IBM 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

132

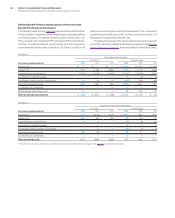

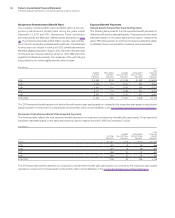

The following table presents the pre-tax net loss and prior service costs/(credits) and transition (assets)/liabilities recognized in OCI and the

changes in the pre-tax net loss, prior service costs/(credits) and transition (assets)/liabilities recognized in AOCI for the retirement-related

benefit plans.

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

2013 2012 2013 2012 2013 2012 2013 2012

Net loss at January 1 $19,488 $18,561 $22,188 $18,309 $ 806 $734 $269 $211

Current period loss/(gain) (3,989) 2,258 (814) 4,905 (480) 104 (85) 75

Curtailments and settlements ——32——0—

Amortization of net loss included

in net periodic (income)/cost (1,790) (1,331) (1,600) (1,027) (21) (32)(23) (17)

Net loss at December 31 $13,709 $19,488 $19,777 $22,188 $ 304 $806 $161 $269

Prior service costs/(credits) at January 1 $ 130 $ 139 $ (614) $ (768)$ — $ — $ (6) $ (10)

Current period prior service costs/(credits) ——0—15 —(31) —

Amortization of prior service (costs)/credits

included in net periodic (income)/cost (10) (10)119 154 ——54

Prior service costs/(credits) at December 31 $ 120 $ 130 $ (496) $ (614) $ 15 $ — $ (32) $ (6)

Transition (assets)/liabilities at January 1 $ — $ — $ 0 $ (0) $ — $ — $ 0 $ 0

Amortization of transition assets/(liabilities)

included in net periodic (income)/cost ——00——0(0)

Transition (assets)/liabilities at December 31 $ — $ — $ 0 $ (0) $ — $ — $ 0 $ 0

Total loss recognized in accumulated other

comprehensive income/(loss)*$13,829 $19,618 $19,281 $21,574 $ 319 $806 $129 $263

*

See note L, “Equity Activity,” on pages 116 through 118 for the total change in AOCI, and the Consolidated Statement of Comprehensive Income for the components of net periodic

(income)/cost, including the related tax effects, recognized in OCI for the retirement-related benefit plans.

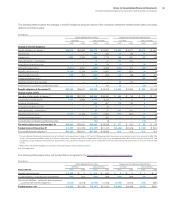

The following table presents the pre-tax estimated net loss, estimated prior service costs/(credits) and estimated transition (assets)/

liabilities of the retirement-related benefit plans that will be amortized from AOCI into net periodic (income)/cost in 2014.

($ in millions)

Defined Benefit

Pension Plans

Nonpension Postretirement

Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

Net loss $1,076 $1,461 $ — $11

Prior service costs/(credits) 10 (127) (7) (6)

Transition (assets)/liabilities — 0 — 0

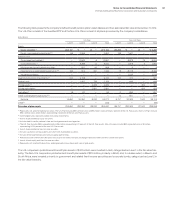

During the years ended December 31, 2013, 2012 and 2011, the

company paid $14 million, $22 million and $16 million, respectively,

for mandatory pension insolvency insurance coverage premiums

in certain non-U.S. countries (Germany, Canada and the UK).

During the year ended December 31, 2013, the company

amended the U.S. nonpension postretirement benefit plan. A plan

amendment effective January 1, 2014, which established an HRA

for Medicare eligible participants increased the benefit obligation

$91 million. A plan amendment which ended life insurance eligibility

for employees who retire on or after January 1, 2015 reduced the

benefit obligation $76 million.

On October 12, 2012, the High Court in London issued a ruling

against IBM United Kingdom Limited and IBM United Kingdom

Holdings Limited, both wholly-owned subsidiaries of the company,

in litigation involving one of IBM UK’s defined benefit plans. As a

result of the ruling, the company recorded an additional pre-tax

retirement-related obligation of $162 million in 2012 in selling, general

and administrative expense in the Consolidated Statement of Earn-

ings. See note M, “Contingencies and Commitments,” on page 120

for additional information.

Assumptions Used to Determine Plan Financial Information

Underlying both the measurement of benefit obligations and net

periodic (income)/cost are actuarial valuations. These valuations

use participant-specific information such as salary, age and years

of service, as well as certain assumptions, the most significant of

which include estimates of discount rates, expected return on plan

assets, rate of compensation increases, interest crediting rates and

mortality rates. The company evaluates these assumptions, at a

minimum, annually, and makes changes as necessary.