IBM 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

108

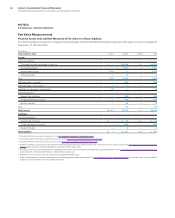

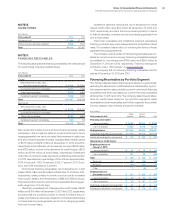

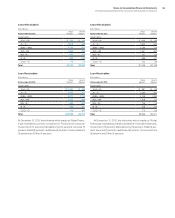

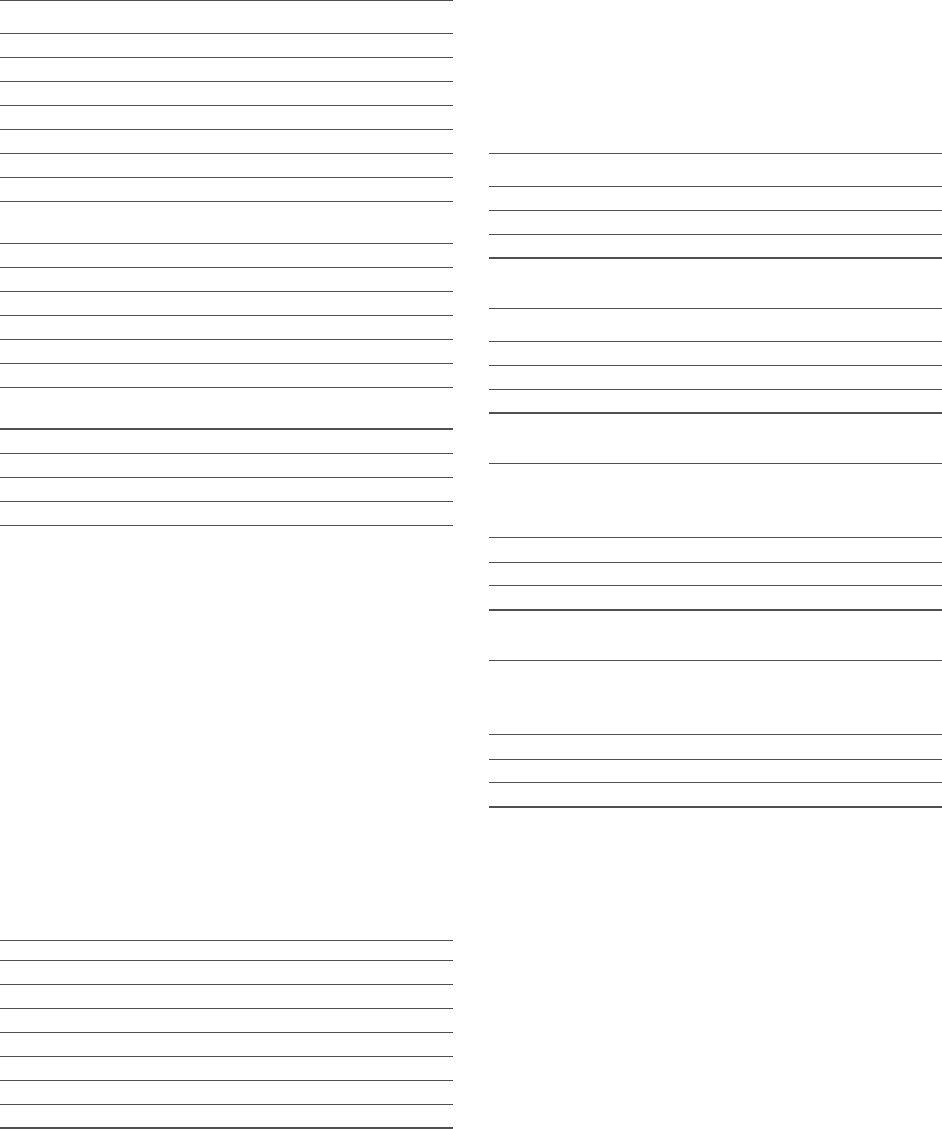

($ in millions)

At December 31, 2012:

Major

Markets

Growth

Markets To ta l

Financing receivables

Lease receivables $ 7,036 $2,138 $ 9,174

Loan receivables 9,666 3,670 13,336

Ending balance $16,701 $5,808 $22,510

Collectively evaluated for impairment $16,570 $5,684 $22,254

Individually evaluated for impairment $ 131 $ 125 $ 256

Allowance for credit losses:

Beginning balance at

January 1, 2012

Lease receivables $ 79 $ 40 $ 118

Loan receivables 125 64 189

To t a l $ 203 $ 104 $ 307

Write-offs (14) (1) (15)

Provision (9) 38 28

Other 0 (2) (2)

Ending balance at

December 31, 2012 $ 180 $ 138 $ 318

Lease receivables $ 59 $ 55 $ 114

Loan receivables $ 121 $ 84 $ 204

Collectively evaluated for impairment $ 69 $ 29 $ 98

Individually evaluated for impairment $ 111 $ 109 $ 220

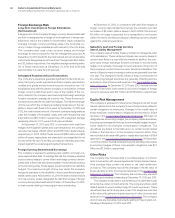

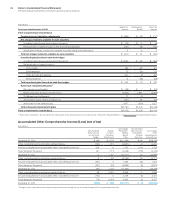

When determining the allowances, financing receivables are evalu-

ated either on an individual or a collective basis. For individually

evaluated receivables, the company determines the expected cash

flow for the receivable and calculates an estimate of the potential

loss and the probability of loss. For those accounts in which the loss

is probable, the company records a specific reserve. In addition, the

company records an unallocated reserve that is calculated by apply-

ing a reserve rate to its different portfolios, excluding accounts that

have been specifically reserved. This reserve rate is based upon

credit rating, probability of default, term, characteristics (lease/loan)

and loss history.

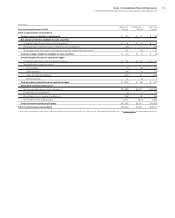

Financing Receivables on Non-Accrual Status

The following table presents the recorded investment in financing

receivables which were on non-accrual status at December 31, 2013

and 2012.

($ in millions)

At December 31: 2013 2012

Major markets $ 25 $ 27

Growth markets 34 21

Total lease receivables $ 59 $ 47

Major markets $ 40 $ 67

Growth markets 92 25

Total loan receivables $132 $ 92

Total receivables $191 $139

Impaired Loans

The company considers any loan with an individually evaluated

reserve as an impaired loan. Depending on the level of impairment,

loans will also be placed on a non-accrual status. The following

tables present impaired client loan receivables at December 31, 2013

and 2012.

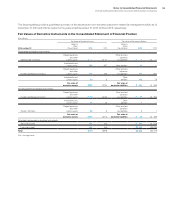

($ in millions)

At December 31, 2013:

Recorded

Investment

Related

Allowance

Major markets $ 79 $ 67

Growth markets 122 116

To t a l $201 $183

($ in millions)

At December 31, 2012:

Recorded

Investment

Related

Allowance

Major markets $ 88 $ 77

Growth markets 72 65

To t a l $160 $143

($ in millions)

For the year ended December 31, 2013:

Average

Recorded

Investment

Interest

Income

Recognized

Interest

Income

Recognized

on Cash

Basis

Major markets $ 76 $0 $0

Growth markets 97 0 0

To t a l $173 $0 $0

($ in millions)

For the year ended December 31, 2012:

Average

Recorded

Investment

Interest

Income

Recognized

Interest

Income

Recognized

on Cash

Basis

Major markets $ 90 $0 $0

Growth markets 65 0 0

To t a l $156 $0 $0

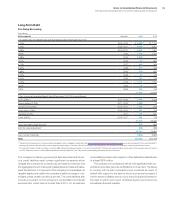

Credit Quality Indicators

The company’s credit quality indicators are based on rating

agency data, publicly available information and information pro-

vided by customers, and are reviewed periodically based on the

relative level of risk. The resulting indicators are a numerical rating

system that maps to Standard & Poor’s Ratings Services credit

ratings as shown on the following page. Standard & Poor’s does

not provide credit ratings to the company on its customers.

The tables present the gross recorded investment for each class

of receivables, by credit quality indicator, at December 31, 2013 and

2012. Receivables with a credit quality indicator ranging from AAA

to BBB- are considered investment grade. All others are considered

non-investment grade. The credit quality indicators do not reflect

mitigation actions that the company may take to transfer credit risk

to third parties.