IBM 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Management Discussion

International Business Machines Corporation and Subsidiary Companies

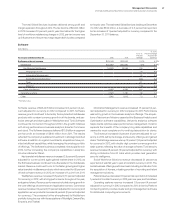

Within the growth markets, the company continued to gain

share and deliver growth in Latin America and in the Middle East

and Africa region. Performance in these regions has been consis-

tently strong, and in particular Latin America had a difficult

compare with revenue growth in the fourth quarter of 2012 up 18

percent at constant currency. In Eastern Europe, the declines

moderated, while revenue in the Asia Pacific countries declined at

a double-digit rate, primarily driven by China. The largest declines

in China were in the hardware business. The company continues

to be impacted by the process surrounding the implementation of

a broad-based governmental economic plan. While there is more

clarity on the overall plan, the company continues to believe that

it will take some time for its business in China to improve. While

the company is disappointed with its performance in certain

regions of the growth markets, the company continues to see

good opportunity in all regions over the long term—and the com-

pany continues to invest in these key markets.

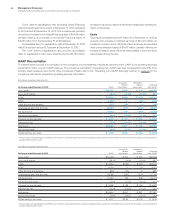

Total Expense and Other (Income)

($ in millions)

For the fourth quarter: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $7,353 $7,336 0.2%

Non-operating adjustments

Amortization of acquired

intangible assets (93) (86) 7.9

Acquisition-related charges (16) (12) 33.5

Non-operating retirement-related

(costs)/income (104) (23) 356.8

Operating (non-GAAP)

expense and other (income) $7,140 $7,215 (1.0)%

Total consolidated

expense-to-revenue ratio 26.5% 25.0%1.5 pts.

Operating (non-GAAP)

expense-to-revenue ratio 25.8% 24.6%1.2 pts.

Total expense and other (income) increased 0.2 percent in the fourth

quarter with an expense-to-revenue ratio of 26.5 percent compared

to 25.0 percent in the fourth quarter of 2012. Total operating (non-

GAAP) expense and other (income) decreased 1.0 percent in the

fourth quarter. The decrease in total operating expense and other

(income) was primarily driven by currency (2 points), lower base

expense (1 point), partially offset by increased expense from the

company’s acquisitions over the past 12 months (2 points). Within

base expense, the company is continuing to shift its spending—

driving productivity across the business, primarily through the

enterprise productivity initiatives. A majority of the savings are re-

invested into the business to drive growth in the key growth areas.

Within selling, general and administrative expense, accounts receiv-

able provisions were up approximately $60 million year to year in

the fourth quarter with reserve coverage up less than 20 basis

points, although flat compared to September 2013.

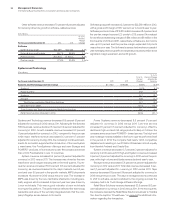

Cash Flow

The company generated $6,528 million in cash flows provided by

operating activities, an increase of $182 million compared to the

fourth quarter of 2012, driven primarily by a decrease in cash used

by financing receivables ($1,218 million) and a decrease in cash

funding of retirement-related plans ($495 million), partially offset by

the December payment of the 401(k) employer matching contribu-

tion ($541 million), increased cash used for income tax payments

($471 million) and declines in operational performance. Net cash

used in investing activities of $2,902 million decreased $1,190 million

primarily due to decreased spending for acquisitions ($961 million).

Net cash used in financing activities of $3,013 million decreased

$779 million compared to the prior year, primarily due to higher

net cash proceeds from total debt ($3,730 million) partially offset

by increased cash used for gross common stock repurchases

($2,791 million).