IBM 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

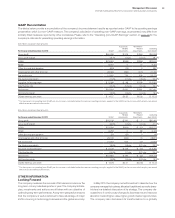

73

Management Discussion

International Business Machines Corporation and Subsidiary Companies

financing receivables provisions ($16 million), partially offset by the

decrease in gross profit ($55 million). The increase in financing

receivable provisions in 2013 was due to higher specific reserve

requirements, primarily in China. At December 31, 2013, the overall

allowance for credit losses coverage rate was 1.2 percent, flat com-

pared to the prior year.

The decrease in return on equity from 2012 to 2013 was driven

by a higher average equity balance, and the increase in return on

equity from 2011 to 2012 was driven by higher after-tax income.

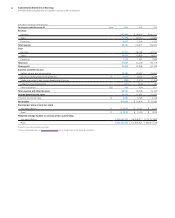

Financial Condition

Balance Sheet

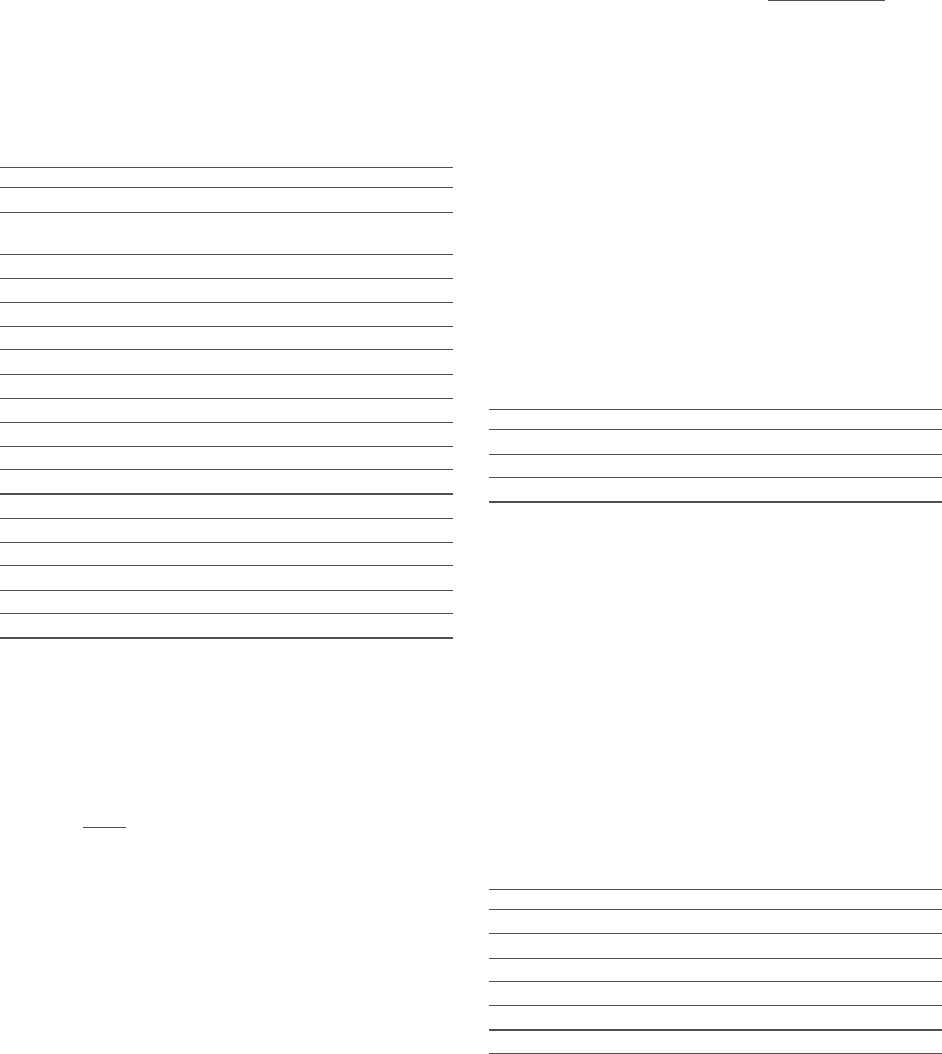

($ in millions)

At December 31: 2013 2012

Cash and cash equivalents $ 1,446 $ 1,380

Net investment in sales-type

and direct financing leases 9,739 10,008

Equipment under operating leases

External clients (a) 947 1,273

Internal clients (b)(c) 025

Client loans 14,297 13,121

Total client financing assets 24,982 24,428

Commercial financing receivables 8,541 7,755

Intercompany financing receivables (b)(c) 4,216 4,328

Other receivables 352 459

Other assets 601 533

Total assets $40,138 $38,882

Intercompany payables

(b) $ 5,766 $ 6,802

Debt (d) 27,504 24,501

Other liabilities 3,043 4,084

Total liabilities 36,314 35,388

Total equity 3,825 3,494

Total liabilities and equity $40,138 $38,882

(a) Includes intercompany mark-up, priced on an arm’s-length basis, on products

purchased from the company’s product divisions, which is eliminated in IBM’s

consolidated results.

(b) Entire amount eliminated for purposes of IBM’s consolidated results and therefore

does not appear on page 80.

(c) These assets, along with all other financing assets in this table, are leveraged at the

value in the table using Global Financing debt.

(d) Global Financing debt is comprised of intercompany loans and external debt.

A portion of Global Financing debt is in support of the company’s internal business,

or related to intercompany mark-up embedded in the Global Financing assets.

See table on page 75.

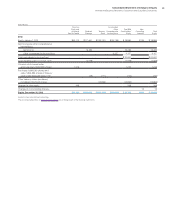

Sources and Uses of Funds

The primary use of funds in Global Financing is to originate client and

commercial financing assets. Client financing assets for end users

consist primarily of IBM systems, software and services, but also

include OEM equipment, software and services to meet IBM clients’

total solutions requirements. Client financing assets are primarily

sales-type, direct financing and operating leases for systems prod-

ucts, as well as loans for systems, software and services with terms

generally from one to seven years. Global Financing’s client loans are

primarily for software and services and are unsecured. These loans

are subjected to credit analysis to evaluate the associated risk and,

when deemed necessary, actions are taken to mitigate risks in the

loan agreements which include covenants to protect against credit

deterioration during the life of the obligation. Client financing also

includes internal activity as described on pages 33 and 34.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of

IBM and OEM products. Payment terms for inventory financing and

accounts receivable financing generally range from 30 to 90 days.

These short-term receivables are primarily unsecured and are

also subjected to additional credit analysis in order to evaluate

the associated risk.

In addition to the actions previously described, in certain circum-

stances, the company may take mitigation actions to transfer credit

risk to third parties.

At December 31, 2013, substantially all financing assets are IT

related assets, and approximately 59 percent of the total external

portfolio was with investment-grade clients with no direct exposure

to consumers.

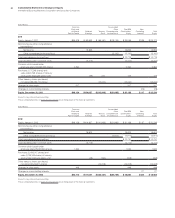

Originations

The following are total financing originations:

($ in millions)

For the year ended December 31: 2013 2012 2011

Client financing $15,792 $16,277 $14,390

Commercial financing 41,027 36,944 35,282

To t a l $56,819 $53,222 $49,673

In 2013, new financing originations exceeded cash collections for

both client and commercial financing. This resulted in a net increase

in total financing assets from December 31, 2012. The increase in

originations in 2013 versus 2012 was due to improving volumes in

commercial financing. The increase in originations in 2012 versus

2011 was due to improving volumes in both client and commercial

financing. Internal loan financing with Global Services is executed

under a loan facility and is not considered originations.

Cash generated by Global Financing in 2013 was deployed to pay

intercompany payables and dividends to IBM as well as business

partners and OEM suppliers.

Global Financing Receivables and Allowances

The following table presents external financing receivables excluding

residual values, and the allowance for credit losses:

($ in millions)

At December 31: 2013 2012

Gross financing receivables $32,319 $30,621

Specific allowance for credit losses 279 240

Unallocated allowance for credit losses 113 115

Total allowance for credit losses 392 355

Net financing receivables $31,928 $30,266

Allowance for credit losses coverage 1.2% 1.2%