IBM 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Storwize products delivered double-digit growth, which were more

than offset by declines in legacy OEM mid-range offerings, and

declines in high-end offerings driven by significant pricing pressure.

Retail Store Solutions (RSS) revenue decreased 98.2 percent

(98 percent adjusted for currency) in 2013 versus 2012. In the third

quarter of 2012, the company divested the RSS business to Toshiba

TEC. See the caption, “Divestitures,” on page 98 for additional infor-

mation regarding the transaction.

Microelectronics OEM revenue decreased 11.9 percent (12 percent

adjusted for currency) in 2013 versus 2012.

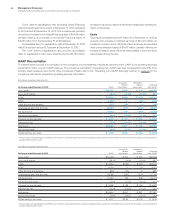

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Systems and Technology

External gross profit $5,120 $6,903 (25.8)%

External gross profit margin 35.6% 39.1% (3.5) pts.

Pre-tax income $(507) $1,227 NM

Pre-tax margin (3.4)% 6.7% (10.1) pts.

NM—Not meaningful

The decrease in external gross profit in 2013 versus 2012 was due

to lower revenue and a lower overall gross profit margin reflecting

the business model challenges. Overall gross margin decreased 3.5

points in 2013 versus the prior year. The decrease was driven by

lower margins in Power Systems (1.0 points), System x (0.9 points),

Microelectronics (0.7 points) and Storage (0.4 points) as well as a

decline due to revenue mix (0.7 points), partially offset by margin

improvement in System z (0.1 points).

Systems and Technology’s pre-tax income decreased $1,734

million to a loss of $507 million in 2013, when compared to the prior

year. Pre-tax margin decreased 10.1 points in 2013 versus 2012. The

decline in pre-tax income was driven by the hardware businesses

which are dealing with business model challenges due to market

shifts and System z, as it entered the backend of the mainframe

product cycle late in the year.

Global Financing

See pages 72 through 75 for an analysis of Global Financing’s

segment results.

Geographic Revenue

In addition to the revenue presentation by reportable segment, the company also measures revenue performance on a geographic basis.

The following geographic, regional and country-specific revenue performance excludes OEM revenue, which is discussed separately below.

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Total revenue $99,751 $104,507 (4.6)%(2.5)%

Geographies $97,800 $102,268 (4.4)%(2.2)%

Americas 43,249 44,556 (2.9) (2.0)

Europe/Middle East/Africa 31,628 31,775 (0.5) (2.1)

Asia Pacific 22,923 25,937 (11.6) (2.8)

Major markets (4.2)%(2.2)%

Growth markets (4.9)%(2.4)%

BRIC countries (8.2)%(5.6)%

Total geographic revenue of $97,800 million decreased 4.4 per-

cent (2 percent adjusted for currency) in 2013. Revenue in the

major markets decreased 4.2 percent (2 percent adjusted for cur-

rency). Revenue from the growth markets, which represented

approximately 23 percent of the total geographic revenue for the

year, decreased 4.9 percent on a year-to-year basis (2 percent

adjusted for currency). Performance at constant currency in the

growth markets was mixed, with year-to-year growth in the first

half offset by declines in the second half. The company had

strength in Latin America and the Middle East and Africa region.

However, declines in some of the larger growth markets, for example

China and Australia, impacted the overall performance in the

growth markets. Within the BRIC countries of Brazil, Russia, India

and China, combined revenue declined 8.2 percent (6 percent

adjusted for currency). The company continues to see good oppor-

tunity in all regions over the long term and is continuing to invest in

these key markets.

Americas revenue decreased 2.9 percent (2 percent adjusted for

currency) compared to the prior year. The major market countries were

down 3.9 percent (4 percent adjusted for currency), partially offset by

an increase in the Latin America growth markets of 4.4 percent

(9 percent adjusted for currency). Within the major market countries,

the U.S. was down 3.4 percent and Canada was down 6.3 percent

(3 percent adjusted for currency). Within the growth market countries,

Brazil increased 3.3 percent (10 percent adjusted for currency) and

Mexico increased 7.8 percent (8 percent adjusted for currency).