IBM 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

116

NOTE L.

EQUITY ACTIVITY

The authorized capital stock of IBM consists of 4,687,500,000

shares of common stock with a $.20 per share par value, of which

1,054,390,937 shares were outstanding at December 31, 2013 and

150,000,000 shares of preferred stock with a $.01 per share par

value, none of which were outstanding at December 31, 2013.

Stock Repurchases

The Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased 73,121,942 common

shares at a cost of $13,993 million, 61,246,371 common shares at a

cost of $12,008 million and 88,683,716 common shares at a cost of

$15,034 million in 2013, 2012 and 2011, respectively. These amounts

reflect transactions executed through December 31 of each year.

Actual cash disbursements for repurchased shares may differ due

to varying settlement dates for these transactions. At December 31,

2013, $14,659 million of Board common stock repurchase authoriza-

tion was still available. The company plans to purchase shares on the

open market or in private transactions from time to time, depending

on market conditions.

Other Stock Transactions

The company issued the following shares of common stock as part

of its stock-based compensation plans and employees stock pur-

chase plan: 9,961,389 shares in 2013, 15,091,320 shares in 2012,

and 20,669,785 shares in 2011. The company issued 1,849,883

treasury shares in 2013, 2,746,169 treasury shares in 2012 and

4,920,198 treasury shares in 2011, as a result of RSU releases and

exercises of stock options by employees of certain acquired busi-

nesses and by non-U.S. employees. Also, as part of the company’s

stock-based compensation plans, 1,666,069 common shares at a

cost of $336 million, 2,406,007 common shares at a cost of $468

million, and 1,717,246 common shares at a cost of $289 million in

2013, 2012 and 2011, respectively, were remitted by employees to

the company in order to satisfy minimum statutory tax withholding

requirements. These amounts are included in the treasury stock

balance in the Consolidated Statement of Financial Position and the

Consolidated Statement of Changes in Equity.

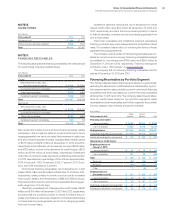

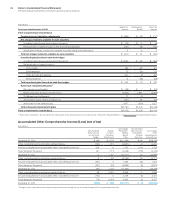

Reclassifications and Taxes Related to Items of Other Comprehensive Income

($ in millions)

For the year ended December 31, 2013:

Before Tax

Amount

Tax (Expense)/

Benefit

Net of Tax

Amount

Other comprehensive income/(loss)

Foreign currency translation adjustments $(1,335) $ (66) $(1,401)

Net changes related to available-for-sale securities

Unrealized gains/(losses) arising during the period $ (4) $ 2 $ (3)

Reclassification of (gains)/losses to other (income) and expense (8)2 (5)

Subsequent changes in previously impaired securities arising during the period 4 (1) 3

Total net changes related to available-for-sale securities $ (8) $ 3 $ (5)

Unrealized gains/(losses) on cash flow hedges

Unrealized gains/(losses) arising during the period $ 43 $ (15) $ 28

Reclassification of (gains)/losses to:

Cost of sales 34 (14) 21

SG&A expense (39) 14 (25)

Other (income) and expense (162) 62 (99)

Interest expense 0 (0) 0

Total unrealized gains/(losses) on cash flow hedges $ (123) $ 47 $ (76)

Retirement-related benefit plans(1)

Prior service costs/(credits) $ 16 $ (0) $ 16

Net (losses)/gains arising during the period 5,369 (1,974) 3,395

Curtailments and settlements (3) 1 (2)

Amortization of prior service (credits)/cost (114) 40 (75)

Amortization of net (gains)/losses 3,499 (1,195) 2,304

Total retirement-related benefit plans $ 8,767 $(3,128) $ 5,639

Other comprehensive income/(loss) $ 7,301 $(3,144) $ 4,157

(1) These AOCI components are included in the computation of net periodic pension cost. (See note S, “Retirement-Related Benefits,” on pages 127 to 141 for additional information.)