IBM 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Management Discussion

International Business Machines Corporation and Subsidiary Companies

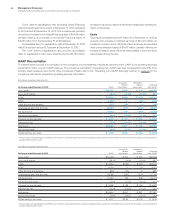

Software

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Software external revenue $25,932 $25,448 1.9%2.9%

Middleware $21,557 $20,983 2.7%3.7%

Key Branded Middleware 17,322 16,528 4.8 5.7

WebSphere Family 8.2 9.1

Information Management 2.8 3.7

Social Workforce Solutions* 10.8 11.9

Tivoli 3.9 4.8

Rational 4.9 6.0

Other middleware 4,235 4,455 (4.9)(3.9)

Operating systems 2,447 2,525 (3.1) (1.9)

Other 1,929 1,940 (0.6) 0.2

* Formerly Lotus

Software revenue of $25,932 million increased 1.9 percent as

reported and 3 percent adjusted for currency in 2013 compared to

2012. The Software business delivered revenue growth, at constant

currency, in all four quarters of the year. Revenue continued to mix

toward key branded middleware with growth in all five brands. The

Software value proposition remains strong for enterprise clients.

Customers continue to increase deployment of the company’s

middleware products and the business is investing and gaining

share in social, mobile, analytics, cloud and security. Some of this is

delivered in a SaaS model, and the company has over 100 SaaS

offerings in its software portfolio. Across the Software brands, there

was strong performance in the growth initiatives that address the

key market trends—Smarter Planet, business analytics and cloud.

The Software business completed eight acquisitions in 2013, adding

to its capabilities in mobile, big data analytics and security. The Soft-

ware business grew segment pre-tax profit 2.7 percent to $11.1 billion

and expanded pre-tax margin 0.5 points.

In January 2014, the company announced a $1 billion investment in

Watson, and it established a new Watson Group within the Software

business. This new unit is dedicated to the development and com-

mercialization of cloud-delivered cognitive innovations.

Key branded middleware revenue increased 4.8 percent (6 percent

adjusted for currency), with strong performance in the areas of analytics,

cloud, mobile, social and security. The faster growing and higher value

branded middleware accounted for 67 percent of total Software revenue

in 2013, an increase of 2 points from 2012.

WebSphere revenue increased 8.2 percent (9 percent adjusted

for currency) in 2013 and gained share. Revenue performance was

driven by double-digit growth in the Commerce offerings, and

growth in Business Integration and the on-premises Application

Server business. Mobile contributed strong revenue growth in 2013.

MobileFirst, the company’s comprehensive portfolio of mobile soft-

ware and services, was introduced in 2013 and extends value to

clients to reach new markets and gain competitive advantage. The

company continues to add capabilities to the WebSphere brand. In

January 2014, the business acquired Aspera, Inc. which provides

best in class transfer speeds for movement of big data.

Information Management revenue increased 2.8 percent (4 per-

cent adjusted for currency) in 2013 compared to 2012. Performance

in 2013 included strong growth in the distributed database offerings,

including Netezza, and content management software.

Tivoli revenue increased 3.9 percent (5 percent adjusted for cur-

rency) in 2013 and gained share, driven by storage growth and the

security solutions portfolio. Tivoli storage revenue was up 7 percent (8

percent adjusted for currency) in 2013. Tivoli security revenue increased

17 percent (19 percent adjusted for currency) and reflects contribution

from the acquisition of Trusteer in the third quarter of 2013, which

extended Tivoli’s data security capabilities further into cloud and mobile

environments. The transformation driven by mobile and cloud comput-

ing is raising the importance of security for enterprise customers. The

company has been building and expanding its security capabilities and

now has 6,000 security experts worldwide, 3,000 patents in security

and 25 security laboratories worldwide across software and services.

Social Workforce Solutions revenue increased 10.8 percent

(12 percent adjusted for currency) in 2013. Performance was driven

by Kenexa, which provides cloud-based recruiting and talent

management solutions.

Rational revenue increased 4.9 percent (6 percent adjusted for

currency) in 2013 year over year.

Operating systems revenue decreased 3.1 percent (2 percent

adjusted for currency) in 2013 compared to 2012, driven by declines in

Systems z and Power Systems.

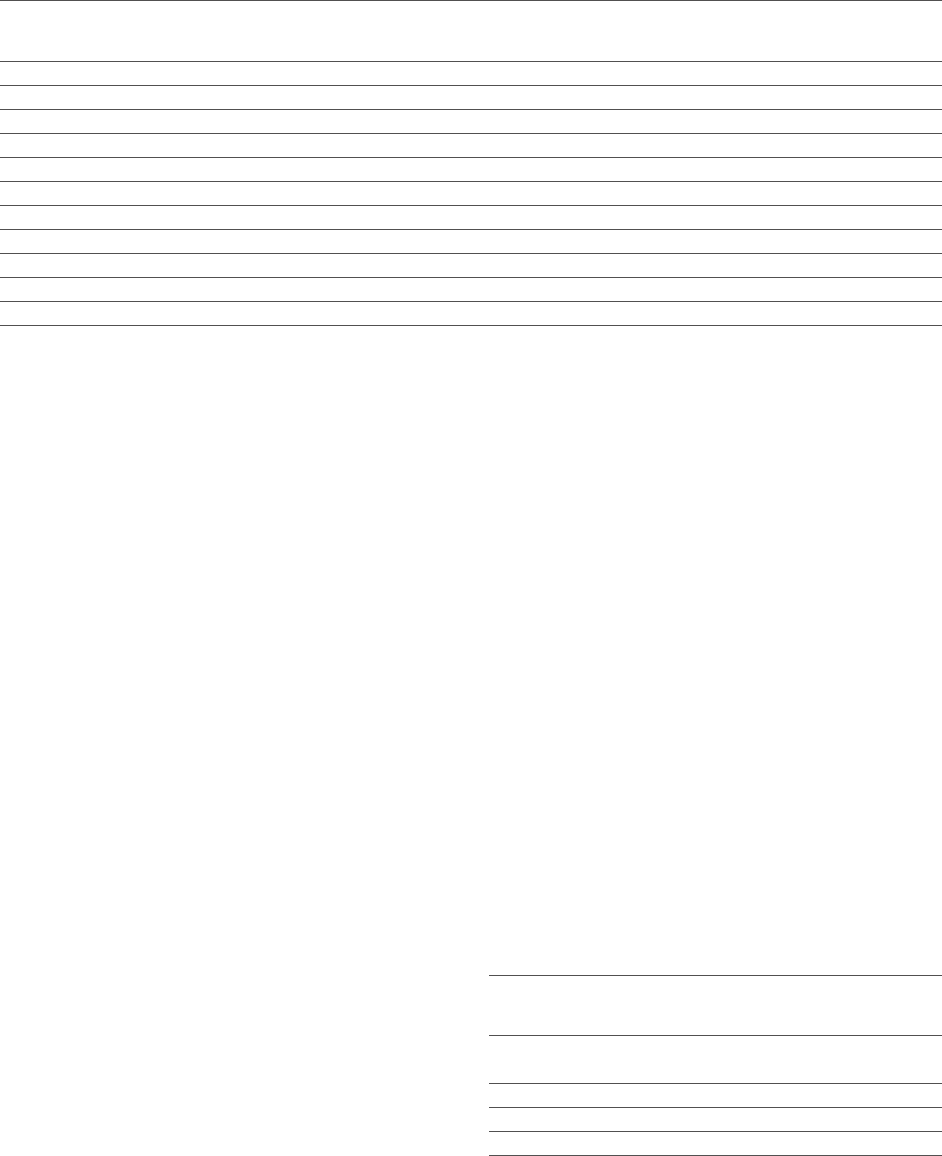

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Software

External gross profit $23,032 $22,569 2.0%

External gross profit margin 88.8% 88.7% 0.1 pts.

Pre-tax income $11,106 $10,810 2.7%

Pre-tax margin 38.1% 37.6% 0.5 pts.