IBM 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

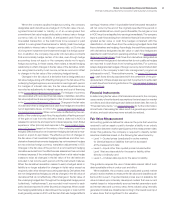

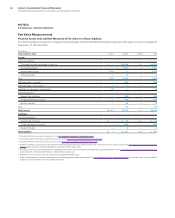

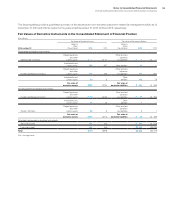

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

95

In September 2011, the FASB issued amended guidance that

simplified how entities test goodwill for impairment. After an assess-

ment of certain qualitative factors, if it is determined to be more likely

than not that the fair value of a reporting unit is less than its carrying

amount, entities must perform the quantitative analysis of the good-

will impairment test. Otherwise, the quantitative test(s) is optional. The

guidance was effective January 1, 2012 with early adoption permitted.

The company adopted this guidance for the 2011 goodwill impair-

ment test. There was no impact in the consolidated financial results.

In June 2011, the FASB issued amended disclosure requirements

for the presentation of OCI and AOCI. OCI is comprised of costs,

expenses, gains and losses that are included in comprehensive

income but excluded from net income, and AOCI comprises the

aggregated balances of OCI in equity. The amended guidance elimi-

nated the option to present period changes in OCI as part of the

Statement of Changes in Equity. Under the amended guidance, all

period changes in OCI are to be presented either in a single continu-

ous statement of comprehensive income, or in two separate, but

consecutive financial statements. Only summary totals are to be

included in the AOCI section of the Statement of Changes in Equity.

These changes were effective January 1, 2012 with early adoption

permitted. The company adopted the two statement approach

effective with its full-year 2011 financial statements. There was no

impact in the consolidated financial results as the amendments

related only to changes in financial statement presentation.

In April 2011, the FASB issued new and clarifying guidance and

to help creditors in determining whether a creditor has granted a

concession, and whether a debtor is experiencing financial difficul-

ties for purposes of determining whether a restructuring constitutes

a troubled debt restructuring. The new guidance became effective

July 1, 2011 applied retrospectively to January 1, 2011. Prospective

application was required for any new impairments identified as a

result of this guidance. These changes did not have a material

impact in the consolidated financial results.

In December 2010, the FASB issued amended guidance to

clarify the acquisition date that should be used for reporting pro-

forma financial information for business combinations. If comparative

financial statements are presented, the pro-forma revenue and earn

-

ings of the combined entity for the comparable prior reporting

period should be reported as though the acquisition date for all

business combinations that occurred during the current year had

been completed as of the beginning of the comparable prior annual

reporting period. The amendments in this guidance were effective

on a prospective basis for business combinations for which the

acquisition date was on or after January 1, 2011. There was no

impact in the consolidated financial results as the amendments

related only to additional disclosures.

In December 2010, the FASB issued amendments to the guid-

ance on goodwill impairment testing. The amendments modified

step 1 of the goodwill impairment test for reporting units with zero

or negative carrying amounts. For those reporting units, an entity is

required to perform step 2 of the goodwill impairment test if it is more

likely than not that a goodwill impairment exists. In making that

determination, an entity should consider whether there are any

adverse qualitative factors indicating that impairment may exist. The

amendments were effective January 1, 2011 and did not have an

impact in the consolidated financial results.

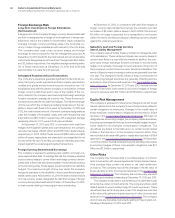

NOTE C.

ACQUISITIONS/DIVESTITURES

Acquisitions

Purchase price consideration for all acquisitions, as reflected

in the tables in this note, is paid primarily in cash. All acquisitions

are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents.

2013

In 2013, the company completed 10 acquisitions at an aggregate

cost of $3,219 million.

SoftLayer Technologies, Inc. (SoftLayer)—On July 3, 2013, the

company completed the acquisition of 100 percent of the privately

held company, SoftLayer, a cloud computing infrastructure provider

based in Dallas, Texas for cash consideration of $1,977 million. Soft-

Layer joins the company’s new cloud services division, which

combines SoftLayer with IBM SmartCloud into a global platform.

The new division provides a broad range of choices to the company’s

clients, ISVs and channel and technology partners. Goodwill of

$1,285 million has been assigned to the Global Technology Services

($1,246 million) and Software ($39 million) segments. It is expected

that none of the goodwill will be deductible for tax purposes. The

overall weighted-average useful life of the identified intangible assets

acquired is 7.0 years.

Other Acquisitions—

The Software segment completed acquisitions

of eight privately held companies: in the first quarter, StoredIQ Inc.

(StoredIQ) and Star Analytics, Inc. (Star Analytics); in the second

quarter, UrbanCode Inc. (UrbanCode); and in the third quarter, Trust-

eer, Ltd. (Trusteer) and Daeja Image Systems, Ltd. (Daeja); and in the

fourth quarter, Xtify, Inc. (Xtify), The Now Factory and Fiberlink Com-

munications (Fiberlink). Systems and Technology (STG) completed

one acquisition: in the third quarter, CSL International (CSL), a

privately held company. All acquisitions were for 100 percent of

the acquired companies.