IBM 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Management Discussion

International Business Machines Corporation and Subsidiary Companies

MANAGEMENT DISCUSSION SNAPSHOT

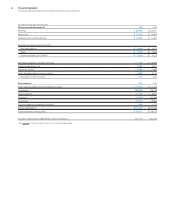

($ and shares in millions except per share amounts)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $ 99,751 $104,507 (4.6)%*

Gross profit margin 48.6% 48.1% 0.5 pts.

Total expense and other (income) $ 28,981 $ 28,396 2.1%

Total expense and other

(income)-to-revenue ratio 29.1% 27.2% 1.9 pts.

Income before income taxes $ 19,524 $ 21,902 (10.9)%

Provision for income taxes 3,041 5,298 (42.6)%

Net income $ 16,483 $ 16,604 (0.7)%

Net income margin 16.5% 15.9% 0.6 pts.

Earnings per share

of common stock

Assuming dilution $ 14.94 $ 14.37 4.0%

Weighted-average shares

outstanding

Assuming dilution 1,103.0 1,155.4 (4.5)%

Assets** $126,223 $119,213 5.9%

Liabilities** $103,294 $100,229 3.1%

Equity** $ 22,929 $ 18,984 20.8%

* (2.5) percent adjusted for currency.

** At December 31.

The following table provides the company’s operating (non-GAAP)

earnings for 2013 and 2012.

($ in millions except per share amounts)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Net income as reported $16,483 $16,604 (0.7)%

Non-operating adjustments

(net of tax)

Acquisition-related charges 747 641 16.5

Non-operating retirement-related

costs/(income) 729 381 91.2

Operating (non-GAAP) earnings* $17,959 $17,627 1.9%

Diluted operating (non-GAAP)

earnings per share $ 16.28 $ 15.25 6.8%

*

See page 46 for a more detailed reconciliation of net income to operating (non-GAAP)

earnings.

In 2013, the company reported revenue of $99.8 billion, expanded

gross and net income margins, and delivered diluted earnings per

share growth of 4.0 percent as reported and 6.8 percent on an oper-

ating (non-GAAP) basis. The company generated $17.5 billion in cash

from operations and $15.0 billion in free cash flow driving shareholder

returns of $17.9 billion in gross common stock repurchases and divi-

dends. In 2013, the company continued the transformation of its

portfolio to higher value expending $3.1 billion to acquire 10 compa-

nies to expand its capabilities in its key growth areas, in addition to

maintaining high levels of investment of $6.2 billion in research and

development and $3.8 billion in net capital expenditures.

The company also continued to shift its investments to address

the key trends in information technology (IT)—social, mobile, big data/

analytics and cloud. Several years ago, the company identified and

established objectives for four key growth initiatives—Smarter Planet,

business analytics, cloud and growth markets—to address these

trends. In 2013, across the business, Smarter Planet, business analyt-

ics and cloud had strong performance. Smarter Planet revenue grew

about 20 percent compared to 2012, with strength across all areas,

including Smarter Commerce, Smarter Cities, Social Business and

industry solutions. The company believes that data, as a natural

resource, will drive demand going forward, and that big data/analytics

will provide the basis for competitive differentiation. Business analyt-

ics revenue of $15.7 billion increased 9 percent year to year, led by

Global Business Services and Software. The company’s cloud solu-

tions address the full scope of client requirements including private

clouds, public clouds and hybrid clouds, as well as platform and

software-as-a-solution (SaaS)-based solutions. In 2013, the company

delivered $4.4 billion of cloud-based solutions revenue, an increase

of 69 percent compared to 2012. In addition, within that content, $1.7

billion was delivered as a service. Across the company’s performance,

there is overlap between these initiatives. In total, software makes up

about half of that combined content. The software content improves

the company’s business mix and contributes to margin expansion.

Segment revenue was led by Software which increased 1.9 per-

cent (3 percent adjusted for currency) driven by key branded

middleware which increased 4.8 percent (6 percent adjusted for cur-

rency). The key growth initiatives fueled this performance. Global

Business Services returned to revenue growth at constant currency

(down 0.9 percent as reported; up 3 percent adjusted for currency)

driven by the company’s investments in the Digital Front Office. While

revenue in Global Technology Services declined 4.2 percent (1 per-

cent adjusted for currency), revenue trajectory improved in the

second half and was stabilizing. Global Financing revenue improved

0.4 percent (3 percent adjusted for currency) versus 2012. The Soft-

ware, Global Services and Global Financing businesses all grew

pre-tax income and expanded their pre-tax margin in 2013 compared

to 2012. Systems and Technology impacted the company’s overall

performance in 2013. Revenue decreased 18.7 percent (18 percent

adjusted for currency) year to year driven by the back end of the

mainframe product cycle and business model challenges specific

to Power Systems, Storage and System x. Pre-tax income in Systems

and Technology decreased $1.7 billion compared to the prior year.

Revenue from the company’s growth markets underperformed

in 2013, particularly in the second half of the year. For the full year,

growth markets revenue decreased 4.9 percent as reported and

2 percent at constant currency. Overall, the company believes that

the opportunity in the growth markets remains attractive, and it is

intensifying its efforts on new growth opportunities in these markets.

The consolidated gross profit margin increased 0.5 points versus

2012 to 48.6 percent. This was the tenth consecutive year of improve-

ment in the gross profit margin. The operating (non-GAAP) gross margin

of 49.7 percent increased 0.9 points compared to the prior year. The

increase in gross margin in 2013 was driven by margin improvements

in the Global Services segments and an improved mix driven by Soft-

ware, partially offset by margin decreases in Systems and Technology.