IBM 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Management Discussion

International Business Machines Corporation and Subsidiary Companies

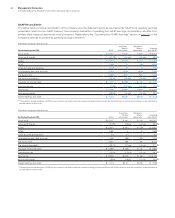

Software

($ in millions)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Software external revenue $25,448 $24,944 2.0% 4.3%

Middleware $20,983 $20,650 1.6% 3.9%

Key Branded Middleware 16,528 16,055 2.9 5.2

WebSphere Family 7.8 9.9

Information Management 1.5 3.8

Social Workforce Solutions* (2.1) 0.3

Tivoli 4.1 6.2

Rational (1.6) 0.6

Other middleware 4,455 4,596 (3.1) (0.6)

Operating systems 2,525 2,480 1.8 4.3

Other 1,940 1,813 7.0 9.2

* Formerly Lotus

Software revenue of $25,448 million increased 2.0 percent (4 per-

cent adjusted for currency) in 2012 compared to 2011. Software

revenue growth continued to be led by the key branded middleware

products with constant currency growth in all the brands, and par-

ticular strength and share gains in WebSphere and Tivoli. Software

continued its momentum throughout 2012 in the growth initiatives

with strong performance in business analytics, Smarter Commerce

and cloud. The Software business delivered $10.8 billion in segment

pre-tax profit, an increase of $840 million from 2011. The results

reflected the company’s sustained investment in strategic branded

software. In addition to organic investments, acquisitions have pro-

vided additional capabilities, while leveraging the existing portfolio

of offerings. The Software business completed nine acquisitions in

2012, further increasing the company’s capabilities in analytics,

cloud and Smarter Planet.

Key branded middleware revenue increased 2.9 percent (5 percent

adjusted for currency) and again gained market share in 2012, as

the Software business continued to be the leader in the middleware

market. Revenue continued to mix to the faster growing and higher

value branded middleware products which accounted for 65 percent

of total software revenue in 2012, an increase of 1 point from 2011.

WebSphere revenue increased 7.8 percent (10 percent adjusted

for currency) in 2012, with strong performance throughout the year,

and gained share. Revenue performance included strong growth in

the core offerings of commerce and application servers. Commerce

revenue increased 14 percent (15 percent adjusted for currency) and

application server products increased 6 percent (8 percent adjusted

for currency). The company further strengthened its WebSphere

portfolio during the year with the acquisitions of Worklight, DemandTec,

Emptoris and Tealeaf.

Information Management revenue increased 1.5 percent (4 per-

cent adjusted for currency) in 2012 compared to 2011. Performance

was led by growth in the business analytics offerings. The acquisi-

tions of Varicent and Vivisimo expanded the Business Analytics and

Optimization software capabilities. Varicent’s analytics software

helps clients optimize sales performance management. Vivisimo

expands the breadth of the company’s big data capabilities and

creates the most complete end-to-end big data solution for clients.

Tivoli revenue increased 4.1 percent (6 percent adjusted for cur-

rency) in 2012, led by its storage and security offerings, and gained

share. Tivoli storage revenue was up 12 percent (14 percent adjusted

for currency) in 2012, with double-digit constant currency growth in

each quarter, reflecting the value of storage software. Tivoli security

revenue increased 8 percent (10 percent adjusted for currency), with

strong contribution from Q1 Labs which provides next generation

security intelligence.

Social Workforce Solutions revenue decreased 2.1 percent as

reported, but was flat year to year at constant currency in 2012. The

social business offerings performed well, including contribution from

the acquisition of Kenexa, a leading provider of recruiting and talent

management solutions.

Rational revenue decreased 1.6 percent as reported, but increased

1 percent at constant currency in 2012 year over year, and held share.

Operating systems revenue increased 1.8 percent (4 percent

adjusted for currency) in 2012 compared to 2011, driven by Platform

Computing which provides cluster and grid management software

for distributed computing environments.

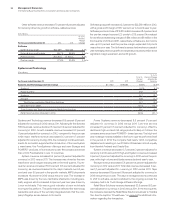

The total Global Services business delivered strong profit and

margin expansion throughout 2012. Pre-tax income of $9,944 million

in 2012 increased 7.0 percent year to year. Normalized for the higher

level of workforce rebalancing charges in 2012, pre-tax income was

up 9.8 percent and the pre-tax margin expanded 1.9 points compared

to the prior year. The estimated Global Services backlog at December

31, 2012 was $140 billion, a decrease of 0.3 percent as reported,

but an increase of 1 percent adjusted for currency compared to the

December 31, 2011 balance.