IBM 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Management Discussion

International Business Machines Corporation and Subsidiary Companies

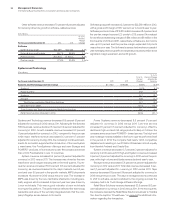

and the increase in net income ($749 million). Net cash used in invest-

ing activities of $9,004 million was $4,608 million higher than 2011,

primarily due to an increase in cash used of $2,719 million associated

with net purchases and sales of marketable securities and other

investments, increased cash used for acquisitions ($1,911 million)

and increased net capital investments ($248 million), partially offset

by increased cash from divestitures ($585 million). Net cash used

in financing activities of $11,976 million was $1,719 million lower com-

pared to 2011, primarily due to lower cash used for common stock

repurchases ($3,051 million), partially offset by lower cash provided

by common stock transactions ($914 million) and increased dividend

payments ($300 million).

For additional information regarding 2002 free cash flow, see the

company’s Form 8-K filed with the SEC on January 22, 2013.

Segment Details

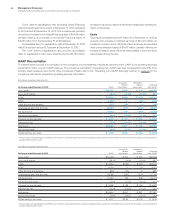

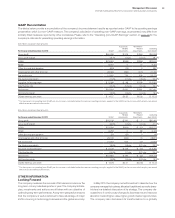

The following is an analysis of the 2012 versus 2011 reportable segment results. The table below presents each reportable segment’s external

revenue and gross margin results. Segment pre-tax income includes transactions between the segments that are intended to reflect an

arm’s-length transfer price and excludes certain unallocated corporate items.

($ in millions)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent/

Margin

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Revenue

Global Technology Services $ 40,236 $ 40,879 (1.6)% 1.3%

Gross margin 36.6% 35.0% 1.6 pts.

Global Business Services 18,566 19,284 (3.7)% (1.6)%

Gross margin 30.0% 28.8% 1.2 pts.

Software 25,448 24,944 2.0%4.3%

Gross margin 88.7% 88.5% 0.2 pts.

Systems and Technology 17,667 18,985 (6.9)% (5.9)%

Gross margin 39.1% 39.8% (0.7) pts.

Global Financing 2,013 2,102 (4.2)% (1.2)%

Gross margin 46.5% 49.8% (3.3 ) pts.

Other 577 722 (20.1)% (18.7)%

Gross margin (71.6)% (54.5)% (17.1) pts.

Total consolidated revenue $104,507 $106,916 (2.3)% 0.0%

Total consolidated gross profit $ 50,298 $ 50,138 0.3%

Total consolidated gross margin 48.1% 46.9% 1.2 pts.

Non-operating adjustments

Amortization of acquired intangible assets 375 340 10.3%

Acquisition-related charges 1 1 13.1

Retirement-related costs/(income) 264 2 NM

Operating (non-GAAP) gross profit $ 50,938 $ 50,481 0.9%

Operating (non-GAAP) gross margin 48.7% 47.2% 1.5 pts.

NM—Not meaningful

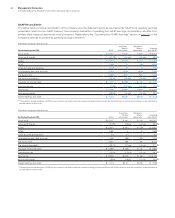

Global Services

In 2012, the Global Services segments, Global Technology Services

and Global Business Services, delivered revenue of $58,802 million,

grew pre-tax profit 7 percent and expanded pre-tax margin 1.5 points

on an as-reported basis. Revenue performance was led by strength

in the growth markets which were up 4.8 percent (9 percent adjusted

for currency) and represented over 20 percent of total Global Services

revenue. Revenue from the major markets declined 4.0 percent

(2 percent adjusted for currency) year to year. The services seg-

ments also had strength in all the key growth initiatives, which are

becoming a larger part of the services business as the company

continues to shift toward higher value content. Total outsourcing

revenue of $27,552 million decreased 2.6 percent (flat adjusted

for currency) and total transactional revenue of $23,907 million

decreased 1.8 percent (flat adjusted for currency) year to year.