IBM 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Management Discussion

International Business Machines Corporation and Subsidiary Companies

enterprise productivity initiatives, to drive profit growth and margin

expansion. The relative strength of the Software business, fueled by

growth in the key growth initiatives, improved the company’s busi-

ness mix and contributed to its operating (non-GAAP) consolidated

gross and net margin improvements.

Software gross profit increased 2.0 percent in 2013, with a gross

profit margin of 88.8 percent. Software pre-tax income increased

2.7 percent and the pre-tax margin improved 0.5 points to 38.1 per-

cent. The Software business had another successful year leveraging

revenue growth and expense savings, primarily from the company’s

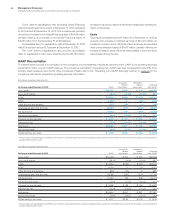

Systems and Technology

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Systems and Technology external revenue $14,371 $17,667 (18.7)%(17.9)%

System z (13.4)%(12.6)%

Power Systems (31.4) (30.7)

System x (13.5) (12.7)

Storage (10.8) (9.7)

Total Systems excluding Retail Store Solutions (17.6) (16.8)

Microelectronics OEM (11.9) (11.9)

Total Systems and Technology excluding Retail Store Solutions (17.0) (16.3)

Retail Store Solutions (Divested in 2012) (98.2) (98.2)

Systems and Technology (STG) revenue decreased 18.7 percent

(18 percent adjusted for currency) in 2013 versus 2012. Adjusting for

the divested RSS business, revenue declined 17.0 percent (16 per-

cent adjusted for currency) in 2013. Growth markets revenue

decreased 16.5 percent (16 percent adjusted for currency) in 2013,

compared to the prior year, while major markets revenue decreased

21.5 percent (20 percent adjusted for currency). Japan declined 18

percent as reported, but was essentially flat adjusted for currency.

Two issues within the business significantly impacted the segment’s

revenue and profit performance in 2013. First, STG is dealing with

challenges in its hardware business models specific to Power Sys-

tems, Storage and x86. In addition, System z revenue was impacted

by the product cycle, particularly in the second half, as the company

entered the back end of the current mainframe cycle with difficult

period-to-period comparisons driving revenue declines.

System z revenue decreased 13.4 percent (13 percent adjusted

for currency) in 2013 versus 2012. The decrease was primarily driven

by lower revenue in North America, while revenue increased in the

growth markets. MIPS (millions of instructions per second) ship-

ments increased 6 percent in 2013 versus the prior year. The

increase in MIPS was driven by specialty engines, which increased

17 percent year over year and continue to be more than 50 percent

of the total volumes. The decline in System z revenue was expected

based on the product’s movement through the product cycle in

2013. In the current mainframe cycle, the company has shipped 28

percent more MIPS compared to the same period in the prior cycle.

The revenue and gross profit in the current cycle are each about 99

percent of the previous cycle, net of currency. Mainframe products

provide the highest levels of availability, reliability, efficiency and

security, which position it as the ideal platform for high volume, mis-

sion critical workloads. The additional MIPS capacity in the current

product cycle is a reflection of the ongoing relevance of the main-

frame to clients, and provides the company with financial returns

consistent with past cycles.

Power Systems revenue decreased 31.4 percent (31 percent

adjusted for currency) in 2013 versus 2012. The Power platform

continues to ship significant capacity into the UNIX market, however

this has been more than offset by significant price performance,

resulting in lower revenue. The company has been very successful

in the UNIX market, and is taking two actions to improve its business

model in Power Systems. First, it is making the platform more rele-

vant to clients. To achieve this:

• In the fourth quarter of 2013, the company introduced a new

Integrated Facility for Linux offering which enables clients to run

Linux workloads in their existing servers. This mirrors the suc-

cessful strategy the company executed on the System z platform;

• The company will expand its Linux relevance even further

with POWER8 in 2014, which will provide additional big data

and cloud capabilities; and

•

Through the company’s OpenPOWER consortium it is making

Power technology available to an open development alliance,

building an ecosystem around the Power technologies.

These effects will take some time.

Secondly, even with these additional capabilities, the company

recognizes that the size of the Power platform will not return to prior

revenue levels. The company will take action by right-sizing the busi

-

ness for the demand characteristics it expects.

System x revenue decreased 13.5 percent (13 percent adjusted for

currency) in 2013 versus 2012. High-end System x revenue decreased

16 percent (16 percent adjusted for currency) and blades revenue

declined 45 percent (45 percent adjusted for currency) in 2013 versus

the prior year. These decreases were partially offset by increased

revenue driven by PureSystems.

PureSystems continued to gain momentum. Globally to date, the

company has shipped over 10,000 systems across its hardware brands.

Storage revenue decreased 10.8 percent (10 percent adjusted for

currency) in 2013 versus 2012. The company’s flash solutions contin-

ued to gain momentum in 2013 with positive revenue growth. The