IBM 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

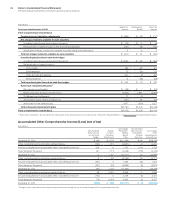

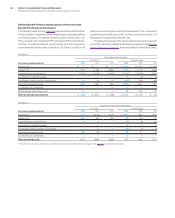

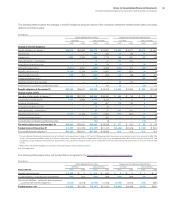

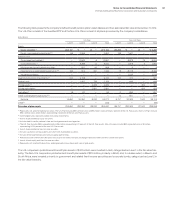

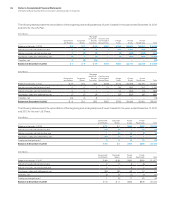

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

128

IBM Excess 401(k) Plus Plan

Effective January 1, 2008, the company replaced the IBM Exec utive

Deferred Compensation Plan, an unfunded, nonqualified, defined

contribution plan, with the IBM Excess 401(k) Plus Plan (Excess

401(k)), an unfunded, nonqualified defined contribution plan.

Employees who are eligible to participate in the 401(k) Plus Plan and

whose eligible compensation is expected to exceed the IRS com-

pensation limit for qualified plans are eligible to participate in the

Excess 401(k). The purpose of the Excess 401(k) is to provide ben-

efits that would be provided under the qualified IBM 401(k) Plus Plan

if the compensation limits did not apply.

Amounts deferred into the Excess 401(k) are record-keeping

(notional) accounts and are not held in trust for the participants.

Participants in the Excess 401(k) may invest their notional accounts

in investments which mirror the primary investment options available

under the 401(k) Plus Plan. Participants in the Excess 401(k) are also

eligible to receive company match and automatic contributions on

eligible compensation deferred into the Excess 401(k) and on com-

pensation earned in excess of the Internal Revenue Code pay limit

once they have completed one year of service. Through June 30,

2009, eligible participants also received transition credits. Amounts

deferred into the Excess 401(k), including company contributions

are recorded as liabilities in the Consolidated Statement of Financial

Position. Effective January 1, 2013, matching and automatic contri-

butions are recorded once annually at the end of the year. In order

to receive such contributions each year, a participant must be

employed on December 15 of the plan year. However, if a participant

separates from service prior to December 15, and has completed

certain service and/or age requirements, then the participant will

be eligible to receive such matching and automatic contributions

following separation from service.

Nonpension Postretirement Benefit Plan

U.S. Nonpension Postretirement Plan

The company sponsors a defined benefit nonpension postretire-

ment benefit plan that provides medical and dental benefits to

eligible U.S. retirees and eligible dependents, as well as life insurance

for eligible U.S. retirees. Effective July 1, 1999, the company estab-

lished a Future Health Account (FHA) for employees who were more

than five years from retirement eligibility. Employees who were within

five years of retirement eligibility are covered under the company’s

prior retiree health benefits arrangements. Under either the FHA or

the prior retiree health benefit arrangements, there is a maximum

cost to the company for retiree health benefits. Effective January 1,

2014, the company amended the plan to establish a Health Reim-

bursement Arrangement (HRA) for each Medicare-eligible plan

retiree, surviving spouse and long-term disability plan participant

who is eligible for company subsidized coverage and who enrolls in

an individual plan under the Medicare Exchange. The company also

amended its life insurance plan. Employees retiring on or after Janu-

ary 1, 2015, will no longer be eligible for life insurance. Existing

retirees and employees retiring during 2014 continue to be eligible

for retiree life insurance.

Since January 1, 2004, new hires, as of that date or later, are not

eligible for company subsidized nonpension postretirement benefits.

Non-U.S. Plans

Certain subsidiaries and branches outside the United States spon-

sor defined benefit and/or defined contribution plans that cover

substantially all regular employees. The company deposits funds

under various fiduciary-type arrangements, purchases annuities

under group contracts or provides reserves for these plans. Ben-

efits under the defined benefit plans are typically based either on

years of service and the employee’s compensation (generally during

a fixed number of years immediately before retirement) or on annual

credits. The range of assumptions that are used for the non-U.S.

defined benefit plans reflect the different economic environments

within the various countries.

In addition, certain of the company’s non-U.S. subsidiaries spon-

sor nonpension postretirement benefit plans that provide medical

and dental benefits to eligible non-U.S. retirees and eligible depen-

dents, as well as life insurance for certain eligible non-U.S. retirees.

However, most non-U.S. retirees are covered by local government-

sponsored and -administered programs.