IBM 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

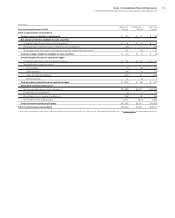

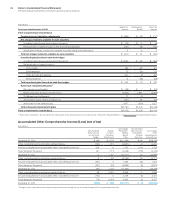

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

109

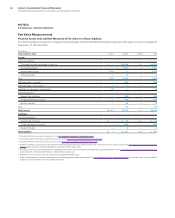

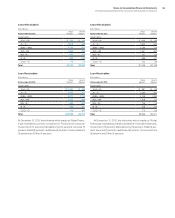

Lease Receivables

($ in millions)

At December 31, 2013:

Major

Markets

Growth

Markets

Credit rating

AAA – A A- $ 743 $ 68

A+ – A- 1,513 168

BBB+ – BBB- 2,111 957

BB+ – BB 1,393 350

BB- – B+ 595 368

B – B- 365 214

CCC+ – D 76 74

To t a l $6,796 $2,200

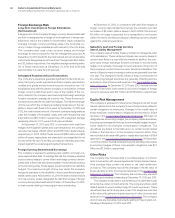

Loan Receivables

($ in millions)

At December 31, 2013:

Major

Markets

Growth

Markets

Credit rating

AAA – A A- $ 1,151 $ 125

A+ – A- 2,344 307

BBB+ – BBB- 3,271 1,745

BB+ – BB 2,158 638

BB- – B+ 922 672

B – B- 565 391

CCC+ – D 118 134

To t a l $10,529 $4,012

At December 31, 2013, the industries which made up Global Financ-

ing’s receivables portfolio consisted of: Financial (39 percent),

Government (14 percent), Manufacturing (14 percent), Services (8

percent), Retail (8 percent), Healthcare (6 percent), Communications

(6 percent) and Other (4 percent).

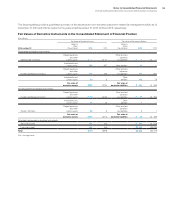

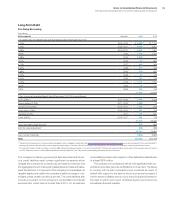

Lease Receivables

($ in millions)

At December 31, 2012:

Major

Markets

Growth

Markets

Credit rating

AAA – A A- $ 646 $ 86

A+ – A- 1,664 223

BBB+ – BBB- 2,285 776

BB+ – BB 1,367 450

BB- – B+ 552 418

B – B- 399 127

CCC+ – D 124 58

To t a l $7,036 $2,138

Loan Receivables

($ in millions)

At December 31, 2012:

Major

Markets

Growth

Markets

Credit rating

AAA – A A- $ 887 $ 148

A+ – A- 2,286 382

BBB+ – BBB- 3,139 1,333

BB+ – BB 1,878 773

BB- – B+ 758 718

B – B- 548 218

CCC+ – D 170 99

To t a l $9,666 $3,670

At December 31, 2012, the industries which made up Global

Financing’s receivables portfolio consisted of: Financial (38 percent),

Government (16 percent), Manufacturing (14 percent), Retail (9 per-

cent), Services (7 percent), Healthcare (6 percent), Communications

(6 percent) and Other (4 percent).