IBM 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Management Discussion

International Business Machines Corporation and Subsidiary Companies

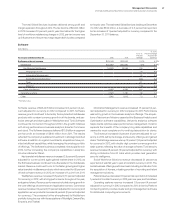

integrated enterprise and how this has allowed the company to cap-

ture new growth and productivity. The company highlighted that by

aligning its business model with its clients’ needs, the company can

achieve its financial goals which will allow the company to invest in

future sources of growth and provide strong returns to its sharehold

-

ers. This delivers long-term value and performance to all key

stakeholders. The execution of the company’s strategy results in the

2015 road map with the expectation of at least $20 of operating

(non-GAAP) earnings per share in 2015.

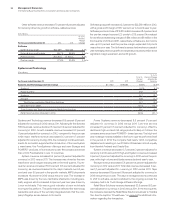

Looking forward, the company expects to continue its transfor-

mation in 2014, shifting its investments to the growth areas and

mixing to higher value. The company will continue to acquire key

capabilities, divest of certain businesses, rebalance its workforce

and invest in innovation as it continues to return value to its share-

holders. In January 2014, the company disclosed that it is expecting

GAAP earnings of at least $17.00 and operating (non-GAAP) earnings

of at least $18.00 per diluted share for the full year 2014. The operat-

ing (non-GAAP) earnings per share expectation exclude

acquisition-related charges of $0.76 per share and non-operating

retirement-related costs of $0.24 per share. This expectation results

in an increase year to year of 13.8 percent in GAAP earnings per

share and an increase of 10.5 percent year to year in operating (non-

GAAP) earnings per share which keeps the company on track to its

2015 objective. The company’s expectation for 2014 includes: a gain

from the sale of its customer care business to SYNNEX of approxi-

mately $150-$175 million, flat year to year pre-tax income in the

Systems and Technology business, a continued headwind from cur

-

rency, approximately flat workforce rebalancing charges year to year,

benefits from both the 2013 and 2014 workforce actions, continued

benefits from productivity initiatives and a 23 percent assumption for

the tax rate. The company also stated that in the first quarter of 2014

it expects to close the initial phase of the sale of its customer care

business, and that it also expects to take the majority of its workforce

rebalancing charges in the same period. As a result, the company

expects first-quarter 2014 GAAP and operating (non-GAAP) earnings

per share to be approximately 14 percent of the full year expectation,

reflecting about half of the divestiture gain, the workforce rebalancing

charges and continued impacts from currency. The year-to-year

dynamics of the workforce rebalancing charges will impact the com-

pany’s quarterly earning profile in the first half. The company expects

first-quarter 2014 GAAP and operating (non-GAAP) earnings per

share to be down year to year as a result of the expected workforce

rebalancing charges, and it expects second-quarter 2014 GAAP and

operating (non-GAAP) earnings per share to increase year to year

due to the workforce rebalancing charges recorded in the prior year.

For the first half of 2014, the company expects low double-digit

growth in its GAAP and operating (non-GAAP) earnings per share

compared to the prior year.

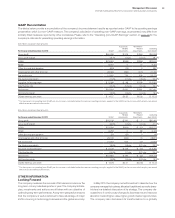

From a segment perspective, the Software business again deliv-

ered improved revenue, pre-tax income and margin expansion in

2013. The company continues to invest in the Software business

and is confident in its profit trajectory going into 2014, expecting

the business to grow consistently with its performance the past few

years. The Global Services business delivered pre-tax income and

margin expansion in 2013. The Global Services business continues

to see strength in cloud, Smarter Planet and business analytics and

the company will continue to invest to extend its capabilities. There

is good momentum in Global Business Services which delivered

double-digit profit growth in the second half of 2013. In Global Tech-

nology Services, the company expects the profit base in this

segment to improve in 2014. Contribution from significant contracts

that the business signed in 2013 should improve as the transitional

investments mature and productivity improves. Overall, the busi-

ness expects Global Services to improve profit in 2014 consistent

with its model for that business, 8-10 percent. In 2013, pre-tax

income in the Systems and Technology business was down $1.7

billion year to year. The performance was driven by the business

model issues in the Power Systems, System x and Storage business

units and System z mainframe product cycle. The company remains

confident in the secular strength of the mainframe and the product

cycle. However, the business will take actions to address the busi-

ness model challenges including making the products more

relevant to clients and right-sizing these businesses to meet the

new value proposition. In January 2014, the company announced

a definitive agreement with Lenovo Group Limited in which Lenovo

will acquire the company’s x86 server portfolio. The company

expects to recognize a total pre-tax gain on the sale of approxi-

mately $1 billion. See the caption “Divestitures” on page 98 for

additional information. While the company is focused on getting

the Systems and Technology business back to profit growth, in its

earnings per share expectation for 2014, the company has assumed

flat pre-tax income year to year for this business, excluding the

divestiture gain.

Within the growth markets, performance in 2013 was mixed;

however, the company was disappointed with the overall results.

The new governmental economic reforms in China impacted per-

formance. As the company expands its footprint in China, the

company continues to see good long-term opportunity and it con-

tinues to invest to capture that opportunity. Overall, in the growth

markets, the company believes it is on a trajectory to growth and

expects mid-single-digit revenue growth at constant currency by

the end of 2014.

Currency movements impacted the company’s year-to-year

revenue and earnings per share growth in 2013. Revenue growth

for the full year was impacted by 2.1 points from currency. Currency

also impacted the company’s profit performance. While there were

a number of currency movements year to year, the company’s

results were significantly impacted by the depreciation of the Yen.

Due to the fact that the company’s business in Japan is more heavily

skewed to local services, the company has less ability to hedge

cross-border cash flows in Japan as compared to most other coun-

tries. As a result, the currency impact related to the Yen largely falls

to profit. In January 2014, the company indicated that at current spot

rates, it expects this impact to continue through 2014.

The company’s free cash flow performance in 2013 compared

to the prior year was impacted by operational performance, changes

in sales cycle working capital and cash tax payments. The company

expects free cash flow in 2014 to increase by approximately $1 billion

year to year, including continued impacts of cash tax payments, and

grow faster than net income. Cash tax payments are expected to be

a year-to-year headwind in 2014 of about $2 billion, with the majority

of that impact in the first quarter.