IBM 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

102

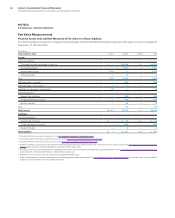

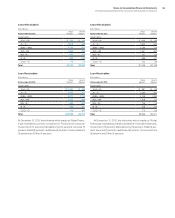

($ in millions)

At December 31, 2013:

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Debt securities—noncurrent (1) $ 7 $1 $— $ 9

Available-for-sale equity investments (1) $20 $2 $ 4 $18

(1) Included within investments and sundry assets in the Consolidated Statement of Financial Position.

($ in millions)

At December 31, 2012:

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Debt securities—noncurrent (1) $ 8 $2 $— $10

Available-for-sale equity investments (1) $31 $4 $ 1 $34

(1) Included within investments and sundry assets in the Consolidated Statement of Financial Position.

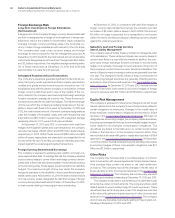

Based on an evaluation of available evidence as of December 31,

2013, the company believes that unrealized losses on debt and

available-for-sale equity securities are temporary and do not repre-

sent an other-than-temporary impairment.

Sales of debt and available-for-sale equity investments during the

period were as follows:

($ in millions)

For the year ended December 31: 2013 2012 2011

Proceeds $41 $112 $405

Gross realized gains (before taxes) 13 45 232

Gross realized losses (before taxes) 51 0

The after-tax net unrealized gains/(losses) on available-for-sale debt

and equity securities that have been included in other comprehen-

sive income/(loss) and the after-tax net (gains)/losses reclassified

from accumulated other comprehensive income/(loss) to net income

were as follows:

($ in millions)

For the year ended December 31: 2013 2012

Net unrealized gains/(losses)

arising during the period $ 0 $ 17

Net unrealized (gains)/losses

reclassified to net income* (5) (25)

* Includes writedowns of $2.0 million in 2012.

The contractual maturities of substantially all available-for-sale debt

securities are less than one year at December 31, 2013.

Derivative Financial Instruments

The company operates in multiple functional currencies and is a

significant lender and borrower in the global markets. In the normal

course of business, the company is exposed to the impact of inter-

est rate changes and foreign currency fluctuations, and to a lesser

extent equity and commodity price changes and client credit risk.

The company limits these risks by following established risk man-

agement policies and procedures, including the use of derivatives,

and, where cost effective, financing with debt in the currencies in

which assets are denominated. For interest rate exposures, deriva-

tives are used to better align rate movements between the interest

rates associated with the company’s lease and other financial assets

and the interest rates associated with its financing debt. Derivatives

are also used to manage the related cost of debt. For foreign cur-

rency exposures, derivatives are used to better manage the cash

flow volatility arising from foreign exchange rate fluctuations.

As a result of the use of derivative instruments, the company is

exposed to the risk that counterparties to derivative contracts will fail

to meet their contractual obligations. To mitigate the counterparty

credit risk, the company has a policy of only entering into contracts

with carefully selected major financial institutions based upon their

overall credit profile. The company’s established policies and proce-

dures for mitigating credit risk on principal transactions include

reviewing and establishing limits for credit exposure and continually

assessing the creditworthiness of counterparties. The right of set-off

that exists under certain of these arrangements enables the legal

entities of the company subject to the arrangement to net amounts

due to and from the counterparty reducing the maximum loss from

credit risk in the event of counterparty default.