with the need

to control risk in the portfolio with less volatile assets, such as fixed-

income securities. Risks include, among others, inflation, volatility in

equity values and changes in interest rates that could cause the plan

to become underfunded, thereby increasing its dependence on

contributions from the company. To mitigate any potential concen-

tration risk, careful consideration is given to balancing the portfolio

among industry sectors, companies and geographies, taking into

account interest rate sensitivity, dependence on economic growth,

currency and other factors that affect investment returns. As a result,

the Qualified PPP portfolio’s target allocation is 42 percent equity

securities, 47 percent fixed-income securities, 6 percent real estate

and 5 percent other investments, which is consistent with the alloca-

tion decisions made by the company’s management and is similar

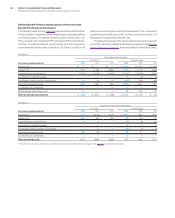

to the prior year target allocation. The table on page 136 details the

actual equity, fixed income, real estate and other types of invest

-

ments in the Qualified PPP portfolio.

The assets are managed by professional investment firms and

investment professionals who are employees of the company. They are

bound by investment mandates determined by the company’s man-

agement and are measured against specific benchmarks. Among

these managers, consideration is given, but not limited to, balancing

security concentration, issuer concentration, investment style and

reliance on particular active and passive investment strategies.

Market liquidity risks are tightly controlled, with $6,809 million

of the Qualified PPP portfolio invested in private market assets

consisting of private equities and private real estate investments,

which are less liquid than publicly traded securities. As of December

31, 2013, the Qualified PPP portfolio had $2,830 million in commit-

ments for future investments in private markets to be made over a

number of years. These commitments are expected to be funded

from plan assets.

Derivatives are used as an effective means to achieve investment

objectives and/or as a component of the plan’s risk management

strategy. The primary reasons for the use of derivatives are fixed

income management, including duration, interest rate management

and credit exposure, cash equitization and to manage currency and

commodity strategies.

Outside the U.S., the investment objectives are similar to those

described above, subject to local regulations. The weighted-average

target allocation for the non-U.S. plans is 33 percent equity securi-

ties, 54 percent fixed-income securities, 2 percent real estate and

11 percent other investments, which is consistent with the allocation

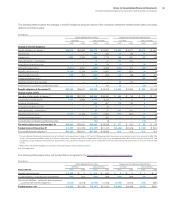

decisions made by the company’s management. The table on page

136 details the actual equity, fixed income, real estate and other

types of investments for non-U.S. plans. In some countries, a higher

percentage allocation to fixed income is required to manage sol-

vency and funding risks. In others, the responsibility for managing

the investments typically lies with a board that may include up to 50

percent of members elected by employees and retirees. This can

result in slight differences compared with the strategies previously

described. Generally, these non-U.S. plans do not invest in illiquid

assets and their use of derivatives is consistent with the U.S. plan

and mainly for currency hedging, interest rate risk management,

credit exposure and alternative investment strategies.

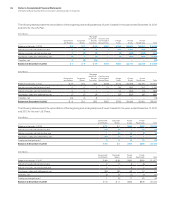

The company’s defined benefit pension plans include invest-

ments in certain European government securities. At December

31, 2013, the U.S. plan held $828 million and the non-U.S. plans

held approximately $11 billion in European sovereign debt invest-

ments, primarily in AAA-rated securities. Investments in government

debt securities in Italy, Spain and Ireland were de minimis in the U.S.

plan and represented less than 1 percent of total non-U.S. plan

assets. The plans hold no direct investments in government debt

securities of Greece and Portugal.

The company’s nonpension postretirement benefit plans are

underfunded or unfunded. For some plans, the company maintains

a nominal, highly liquid trust fund balance to ensure timely benefit

payments.