IBM 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Europe/Middle East/Africa (EMEA) revenue decreased 0.5 per-

cent (2 percent adjusted for currency) compared to the prior year.

The major market countries were down 0.5 percent (3 percent

adjusted for currency), while the growth market countries were down

0.6 percent (up 1 percent adjusted for currency). In the major market

countries, the UK decreased 1.4 percent (flat adjusted for currency),

Germany decreased 0.1 percent (3 percent adjusted for currency),

France decreased 1.8 percent (5 percent adjusted for currency), and

Italy decreased 2.1 percent (5 percent adjusted for currency). Within

the EMEA growth markets, the Middle East and Africa region

increased 5.0 percent (11 percent adjusted for currency), but this

growth was offset primarily by a decrease in Russia of 22.7 percent

(22 percent adjusted for currency).

Asia Pacific revenue decreased 11.6 percent (3 percent adjusted

for currency) year to year. Japan revenue decreased 15.2 percent as

reported, but increased 4 percent overall and grew in every quarter

on a constant currency basis. This growth reflects the benefits of

shifting investment and redirection of the company’s go-to-market

focus to improve performance in Japan. The Asia Pacific growth

markets decreased 9.1 percent (7 percent adjusted for currency),

with China down 12.2 percent (14 percent adjusted for currency) and

Australia down 15.9 percent (10 percent adjusted for currency).

During 2013, performance in China was impacted by the process

surrounding the implementation of a broad governmental economic

reform plan.

OEM revenue of $1,951 million in 2013 decreased 12.9 percent

(12 percent adjusted for currency) compared to the prior year, driven

by the Microelectronics OEM business.

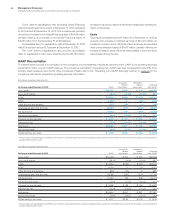

Total Expense and Other (Income)

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $28,981 $28,396 2.1%

Non-operating adjustments

Amortization of acquired

intangible assets (370) (328) 12.9

Acquisition-related charges (40) (35) 14.9

Non-operating retirement-related

(costs)/income (433) (274) 58.3

Operating (non-GAAP)

expense and other (income) $28,137 $27,760 1.4%

Total consolidated

expense-to-revenue ratio 29.1% 27.2% 1.9 pts.

Operating (non-GAAP)

expense-to-revenue ratio 28.2% 26.6%1.6 pts.

Total expense and other (income) increased 2.1 percent in 2013

versus 2012. Total operating (non-GAAP) expense and other

(income) increased 1.4 percent versus the prior year. The key drivers

of the year-to-year change in total expense and other (income) were

approximately:

Total Operating

Consolidated (non-GAAP)

• Currency* (1) point (1) point

• Acquisitions** 2 points 2 points

• Base expense 1 point 1 point

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period.

In the execution of its strategy, the company continues to invest

in its growth initiatives, innovation and strategic acquisitions. The

company also has had an ongoing focus on increasing efficiency

and productivity across the business.

For additional information regarding total expense and other

(income), see the following analyses by category.

Selling, General and Administrative

($ in millions)

For the year ended December 31: 2013 2012

Yr.-to-Yr.

Percent

Change

Selling, general and

administrative expense

Selling, general and

administrative—other $19,187 $19,589 (2.1)%

Advertising and promotional expense 1,294 1,339 (3.3)

Workforce rebalancing charges 1,064 803 32.4

Retirement-related costs 995 945 5.3

Amortization of acquired

intangible assets 370 328 12.9

Stock-based compensation 435 498 (12.6)

Bad debt expense 156 50 210.0

Total consolidated selling, general

and administrative expense $23,502 $23,553 (0.2)%

Non-operating adjustments

Amortization of acquired

intangible assets (370) (328)12.9

Acquisition-related charges (25) (22)13.3

Non-operating retirement-related

(costs)/income (376) (294)28.1

Operating (non-GAAP)

selling, general and

administrative expense $22,731 $22,910 (0.8)%