IBM 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

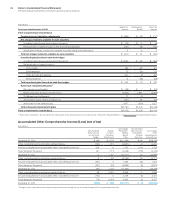

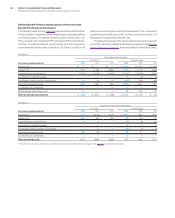

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

122

The significant components reflected within the tax rate reconcili-

ation labeled “Foreign tax differential” include the effects of foreign

subsidiaries’ earnings taxed at rates other than the U.S. statutory

rate, foreign export incentives, the U.S. tax impacts of non-U.S.

earnings repatriation and any net impacts of intercompany trans-

actions. These items also reflect audit settlements or changes in

the amount of unrecognized tax benefits associated with each of

these items.

In the fourth quarter of 2013, the Internal Revenue Service (IRS)

concluded its examination of the company’s income tax returns for

2008 through 2010 and issued a final Revenue Agent Report (RAR).

The company agreed with all of the adjustments. The company has

redetermined its unrecognized tax benefits, including similar items

in open tax years, based on the agreed adjustments in the RAR and

associated information and analysis.

The 2013 effective tax rate benefitted by 11.5 points from the

completion of the IRS examination discussed above including associ-

ated reserve redeterminations. In addition, the effective tax rate also

benefitted from the company’s geographic mix of pre-tax income and

incentives, the impact of foreign tax credits, benefits realized during

the year related to the American Taxpayer Relief Act, a favorable tax

agreement which required a reassessment of certain valuation allow-

ances on deferred taxes and certain non-U.S. audit settlements.

These benefits were partially offset by 2013 tax charges related to

certain intercompany payments made by foreign subsidiaries and the

tax costs associated with the intercompany licensing of certain IP.

The effect of tax law changes on deferred tax assets and liabilities

did not have a material impact on the company’s effective tax rate.

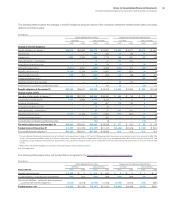

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial Position

were as follows:

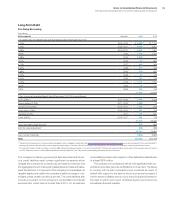

Deferred Tax Assets

($ in millions)

At December 31: 2013 2012*

Retirement benefits $ 3,704 $ 5,870

Share-based and other compensation 1,262 1,666

Domestic tax loss/credit carryforwards 982 954

Deferred income 964 1,018

Foreign tax loss/credit carryforwards 651 681

Bad debt, inventory and warranty reserves 592 586

Depreciation 382 456

Other 1,774 1,659

Gross deferred tax assets 10,311 12,890

Less: valuation allowance 734 1,187

Net deferred tax assets $ 9,577 $11,703

* Reclassified to conform with 2013 presentation.

Deferred Tax Liabilities

($ in millions)

At December 31: 2013 2012*

Depreciation $1,346 $1,378

Retirement benefits 1,219 257

Goodwill and intangible assets 1,173 957

Leases 1,119 2,216

Software development costs 558 542

Deferred transition costs 424 440

Other 841 993

Gross deferred tax liabilities $6,680 $6,783

* Reclassified to conform with 2013 presentation.

For income tax return purposes, the company has foreign and

domestic loss carryforwards, the tax effect of which is $626 million,

as well as domestic and foreign credit carryforwards of $1,007 mil-

lion. Substantially all of these carryforwards are available for at least

two years or are available for 10 years or more.

The valuation allowance at December 31, 2013 principally applies

to certain foreign, state and local loss carryforwards that, in the

opinion of management, are more likely than not to expire unutilized.

However, to the extent that tax benefits related to these carry-

forwards are realized in the future, the reduction in the valuation

allowance will reduce income tax expense.

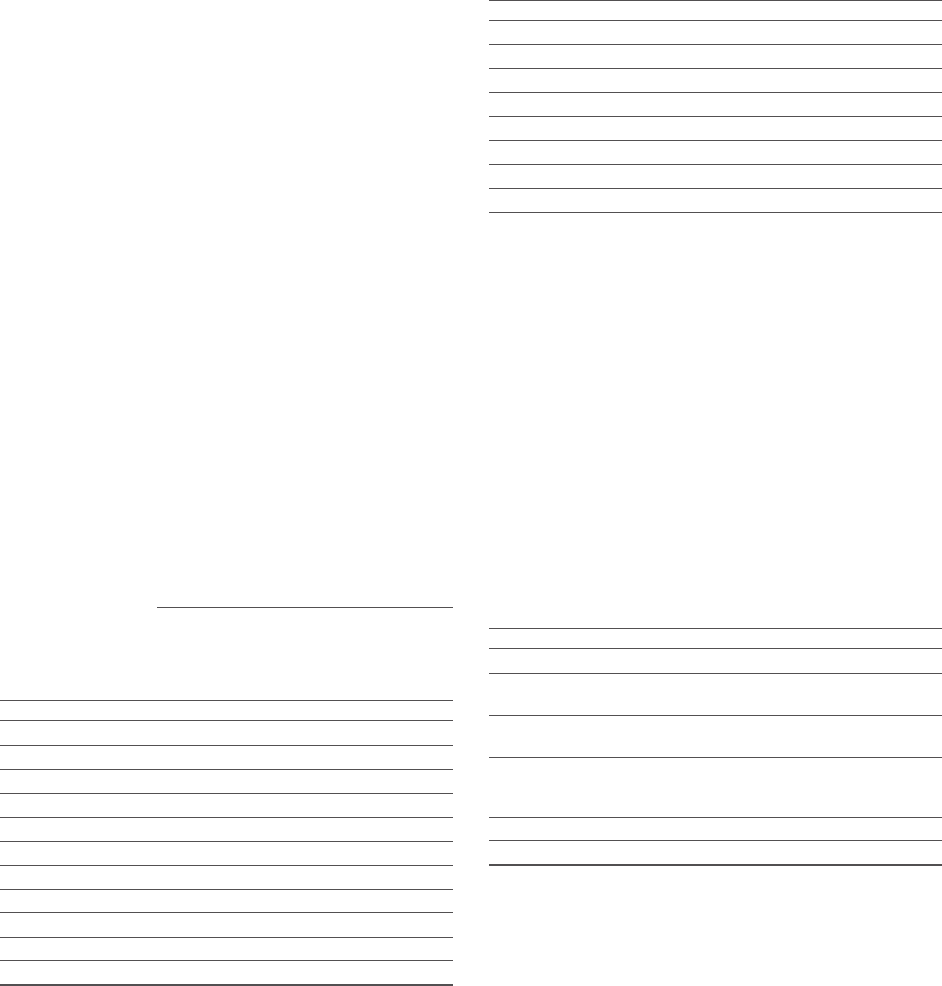

The amount of unrecognized tax benefits at December 31, 2013

decreased by $1,214 million in 2013 to $4,458 million. A reconciliation

of the beginning and ending amount of unrecognized tax benefits

is as follows:

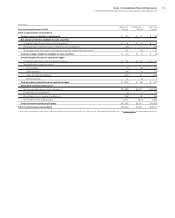

($ in millions)

2013 2012 2011

Balance at January 1 $ 5,672 $5,575 $5,293

Additions based on tax positions

related to the current year 829 401 672

Additions for tax positions

of prior years 417 215 379

Reductions for tax positions

of prior years (including impacts

due to a lapse in statute) (2,201) (425) (538)

Settlements (259) (94) (231)

Balance at December 31 $ 4,458 $5,672 $5,575

The additions to unrecognized tax benefits related to the current

and prior years are primarily attributable to non-U.S. issues, certain

tax incentives and credits, acquisition-related matters and state

issues. The settlements and reductions to unrecognized tax benefits

for tax positions of prior years are primarily attributable to the com-

pletion of the IRS examination for 2008-2010, non-U.S. audits and

impacts due to lapses in statutes of limitation.

In April 2010, the company appealed the determination of a

non-U.S. taxing authority with respect to certain foreign tax

losses. The tax benefit of these losses totals $1,141 million as of

December 31, 2013. The 2013 decrease was driven by currency