IBM 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Management Discussion

International Business Machines Corporation and Subsidiary Companies

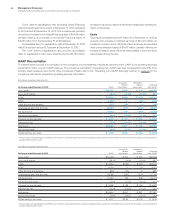

Global Services

The Global Services segments, Global Technology Services and

Global Business Services, generated $14,664 million of revenue in

the fourth quarter, a decrease year to year of 2.3 percent as

reported, but an increase of 1 percent adjusted for currency. This

was the second consecutive quarter of constant currency revenue

growth in total Global Services. Pre-tax income of $2,929 million in

the fourth quarter of 2013 was up 2.1 percent year to year and the

pre-tax margin improved 0.9 points, with margin expansion in both

segments. Global Services continued to have good performance in

the key growth areas of cloud, business analytics and Smarter

Planet in the quarter, and the company is continuing to invest to

extend its capabilities. Total outsourcing revenue of $6,662 million

decreased 4.5 percent (1 percent adjusted for currency) and total

transactional revenue of $6,202 million increased 0.3 percent

(4 percent adjusted for currency) year over year.

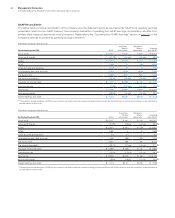

Global Technology Services revenue of $9,917 million decreased

3.6 percent (1 percent adjusted for currency) in the fourth quarter

of 2013 with constant currency performance in line with the third

quarter of 2013. The major markets returned to constant currency

growth for the first time since the first half of 2012, led by Europe,

while the growth markets performance decelerated. GTS Outsourc-

ing revenue decreased 4.2 percent (1 percent adjusted for currency)

in the fourth quarter of 2013; however, constant currency perfor-

mance improved 2 points from the third quarter. While GTS

Outsourcing is beginning to realize the benefit from several of the

large client transformational contracts signed earlier in 2013, it con-

tinues to see a decline in revenue from sales into existing base

accounts where the activity is more transactional in nature and can

be economically sensitive. ITS revenue decreased 3.1 percent (flat

adjusted for currency) in the fourth quarter. The company continues

to shift the ITS business toward higher value managed services

such as business continuity, security and cloud. Within the cloud

offerings, SoftLayer contributed to the ITS revenue performance

and drove one point of constant currency revenue growth to total

GTS in the fourth quarter. The GTS gross profit margin improved 1.2

points in the fourth quarter, with margin expansion across all lines

of business, led by ITS and Maintenance. Pre-tax income decreased

1.9 percent to $1,989 million while the pre-tax margin improved 0.4

points to 19.5 percent in the fourth quarter of 2013 compared to the

prior year. Profit performance was impacted by the performance in

the growth markets. In addition, the company continues to make

investments in key growth areas such as cloud, mobility and secu-

rity. These initiatives are beginning to contribute to revenue growth,

and will yield improved profit results as they achieve scale. Margin

expansion was driven by reductions in performance-related com-

pensation and benefits from the second-quarter 2013 workforce

rebalancing actions.

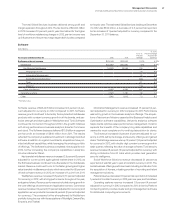

Global Business Services revenue of $4,747 million increased

0.6 percent as reported and 4 percent at constant currency in the

fourth quarter of 2013 and gained share again in the period. GBS

had constant currency revenue growth in all geographic regions led

by North America and the growth markets. Japan continued its solid

performance, and Europe had constant currency revenue growth

for the second consecutive quarter. On an offering basis, growth

was driven by the practices that address the Digital Front Office.

GBS delivered double-digit growth in each of the strategic growth

initiatives—business analytics, Smarter Planet and cloud. In addi-

tion, within the back office solutions that address the Globally

Integrated Enterprise, implementation services that support the

traditional packaged applications increased again in the fourth quar-

ter at constant currency. Application Outsourcing revenue decreased

6.5 percent (2 percent adjusted for currency) and C&SI revenue

increased 2.7 percent (6 percent adjusted for currency), representing

a 1 point sequential improvement at constant currency from the third

quarter of 2013. The GBS gross profit margin improved 0.7 points

in the fourth quarter versus the prior year. GBS pre-tax income of

$940 million in the fourth quarter of 2013 increased 11.7 percent,

with a pre-tax margin of 19.1 percent, an improvement of 2.0 points

year to year. The primary year-to-year profit drivers were reductions

in performance-related compensation, continued benefits from the

enterprise productivity initiatives and the second-quarter 2013 work-

force rebalancing actions.

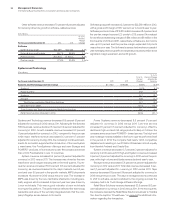

Software

Software revenue of $8,140 million increased 2.8 percent (4 percent

adjusted for currency) in the fourth quarter led by growth in key

branded middleware. Key branded middleware revenue increased

5.5 percent (6 percent adjusted for currency) year to year and

gained share.

WebSphere revenue increased 14.3 percent (15 percent adjusted

for currency) in the fourth quarter and gained share. Revenue per-

formance included good growth in both the on-premise Application

Server business and the newer cloud-based offerings. Mobile con-

tinued to have strong growth—the comprehensive MobileFirst

portfolio of software and services extends value to clients enabling

them to reach new markets and gain competitive advantage. In addi

-

tion, the core WebSphere offerings of Business Integration and

Commerce delivered strong growth. Information Management rev-

enue increased 4.8 percent (5 percent adjusted for currency) in the

fourth quarter and gained share. Distributed database offerings

were up double-digits at constant currency, and the business ana-

lytics software offerings had its strongest growth in 2013 in the

fourth quarter, led by business intelligence and Netezza appliances.

Tivoli revenue increased 0.5 percent (1 percent adjusted for cur-

rency) in the fourth quarter compared to the prior year period, driven

by double-digit growth in its security business. The transformation

driven by mobile and cloud computing is raising the importance of

security for enterprise customers, and the company is continuing to

build its capabilities in this area. Social Workforce Solutions revenue

increased 2.4 percent (3 percent adjusted for currency) in the fourth

quarter and continued to be driven by Kenexa, which provides

cloud-based recruiting and talent management. Rational revenue

increased 0.3 percent (1 percent adjusted for currency) year to year

in the fourth quarter.

The Software business delivered pre-tax income of $4,239

million in the fourth quarter of 2013, an increase of 5.5 percent year

to year, with a pre-tax margin of 47.0 percent, an improvement of

1.0 points.