IBM 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154

|

|

2000 2013

7

A Letter from the Chairman

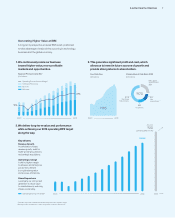

1. We continuously remix our business

toward higher-value, more profitable

markets and opportunities.

Segment Pre-tax Income Mix*

($ in billions)

Key drivers:

Revenue Growth

A combination of base

revenue growth, a shift to

faster-growing businesses

and strategic acquisitions.

Operating Leverage

A shift to higher-margin

businesses and enterprise

productivity derived

from global integration

and process efficiencies.

Share Repurchase

Leveraging our strong cash

generation to return value

to shareholders by reducing

shares outstanding.

* Excludes acquisition-related and nonoperating retirement-related charges.

** Net acquisitions include cash used in acquisitions and from divestitures.

A long-term perspective ensures IBM is well-positioned

to take advantage of major shifts occurring in technology,

business and the global economy.

Generating Higher Value at IBM

Operating Earnings Per Share*

2. This generates significant profit and cash, which

allows us to invest in future sources of growth and

provide strong returns to shareholders.

Free Cash Flow

($ in billions)

Primary Uses of Cash Since 2000

($ in billions)

$165

Net capital

expenditures

Dividends

Net share

repurchases

$59

$

108

$30

$3

2

Net

acquisitions**

$170

Operating Pre-tax Income Margin*

Hardware/Financing

Services

Software

2000 2013

$16.28

2015

$20

At Least

Operating EPS in 2015*

3. We deliver long-term value and performance

while achieving our 2015 operating EPS target

along the way.

2000 2013

10%

2

1%