IBM 2013 Annual Report Download - page 51

Download and view the complete annual report

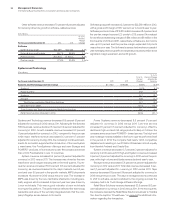

Please find page 51 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50 Management Discussion

International Business Machines Corporation and Subsidiary Companies

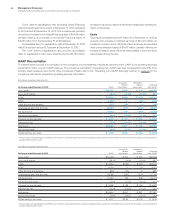

Systems and Technology

Systems and Technology revenue of $4,261 million decreased 26.1

percent (25 percent adjusted for currency) in the fourth quarter

versus the same period in 2012.

System z revenue decreased 37.4 percent (37 percent adjusted

for currency) in the fourth quarter of 2013 compared to a very strong

fourth quarter of 2012, when revenue increased 56 percent year to

year. During the fourth quarter, the company entered the back end

of the current mainframe cycle and, as expected, delivered a higher

gross margin percentage on a lower base of revenue. Fourth quarter

MIPS shipments decreased 26 percent following the largest MIPS

shipment in mainframe history in the fourth quarter of 2012. In the

current mainframe cycle, the company has shipped 28 percent more

MIPS compared to the same period in the prior cycle. The revenue

and gross profit in the current cycle are each approximately 99 per-

cent of the previous cycle, net of currency. The additional capacity

reflects the ongoing relevance of the mainframe to clients, and pro-

vides the company with financial returns consistent with past cycles.

Power Systems revenue decreased 31.4 percent (31 percent

adjusted for currency) in the fourth quarter. The company continues

to ship significant capacity into the UNIX market, but this has been

more than offset by significant price performance resulting in lower

revenue. The company is taking actions to improve its business

model in Power Systems, including introducing in the fourth quarter

a new Integrated Facility for Linux offering which enables clients to

run Linux workloads in their existing servers. This mirrors the suc-

cessful strategy executed on System z.

System x revenue decreased 15.9 percent (15 percent adjusted

for currency) in the fourth quarter of 2013 versus the fourth quarter

of 2012. PureSystems continues to gain momentum. Across the

hardware product lines, PureSystems revenue was up more than

30 percent in the fourth quarter compared sequentially to the third

quarter of 2013. Globally, the company shipped over 2,500 systems

in fourth quarter, and over 10,000 total systems to date.

Storage revenue decreased 13.4 percent (12 percent adjusted for

currency) in the fourth quarter. The company’s flash solutions con-

tinued to gain momentum and contributed a few points of growth in

the quarter. The Storwize product delivered double-digit growth,

which was offset by declines in the legacy OEM midrange offerings.

Highend offerings declined driven by significant pricing pressure.

Microelectronics OEM revenue decreased 33.0 percent

(33 percent adjusted for currency) in the fourth quarter.

Systems and Technology’s gross profit margin decreased 5.5

points in the fourth quarter of 2013 versus the prior year. The

decrease was driven by lower margins in Power Systems (1.3 points),

System x (1.2 points), Storage (0.6 points), Microelectronics (0.5 points)

and a decline due to revenue mix (2.2 points). Systems and Technol-

ogy’s pre-tax income decreased $768 million or 78.8 percent in the

fourth quarter, and pre-tax margin decreased 11.7 points versus the

prior year period. Approximately half of the fourth-quarter pre-tax

income decline was driven by System z due to the product cycle

dynamics, though the platform remains secularly strong with a solid

business model. The other System & Technology hardware busi-

nesses are dealing with business model challenges due to market

shifts. The company will make these products more relevant while

right-sizing these businesses to meet the new value proposition.

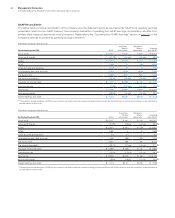

Global Financing

Global Financing revenue of $534 million was essentially flat as

reported and increased 3 percent adjusted for currency, with

increased financing revenue offset by a decrease in used equipment

sales revenue. The Global Financing fourth-quarter pre-tax income

increased 13.8 percent to $589 million and the pre-tax margin

increased 2.7 points to 49.6 percent. The increase in pre-tax income

was driven by the increase in internal gross profit ($118 million), par-

tially offset by increases in financing receivables provisions ($33

million) and SG&A expenses ($14 million).

Geographic Revenue

Total geographic revenue of $27,246 million decreased 4.8 percent

(3 percent adjusted for currency) in the fourth quarter of 2013 compared

to the prior year. In total, the major markets decreased 3.3 percent

(2 percent at constant currency) and the growth markets decreased

9.5 percent as reported and 6 percent at constant currency.

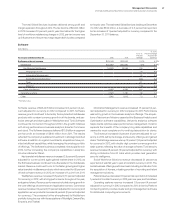

Americas revenue decreased 2.8 percent (2 percent adjusted

for currency) compared to the fourth quarter of 2012. Strong growth

in software was more than offset by the impact from the mainframe

product cycle, predominantly in the U.S. The U.S. was down 3.0

percent and Canada was down 4.5 percent as reported, but

increased 1 percent adjusted for currency. Canada improved their

year-to-year revenue growth rate at constant currency by 3 points

in both the third and fourth quarters of 2013. Revenue in the Latin

America growth markets was essentially flat as reported, but

increased 5 percent at constant currency, led by Brazil which

increased 2.0 percent (7 percent adjusted for currency) year to year.

Europe/Middle East/Africa revenue increased 0.9 percent as

reported, but decreased 2 percent adjusted for currency year to

year, consistent with the third-quarter performance. Western Europe

revenue declined year to year at constant currency in line with the

market, although software performed well. Germany grew 3.9 per-

cent (decreased 1 percent at constant currency) and the UK

increased 3.5 percent (3 percent at constant currency). Italy

decreased 6.1 percent (10 percent adjusted for currency).

Overall, Asia Pacific fourth-quarter revenue decreased 15.8

percent (6 percent adjusted for currency) year over year. Japan

revenue decreased 16.0 percent as reported, but increased 4 per-

cent on a constant currency basis. Adjusted for currency, this was

the fifth consecutive quarter of revenue growth in Japan. The com-

pany has shifted investment and redirected its go-to-market-focus

to significantly improve performance in Japan. The Asia Pacific

growth markets decreased 15.7 percent (12 percent adjusted for

currency) and China was down 22.1 percent (23 percent adjusted

for currency).